Most Popular

-

1

Actor Jung Woo-sung admits to being father of model Moon Ga-bi’s child

-

2

Wealthy parents ditch Korean passports to get kids into international school

-

3

Man convicted after binge eating to avoid military service

-

4

First snow to fall in Seoul on Wednesday

-

5

Final push to forge UN treaty on plastic pollution set to begin in Busan

-

6

Korea to hold own memorial for forced labor victims, boycotting Japan’s

-

7

Nvidia CEO signals Samsung’s imminent shipment of AI chips

-

8

Job creation lowest on record among under-30s

-

9

NK troops disguised as 'indigenous' people in Far East for combat against Ukraine: report

-

10

Opposition leader awaits perjury trial ruling

-

Household loans grow by most in 4 months

South Korean banks’ household loans grew by the most in four months in October on a rise in mortgage lending, the central bank said Thursday, complicating the government’s efforts to curb growing household debt.Local banks’ household loans, including home-backed and credit loans, reached 451.8 trillion won ($398 billion) as of the end of October, up 3.2 trillion won from the previous month, according to the Bank of Korea.The October monthly growth marked the largest expansion since such loans in

Nov. 10, 2011

-

Private lending market faces major overhaul

Regulator moves to punish lenders for breaching rules on interest ratesA major disruption is expected to hit the private lending market dominated by Japanese firms as Korea’s financial regulators threaten to suspend leading players for violating rules.Amid growing public outcry over the high interest rates charged by private lenders, the initial salvo came on Nov. 6 from the Financial Supervisory Service, which confirmed it was considering suspending major lenders including No. 1 player A&P Fina

Nov. 10, 2011

-

Producer price growth sinks to 10-month low

South Korea’s producer prices grew at the slowest clip in 10 months in October as crude oil prices posted more modest gains, which helped offset the local currency’s depreciation to the dollar, the central bank said Thursday.The producer price index, a barometer of future consumer inflation, rose 5.6 percent in October from a year earlier, down slightly from a 5.7 percent on-year gain in September, according to the Bank of Korea.Last month’s data marked the slowest growth since the 5.3 percent g

Nov. 10, 2011

-

Gold prices near 7-week high amid Italian woes

Gold prices on both the international and South Korean markets are expected to continue rising as renewed worries on the eurozone, sparked by Italy’s financial woes, prompt investors to scurry for safer assets, data showed Thursday.On Tuesday, the contract for December delivery hit $1,799.2 per troy ounce on the Comex division of the New York Mercantile Exchange, hitting a near seven-week high. The price closed slightly lower on Wednesday but continued to hover near the $1,800 level.Demand for t

Nov. 10, 2011

-

Money supply growth quickens in September

The growth of South Korea’s money supply picked up in September from the previous month as bank lending to companies expanded and the current account surplus widened, the central bank said Thursday.The country’s M2, a narrow measure of the money supply, reached 1,729.5 trillion won ($1.52 trillion) in September, up 4.2 percent from a year earlier, according to the Bank of Korea.The M2 in September quickened from the 4 percent on-year expansion tallied in August and marked the fastest growth sinc

Nov. 10, 2011

-

Savings banks seek state funds

Several banks hope to tap Financial Market Stabilization FundA number of savings banks are seeking state help in securing additional capital, sources said Thursday.“Some of the savings banks have shown interest in receiving support through the Financial Market Stabilization Fund,” an unnamed official with the Financial Services Commission was quoted as saying by a local news agency.According to industry sources, three or four savings banks are seeking state funds.“It is expected that application

Nov. 10, 2011

-

SKT makes bid for Hynix

SK Telecom submitted its application to take over Hynix Semiconductor, owned by creditors, as a sole bidder on Thursday.Credit Suisse, one of the co-sale brokers for the deal, received the bid to acquire a 15 percent stake in Hynix from SKT, said officials at Korea Exchange Bank, the main creditor.SKT tendered the last minute application just before the 5:00 p.m. deadline after hours of heated in-house debate over whether to bid amid turmoil following the prosecution’s probe of the SK Group chai

Nov. 10, 2011

-

Banks' household loans grow by most in 4 months in Oct.

South Korean banks' household loans grew by the most in four months in October on a rise in mortgage lending, the central bank said Thursday, complicating the government's efforts to curb growing household debt.Local banks' household loans, including home-backed and credit loans, reached 451.8 trill

Nov. 10, 2011

-

Most foreign IBs plan to buy more Korean stocks

Seven out of 10 foreign investment banks plan to increase their portion of South Korean stocks next year, citing the country’s solid economic fundamentals and low price valuation, a report showed Wednesday.Citigroup Inc., Barclays Plc and five others said they plan to invest more in South Korean equities, while two players, HSBC Holdings Plc and Royal Bank of Scotland Group Plc, opted to scale back their stock purchases, according to the report by the Korea Center for International Finance. JP M

Nov. 9, 2011

-

Credit card loans begin to decline

The amount of Korea’s credit card loans declined for the first time in two years amid intensifying pressure from the authorities. The Financial Supervisory Service and the credit card industry estimate that the total loan balance ― including card loans and cash advance services ― has fallen slightly at the end of September compared to three months earlier. “Preliminary figures show that most credit card firms saw their loans decline in the third quarter of this year,” said an official from the F

Nov. 9, 2011

-

KB chief hints at foreign bank buy

KB Financial Group chairman Euh Yoon-dae said on Wednesday local lenders will be given a chance to take over a foreign bank. Euh said more European banks are likely to be on the M&A market and it’s a good opportunity for Korean banks. “I believe Korea Development Bank should take over one of the global banks,” he said without elaborating on whether KB would pursue such a deal. As for the takeover of a life insurance firm, Euh said KB is not interested in a stake in Kyobo Life Insurance since the

Nov. 9, 2011

-

Shares up on eurozone optimism

South Korean stocks inched 0.23 percent up on Wednesday as European optimism boosted investor sentiment but they contined to remain cautious about the region’s worsening debt crisis, analysts said. The local currency rose against the U.S. dollar.The benchmark Korea Composite Stock Price Index rose 4.39 points to 1,907.53. Trading volume was moderate at 414.3 million shares worth 5.47 trillion won ($4.9 billion), with losers leading gainers 416 to 395.“The prices were steady all day, just up and

Nov. 9, 2011

-

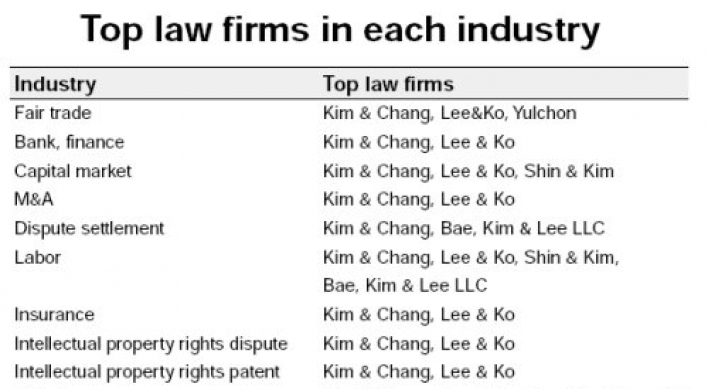

Kim & Chang tops law firms: Legal 500

Kim & Chang and Lee & Ko were named among the Legal 500’s best law firms in Korea, its report said Thursday. The London-based firm’s annual assessment of the world’s legal industry said Kim & Chang topped the list across all 14 practice areas including merger & acquisition advisory, corporate finance, intellectual property and tax. The long-standing runner-up Lee & Ko outscored Kim & Chang in M&A in terms of combined contract size. The report, a combined effort by Legal 500 and Thomson Reuters,

Nov. 9, 2011

-

FSC may order bourse sale of KEB shares

Regulator apparently determined to take stern action against Lone Star FundsFinancial regulators hinted at the possibility that they could order Lone Star Funds, which was convicted of stock manipulation, to sell most of its stake in Korea Exchange Bank at market-determined prices on the stock market.A senior official of the Financial Services Commission on Wednesday dismissed speculation that the regulator will simply order Lone Star to sell the KEB shares with no specific conditions, which may

Nov. 9, 2011

-

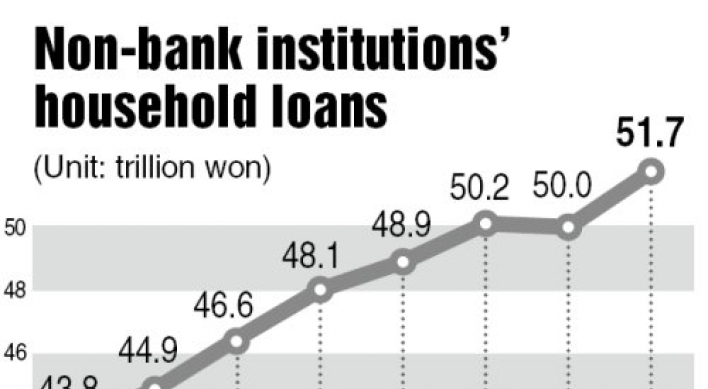

Non-banking institutions’ household loans on the rise

The weight of household lending out of non-bank institutions’ total loans hit a record high in the second quarter, central bank data showed Tuesday, spawning concerns about growing household debt.The portion of non-bank institutions’ home loans out of their total lending reached 51.7 percent in the April-June period, up from 50 percent tallied in the first quarter, according to data by the Bank of Korea.The second-quarter figures marked the highest level since the first quarter of 2008 when the

Nov. 8, 2011

-

BOK in dilemma over interest rate

Korea’s central bank board to decide key rate on FridayIn recent months, the key debate concerning the interest rate policy of the Bank of Korea revolved around when it would raise benchmark rates. Not for Friday, when the central bank holds its policy-setting meeting amid growing worries over whether the eurozone debt crisis will spin out of control, engulfing bigger nations like Italy and dragging down the global economy.Although analysts and economists expect the central bank to keep the rate

Nov. 8, 2011

-

Economy showing signs of weakness: ministry

The Korean economy is showing signs of weakness from the subdued outlook for global growth and uncertainties over the European debt crisis, the Finance Ministry said Tuesday.In its monthly economic assessment, the ministry cited slowing industrial output, export growth, job creation and facility investment as evidence of slowing economic momentum. It also warned of persistent price pressure which could worsen with rising import costs.“Our economy keeps recovering but some indicators are weakenin

Nov. 8, 2011

-

Seoul shares end 0.83% lower on eurozone concerns

South Korean stocks edged 0.83 percent down on Tuesday, as investors remained cautious over debt-ridden Italy’s situation, which could spill over into the entire region, analysts said. The local currency fell against the U.S. dollar.The benchmark Korea Composite Stock Price Index fell 15.96 points to 1,903.14. Trading volume was moderate at 398.6 million shares worth 5.16 trillion won ($4.6 billion), with losers outnumbering gainers 508 to 313.“There’s no big issue to prompt investors to bet on

Nov. 8, 2011

-

FSC challenged on Lone Star’s KEB sale

KEB union files injunction with Constitutional Court to ban regulator’s actionUnionized workers of Korea Exchange Bank, owned by Lone Star, filed an injunction with the Constitutional Court on Tuesday to ban the Financial Services Commission from ordering the U.S.-based fund to dispose of its KEB shares without probing the fund’s shareholder eligibility.If the Constitutional Court accepts the request from the KEB union, the FSC cannot instruct Lone Star to do so for the time being. The financial

Nov. 8, 2011

-

Regulator to lift short-selling ban on non-financial stocks

South Korea’s financial regulator on Tuesday said it will lift a three-month ban on short selling of non-financial stocks starting this week.“The ban on short selling of non-financial shares will be lifted starting Nov. 10, but the measure on financial shares will be retained for the time being,” the Financial Services Commission said in an e-mailed statement.The FSC had imposed a ban on short selling of all local stocks listed on the main KOSPI and the secondary tech-heavy KOSDAQ markets for th

Nov. 8, 2011