Articles by Son Ji-hyoung

Son Ji-hyoung

consnow@heraldcorp.com-

Mastern cheers health care workers

Mastern Investment Management said Thursday it has sent a message of support from its staff to health care professionals, health authorities and citizens in the battle against the novel coronavirus. Employees of the South Korean real estate investment house, including CEO Kim Dae-hyeong, took part in a campaign at its headquarters to express gratitude to those at the forefront of the strenuous battle. “I was delighted to participate in such a meaningful campaign and contribute to overco

Market July 30, 2020

-

[Herald Interview] Digital forensics to play bigger role in Korean companies’ foreign litigation

The dominance of digital devices in the work environment has led to significant changes in global litigation involving corporate disputes. The massive amounts of intangible data have increasingly emerged as key evidence of business misconduct that is becoming more and more sophisticated. A high-profile case in the US this year was a true testament to the trend. Electronic discovery conducted by the US International Trade Commission led to a preliminary ruling -- by default -- in favor of plai

Market July 27, 2020

![[Herald Interview] Digital forensics to play bigger role in Korean companies’ foreign litigation](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/07/27/20200727000651_0.jpg&u=20200727182202)

-

REIT IPOs elicit lukewarm response from retail investors

The initial public offerings of South Korean real estate investment trusts are drawing lackluster response from retail investors before their listing on the local stock market, estimates showed Sunday. The latest was the undersubscription of the stock offering to individual investors, when JR Asset Management’s REIT was going public on the main bourse Kospi to invest in Finance Tower Complex in Brussels, Belgium. REITs are companies designed to generate returns for investors in the for

Market July 26, 2020

-

Samsung Asset delays merger with hedge fund arm

Samsung Asset Management disclosed Sunday it has put a merger plan with its wholly owned hedge fund subsidiary on hold. The Seoul-based asset manager that oversees 26.9 trillion won ($22.3 billion) assets -- largest in South Korea -- added it would make an announcement once the date of merger is rescheduled. The deal was initially set to be closed by Aug. 1, following regulatory approval. The news comes amid intensifying scrutiny by authorities of Korean privately pooled funds -- private equ

Market July 26, 2020

-

IGIS drops Gangnam apartment renovation plan amid backlash

IGIS Asset Management said Thursday it has canceled a plan to renovate an apartment building in Gangnam, an affluent southern district of Seoul, it acquired in April. The nation’s largest commercial property investor added it would liquidate the privately pooled fund that was created to invest in the redevelopment project, immediately after it sells the residential building. The asset management company purchased Samsung World Tower from an individual for 42 billion won ($35 mil

Market July 23, 2020

-

Watchdog accuses Optimus hedge fund of alleged fraud, embezzlement

The nation’s financial watchdog said Thursday its probe revealed that scandal-ridden hedge fund Optimus Asset Management faked the fund portfolio to its investors, misappropriated their money and obstructed the authorities’ investigation. “Optimus misguided fund investors to pool their money, which led to fraudulent transactions,” Financial Supervisory Service Deputy Governor Kim Dong-hoe, who is in charge of financial investment services supervision, said in a briefing

Market July 23, 2020

-

Local PEF zeroes in on Mr. Pizza acquisition

TR Investment has been given exclusive rights to negotiate with shareholders of MP Group, the operator of pizza restaurant chain Mr. Pizza, to buy a 41.39 percent stake for 35 billion won ($29.19 million), a disclosure showed Thursday. Under the binding memorandum of understanding, the South Korean private equity firm has agreed to buy 10 million existing shares of MP Group -- which operates pizza restaurants and coffeehouse chain -- from its current major shareholders including founder and e

Market July 23, 2020

-

'Korean investors’ growing interest in US tech stocks risky'

Persisting economic uncertainties due to the coronavirus outbreak appear to have only made blue chip tech stocks in the United States more expensive, while growing retail investors’ appetite for US stocks on global monetary expansion have left them prone to risks, said a strategist at global asset management firm AllianceBernstein. “On the issue of COVID-19 risk, we would just very simply say why bet on things that we don’t know?” David Wong, a senior investment strateg

Market July 22, 2020

-

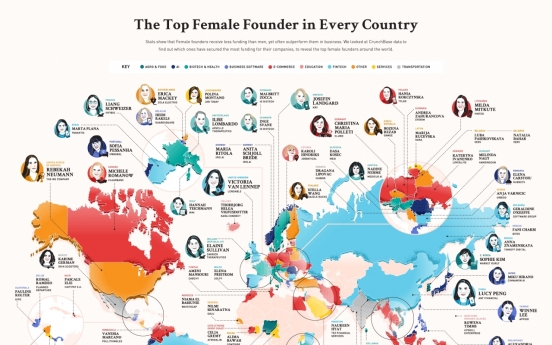

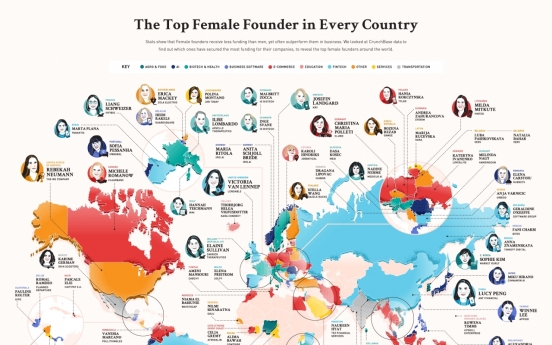

Kurly founder named among world’s top female fundraisers

Founder of Seoul-based same-day deliery startup Kurly, Sophie Kim, was listed among the top 10 female founders in the world by fundraising, data showed Tuesday. The founder of Market Kurly had raised the eighth-most money on the list as of June, raking in a combined $282 million since Kurly’s inception in 2014, according to data compiled by Businessfinancing.co.uk, a research and information provider in UK. Kim was the only Korean and one of four from Asia. The list of Asian entreprene

Market July 21, 2020

-

Seoul's commercial properties market less affected by coronavirus: reports

South Korea‘s commercial real estate market has been relatively less affected by the pandemic as the demand for both prime offices and logistics assets remains stable partly thanks to high liquidity and profit-seeking investors, reports showed Tuesday. The higher market liquidity coupled with the resilience of the economy, has instead beefed up competition for deals involving “core assets,” or prime office buildings that offer investors a stable source of income. “The

Market July 21, 2020

-

[Market Close-up] Snowballing fiasco shows Korea's failure to create healthy hedge fund environment

This is the first in a two-part series exploring South Korea’s troubled hedge funds market. -- Ed. Yoo Hye-kyung, 76, discharged herself from a hospital a day early to participate in a rally on Wednesday in Seoul to demand full compensation for her 500 million won ($450,000) investment in Optimus Asset Management. Claiming that she hadn’t even heard of the hedge fund manager when she signed a contract with NH Investment & Securities, a leading brokerage here, Yoo was furious th

Market July 19, 2020

![[Market Close-up] Snowballing fiasco shows Korea's failure to create healthy hedge fund environment](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/07/19/20200719000193_0.jpg&u=20200719201706)

-

Kakao Pay vows to expand e-bills service

Electronic payment service provider Kakao Pay said Thursday it aims to expand its service to enable bills to be created, delivered and paid online to spearhead Korea’s aim to transform into a paperless society. Capitalizing on the group’s popular mobile messenger platform KakaoTalk, Kakao Pay is likely to dominate the e-bills market by inviting more e-bill distributors to its platform, Lee Seung-hyo, chief product officer of Kakao Pay, said in a seminar held in Seoul. “At th

Market July 16, 2020

-

Mastern to invite W110b for French office acquisition through REIT IPO

Seoul-based property investment house Mastern Investment Management said Wednesday it plans to invite 110 billion won ($91.6 million) in South Korean retail money through its new real estate investment trust to take over part of equities in an office building in the suburb of Paris. Mastern plans to list the REIT’s 22 million shares, each priced at 5,000 won, on Korea’s main bourse Kospi in August. The listing schedule will be determined after an initial public offering that is set

Market July 15, 2020

-

NH-Amundi names new deputy CEO

Seoul-based joint venture NH-Amundi Asset Management said Tuesday that it named Nicolas Simon as the deputy chief executive officer of the France-based asset management house’s South Korean arm on Monday. Simon is formerly a deputy CEO of State Bank of India Funds Management, a joint venture of State Bank of India and Amundi to lead Amundi’s Indian operation. He served the term for five years until March. The start date has yet to be determined, according to NH-Amundi. Simon wi

Market July 14, 2020

-

K bank resumes consumer loan service

South Korea’s oldest online-only lender K bank said Monday it has resumed its consumer loan business through its mobile apps. The new loan products will be offered either in the form of personal loans for consumers with mid- to high-credit scores or overdrafts. The annual interest rate for borrowers will be 2.08 percent at its lowest. Borrowers’ credit-worthiness will be assessed under K bank’s own credit scoring system that applies machine-learning techniques and big data

Market July 13, 2020

Most Popular

-

1

Industry experts predicts tough choices as NewJeans' ultimatum nears

-

2

Jung's paternity reveal exposes where Korea stands on extramarital babies

-

3

Seoul city opens emergency care centers

-

4

Samsung entangled in legal risks amid calls for drastic reform

-

5

Opposition chief acquitted of instigating perjury

-

6

[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg&u=20241126161719)

-

7

[Exclusive] Hyundai Mobis eyes closer ties with BYD

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg&u=)

-

8

Agency says Jung Woo-sung unsure on awards attendance after lovechild revelations

-

9

[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance

![[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050072_0.jpg&u=)

-

10

Why S. Korean refiners are reluctant to import US oil despite Trump’s energy push

![[Herald Interview] Digital forensics to play bigger role in Korean companies’ foreign litigation](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/07/27/20200727000651_0.jpg&u=20200727182202)

![[Market Close-up] Snowballing fiasco shows Korea's failure to create healthy hedge fund environment](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/07/19/20200719000193_0.jpg&u=20200719201706)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg&u=20241126161719)

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg&u=)

![[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050072_0.jpg&u=)