Articles by Son Ji-hyoung

Son Ji-hyoung

consnow@heraldcorp.com-

Toss joins hands with Crosscert to expand e-sign biz

Viva Republica, a leading financial technology startup in South Korea that operates the money transfer app Toss, said Tuesday that it had joined hands with the Korea Electronic Certification Authority (Crosscert) to accelerate the expansion of its electronic signature business. The partnership will make it possible to use Toss e-signatures for civil affairs, bidding procedures, contracts and online tax payments, with Crosscert serving as the certificating authority, Viva Republica said. The n

Market May 26, 2020

-

NH-Amundi names new CMO

Seoul-based NH-Amundi Asset Management on Monday named Kim Seung-ho as its new chief marketing officer. Kim was formerly headed the fund management unit at NongHyup Bank. He will serve a one-year term. He will replace Moon Young-sik, whose term ended in April. NH-Amundi Asset Management is a 70:30 joint venture of NongHyup Financial Group and France-based Amundi Asset Management. NongHyup Bank is a wholly owned banking arm of NongHyup Financial Group. Kim started his career in 1985 at Nat

Market May 25, 2020

-

KB Asset launches fund to invest in US blue chips

Seoul-based KB Asset Management said Monday it has launched a fund that targets blue chips listed in the US stock exchanges. The open-ended fund is raising funds from South Korean retail investors and is expected to invest in US firms that generate stable income supported by their new growth engine, such as Amazon, Apple and Alphabet. At least 70 percent of the funds will go to large-cap stocks, KB Asset said. “The US is taking the lead in new growth engine industries, and is expected

Market May 25, 2020

-

FSS warns of puffed-up promotion of offshore life insurance plans

South Korea’s financial watchdog vowed Sunday to stamp out ill-advised sales promotion of offshore retirement plans through unauthorized online channels such as social media. The Financial Supervisory Service also pledged to monitor such sales activities online and issued the mildest level of alert to consumers to protect them. This comes as the online sales promotion of offshore life insurance schemes including retirement plans from outside Korea, such as Hong Kong, became widespread w

Market May 24, 2020

-

Hana Financial, Hahn & Co. agree to buy H-Line Shipping for W1.8tr

South Korea’s private equity house Hahn & Co. and Hana Financial Group have agreed to buy a 100 percent stake in H-Line Shipping, former dry bulk cargo arm of bankrupt carrier Hanjin Shipping, for 1.8 trillion won ($1.45 billion), according to sources on Sunday. The two firms will create a project fund for the leveraged buyout of H-Line Shipping, which is now fully owned by another fund of Hahn & Co. Under the plan, nearly 45 percent of the acquisition cost will be leveraged. T

Market May 24, 2020

-

W550b Young City prime office deal closes

A consortium composed of D&D Investment and NH Investment & Securities has completed its acquisition of Young City office complex from UK-based investment house Actis for 550 billion won ($447.2 million), the deal manager Cushman & Wakefield Korea said Thursday. D&D Investment, an affiliate of SK conglomerate’s real estate development arm SK D&D, seeks to establish a real estate investment trust called Young City REITs by securitizing the properties. The deal allowe

Market May 21, 2020

-

[Market Close-up] Doosan Bobcat under credit pressure on US unit’s $300m leveraging plan

South Korea’s construction equipment maker Doosan Bobcat is under credit pressure as its US subsidiary Clark Equipment is looking to leverage $300 million via five-year senior secured notes in May, filings showed Thursday. Clark Equipment’s leveraging plan is adding a financial burden to Doosan Bobcat, as affiliates and subsidiaries of conglomerate Doosan Group‘s liquidity crunch might spill over to Doosan Bobcat that is already suffering a sharp fall in sales due to the ongo

Market May 21, 2020

![[Market Close-up] Doosan Bobcat under credit pressure on US unit’s $300m leveraging plan](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/05/21/20200521000545_0.jpg&u=20200521160313)

-

Eximbank issues AU$700m Kangaroo bonds

The state-run Export-Import Bank of Korea said Thursday it has issued a three-year Australian dollar-denominated bonds worth AU$700 million ($460 million) to investors. Following the deal, Eximbank said it has become the first Asian financial institution to sell Kangaroo bonds, or Australian dollar-denominated bonds issued by a non-Australian entity, since the coronavirus outbreak. The bonds were oversubscribed as Eximbank received AU$1.7 billion subscriptions from 57 investors. JPMorgan, Mits

Market May 21, 2020

-

NPS to cut back in Korean stock exposure

South Korea’s public pension fund National Pension Service on Wednesday has affirmed its plan to shrink its exposure to domestic stocks in a move to ward off uncertainties due to fallout from the coronavirus outbreak, Welfare Minister Park Neung-hoo told reporters Wednesday. “(NPS) is certainly lowering the allocation of Korean stocks from the mid- to long-term perspective,” said Park, who also heads NPS Investment Management Committee. He added NPS Investment Management Comm

Market May 20, 2020

-

W550b Lotte Mart properties deal in legal dispute

South Korea’s Ryukyung PSG Asset Management and retailer Lotte Shopping are facing legal action from entities that proposed to buy four Lotte Mart discount stores for some 550 billion won ($448.4 million) in 2019, according to industry sources on Tuesday. The prospective buyers, real estate developer Moon Development Marketing and subsidiary the Korea Asset Investment Trust, filed a lawsuit in April against Ryukyung PSG -- a local asset management company that oversaw some 1.59 trillion

Market May 19, 2020

-

Virus-hit firms look to raise capital to ensure liquidity

As the number of moviegoers, air passengers and shoppers shrank sharply largely due to the coronavirus outbreak and social distancing, related companies have recently turned to fundraising efforts to meet the deadline for debt repayment or refinancing. Also, those raising share capital are offering equities at a discounted price to subscribers in order to ensure success. A leading example is multiplex cinema operator CJ CGV, which aims to raise 250.2 billion won ($202.9 million) in July from in

Market May 17, 2020

-

Yuanta Korea offers access to US stock reports

Yuanta Securities Korea said Thursday it has partnered with multinational financial market data provider Refinitiv to mount a new stock search engine function on its trading system for investors in US stocks. The service, dubbed “Reuters tRadar,” will allow users to access Refinitiv’s stock reports related to US stocks and their forecasts on the company performance based on its Institutional Brokers’ Estimate System database, which comprise the combined estimates of som

Market May 14, 2020

-

[Herald Interview] ‘Private investor engagement key to climate-resilient world’

In the climate finance world, money goes not only to the countries most vulnerable to the impacts of climate change, but also to innovative, eco-friendly infrastructure projects that help the world reduce greenhouse gas emissions. Striking the balance between the two themes -- adaptation and mitigation -- is one of the primary missions of the Green Climate Fund, the world’s largest fund dedicated to helping developing countries take climate actions. The fund serving the Paris Agreement on

Market May 13, 2020

![[Herald Interview] ‘Private investor engagement key to climate-resilient world’](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/05/13/20200513000714_0.jpg&u=20200514135541)

-

Seoul office market to face pandemic impact in Q2: report

Seoul’s prime office building market will face flagging demand due to the coronavirus coupled with new supply in the second quarter, which will create more empty space within the properties and reduce their cash flow, Savills Korea said in a report Wednesday. According to the real estate services firm, real estate investors in South Korea are expected to take a cautious stance as uncertainties in the leasing market are likely to erupt in terms of the proposed buyers’ financing cond

Market May 13, 2020

-

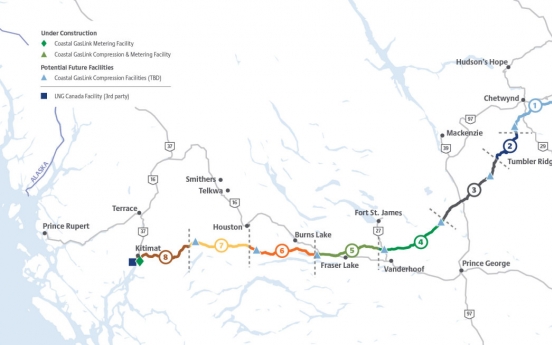

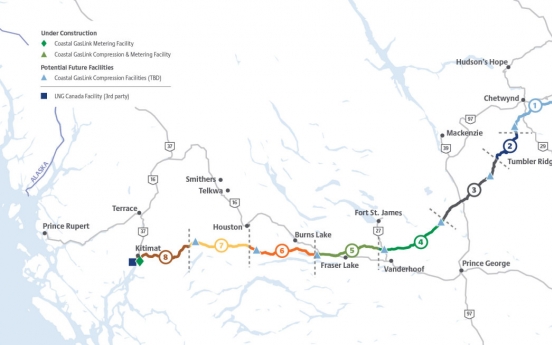

KB Kookmin Bank to finance gas pipeline project in Canada

KB Kookmin Bank said Tuesday that it has signed a commitment of 240 million Canadian dollars ($171 million) to finance a Coastal GasLink natural gas pipeline project in Canada through a senior loan. This is part of the C$6.6 billion project financing from a syndicate of lenders, composed of KB Kookmin Bank and 26 other banks including JPMorgan Chase, Bank of Montreal and Royal Bank of Canada, it added. KB Kookmin Bank was the sole Korean participant. The loans will go to TC Energy, formerly kn

Market May 12, 2020

Most Popular

-

1

Industry experts predicts tough choices as NewJeans' ultimatum nears

-

2

Jung's paternity reveal exposes where Korea stands on extramarital babies

-

3

Seoul city opens emergency care centers

-

4

Samsung entangled in legal risks amid calls for drastic reform

-

5

Opposition chief acquitted of instigating perjury

-

6

[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg&u=20241126161719)

-

7

[Exclusive] Hyundai Mobis eyes closer ties with BYD

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg&u=)

-

8

Agency says Jung Woo-sung unsure on awards attendance after lovechild revelations

-

9

[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance

![[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050072_0.jpg&u=)

-

10

Why S. Korean refiners are reluctant to import US oil despite Trump’s energy push

![[Market Close-up] Doosan Bobcat under credit pressure on US unit’s $300m leveraging plan](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/05/21/20200521000545_0.jpg&u=20200521160313)

![[Herald Interview] ‘Private investor engagement key to climate-resilient world’](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/05/13/20200513000714_0.jpg&u=20200514135541)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg&u=20241126161719)

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg&u=)

![[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050072_0.jpg&u=)