Articles by Son Ji-hyoung

Son Ji-hyoung

consnow@heraldcorp.com-

Koramco closes W134b fund to invest in pre-IPO REITs

Korean real estate investment firm Koramco Asset Management said Tuesday it has signed a combined 134 billion won ($109.5 million) in commitments to its two blind-pool funds to capitalize on the potential of the nation’s growing properties market. Mainly targeting real estate investment trusts that eye initial public offerings here, the funds received commitments by undisclosed institutional investors and corporate investors. A REIT refers to a company that owns income-generating commerc

Market April 28, 2020

-

KB Kookmin Card to acquire Thai lender in $20m deal

Seoul-based consumer loan provider KB Kookmin Card said Monday that it had signed a deal to buy a controlling 50.99 percent stake in J Fintech, a Thailand-based personal loan provider, for 650 million baht ($20 million). This marks the first acquisition deal that allows a South Korean credit card company to enter the Thai financial market since the Asian financial crisis in 1997. The deal is awaiting approval from the financial authorities in Korea and Thailand. The credit card company ex

Market April 27, 2020

-

Authorities tighten grip on PEFs as Lime case shows sign of progress

South Korea’s financial authorities on Sunday unveiled plans to tighten regulations on privately pooled funds to protect investors, as an embezzlement case surrounding disgraced Lime Asset Management, which drew 1.6 trillion won ($1.3 billion) from investors, shows signs of progress with key suspects being arrested. Under the plans finalized Sunday, a private fund -- which comprises money from no more than 49 investors here -- will be subject to external audits if its assets exceed 50 bi

Market April 26, 2020

-

Testing kit maker Solgent gears up for IPO

South Korean genetic technology firm Solgent has picked local brokerage Mirae Asset Daewoo as an underwriter for its initial public offering, buoyed by sales of its diagnostic kits for the novel coronavirus, the company said Thursday. The Daejeon-based company and the underwriter are in the nascent stages of the IPO process, which precedes its listing on the development bourse Kosdaq. Details as to when the company will be listed and which option it will go for have yet to be determined. &ldqu

Market April 23, 2020

-

[Economy in Pandemic] With flattened curve, what’s ahead for S. Korean economy?

The signs of a slowing COVID-19 spread on the back of a strong state drive to contain the novel coronavirus are raising expectations of an early recovery of the South Korean economy. Despite the flattened curve of infection cases, it is premature for excessive optimism on Korea posting a V-shaped recovery, considering its heavy dependence on exports for growth, experts said Wednesday. “Given that Korea is quite an export-oriented economy, the slumping global demand is expected to hit th

Economy April 22, 2020

![[Economy in Pandemic] With flattened curve, what’s ahead for S. Korean economy?](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/04/22/20200422000608_0.jpg&u=20200423093147)

-

Crowdfunding platform Wadiz launches offline space to showcase products

South Korean crowdfunding platform Wadiz said Wednesday it has launched an offline space to help fundraising efforts by showcasing products to visitors and funders. Located in eastern Seoul, Gonggan Wadiz features a display room for “makers,” or those with an ongoing fundraising project on the Wadiz platform, as well as a workstation and networking space, officials said. Visitors and funders will be able to try the products before they invest in a project, they added. The two-sto

Market April 22, 2020

-

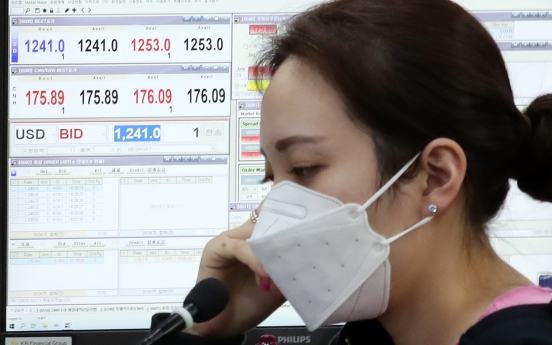

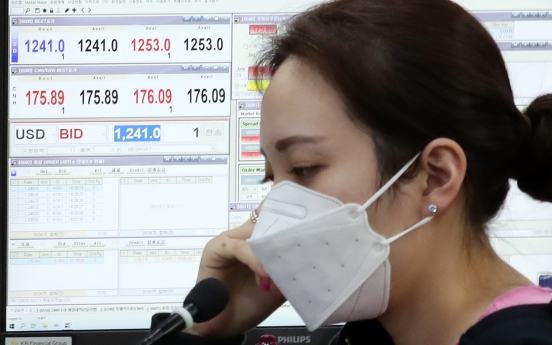

Stocks tank on NK leader's health rumor, oil plunge

South Korea’s stock market fluctuated as the geopolitical uncertainties triggered by the health condition of North Korean leader Kim Jong-un and historic oil price plunge sapped investor sentiment. The benchmark indexes -- main bourse Kospi and Kosdaq -- had a roller-coaster ride. Kospi sank 3 percent to its lowest in the late morning session and the loss narrowed to 1 percent in its closing. Kosdaq saw a 5.6 percent plunge at its largest, and closed 1.4 percent lower. Market bellweth

Market April 21, 2020

-

Talks underway to create bad bank to salvage Lime losses

South Korea’s financial institutions and authorities are in talks to create a bad bank to help companies recoup the losses from disgraced hedge fund Lime Asset Management, according to industry sources Monday. The Financial Supervisory Service held a closed-door meeting with 19 private financial institutions including commercial lenders Woori Bank and Shinhan Bank and securities firms Shinhan Investment and Daishin Securities to discuss details of the private bad bank, or an asset manage

Market April 20, 2020

-

[Market Close-up] Virus-hit air carriers brace for liquidity crisis

South Korea’s major airlines are likely to suffer a sharp revenue decline due to the coronavirus outbreak, putting further pressure on their liquidity, according to market watchers Sunday. Flag carriers Korean Air and Asiana Airlines are facing a financial slump as services have been curtailed for now, but they are also facing the possibility of a debt crisis if the pandemic lingers. The market has been focusing on one of the frequent leveraging measures for Korean airlines, as they imm

Market April 20, 2020

![[Market Close-up] Virus-hit air carriers brace for liquidity crisis](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/04/20/20200420000114_0.jpg&u=20200420093814)

-

IPO market stagnates as coronavirus woes drag on

South Korea’s market volatility is likely to continue as initial public offering plans for April are slipping through the cracks amid the coronavirus outbreak, according to market watchers Sunday. Sencoretech, a Seoul-based engineering firm dedicated to manufacturing steel structures, has withdrawn its listing plan on Kosdaq, which could have raised at least 27.16 billion won ($22.32 million). “Due to the high volatility caused by COVID-19, we decided to cancel the remaining proce

Market April 19, 2020

-

Dark clouds loom over credit ratings of Korean firms

South Korean companies are bracing for a massive credit rating downgrade as the novel coronavirus spillover threatens their business outlook, according to industry sources Wednesday. The weakening prospect of retailers, petrochemical firms and manufacturers in the wake of the coronavirus spread appears to be putting pressure on their liquidity. On Tuesday, the credit outlook of three companies for straight bonds was revised to “negative,” according to three credit rating agencies -

Market April 15, 2020

-

Corporate bond market shivers despite steps to calm down

Despite the government‘s bond-buying initiative aimed at shoring up liquidity, South Korea’s corporate bond market is rattled by changes in credit outlooks that reflect lingering uncertainties on falling oil prices and the COVID-19 pandemic. On Monday, Hanwha Solutions’ corporate bonds meant to raise 210 billion won were undersubscribed by institutional investors. Absent in the bidding was the vehicle dubbed the “bond market stabilization fund,” a state commitment

Market April 14, 2020

-

Lime investors to lose over half of principal

Investors in two funds of Lime Asset Management, a South Korean hedge fund that fell from grace on a deluge of scandals, are expected to lose over half of their money, according to redemption plans issued Monday. Investments in two master funds -- Pluto FI D-1, dedicated to privately placed bonds, and Tethys II, which targeted mezzanine instruments – were frozen due to illiquidity last year. Their total value will fall to a combined 534.7 billion won ($439.18 million) according to the pl

Market April 13, 2020

-

KDB in talks with local PEF to sell life insurer

State-run policy lender Korea Development Bank is in talks with South Korea’s private equity firm JC Partners to sell a life insurer unit as part of its restructuring process, an industry source said Monday. JC Partners is the only bidder participating in the preliminary stage that is undergoing a due diligence for the acquisition, the source added. KDB said further details cannot be disclosed because the talks are ongoing with the potential buyer before signing a deal. “Regardi

Market April 13, 2020

-

SparkLabs partners with Shinhan Capital for startup fund

Seoul-based global startup accelerator SparkLabs said Monday it has joined hands with nonbanking lender Shinhan Capital to create a 10.1 billion won ($8.28 million) fund to support early-stage startups. The vehicle is aimed at investing in SparkLabs alumni and other early-stage startups with growth potential, as well as secondary investing in fast-growing companies in the fields of health care, biotechnology and manufacturing. The fund is co-managed by SparkLabs and Shinhan Capital, and

Market April 13, 2020

Most Popular

-

1

Industry experts predicts tough choices as NewJeans' ultimatum nears

-

2

Jung's paternity reveal exposes where Korea stands on extramarital babies

-

3

Seoul city opens emergency care centers

-

4

Samsung entangled in legal risks amid calls for drastic reform

-

5

Opposition chief acquitted of instigating perjury

-

6

[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg&u=20241126161719)

-

7

[Exclusive] Hyundai Mobis eyes closer ties with BYD

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg&u=)

-

8

Agency says Jung Woo-sung unsure on awards attendance after lovechild revelations

-

9

[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance

![[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050072_0.jpg&u=)

-

10

Why S. Korean refiners are reluctant to import US oil despite Trump’s energy push

![[Economy in Pandemic] With flattened curve, what’s ahead for S. Korean economy?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/04/22/20200422000608_0.jpg&u=20200423093147)

![[Market Close-up] Virus-hit air carriers brace for liquidity crisis](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/04/20/20200420000114_0.jpg&u=20200420093814)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg&u=20241126161719)

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg&u=)

![[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050072_0.jpg&u=)