Most Popular

-

1

Actor Jung Woo-sung admits to being father of model Moon Ga-bi’s child

-

2

Wealthy parents ditch Korean passports to get kids into international school

-

3

Man convicted after binge eating to avoid military service

-

4

First snow to fall in Seoul on Wednesday

-

5

Final push to forge UN treaty on plastic pollution set to begin in Busan

-

6

Korea to hold own memorial for forced labor victims, boycotting Japan’s

-

7

Nvidia CEO signals Samsung’s imminent shipment of AI chips

-

8

Job creation lowest on record among under-30s

-

9

NK troops disguised as 'indigenous' people in Far East for combat against Ukraine: report

-

10

Opposition leader awaits perjury trial ruling

-

Can Hana Financial chairman’s term be extended?

Financial regulators’ planned action against Lone Star Funds is expected to affect the fate of Kim Seung-yu, chairman of Hana Financial Group striving to acquire Korea Exchange Bank from the U.S.-based equity fund.Early this year, group board members allowed Kim, who secured the post of Hana Bank CEO and Hana Financial chairman in 1997, to extend his term for the top post by one more year until March 2012.The board members’ endorsement for Kim’s tenure extension was attributable to necessity of

Nov. 14, 2011

-

Big savings banks to swing to Q3 profit

The nation’s major savings banks, including Hyundai Swiss, HK and Solomon, will swing to a third-quarter profit due to a healthier loan portfolio restructured recently to favor more small lending to individuals and less project finance, officials said. Solomon Savings Bank, the largest of its kind in Korea in terms of assets, is to post more than 20 billion won ($17.85 million) in profit for July-September, according to provisional data compiled by the Financial Supervisory Service. Hyundai Swis

Nov. 14, 2011

-

Korea’s total debt reaches 2.6 times GDP

Analysts express concern about pace of debt growth amid Hankook Tire Co., South Ko- economic downturnKorea’s public and private-sector borrowing reached 2.6 times its gross domestic product, data showed Monday, fueling concerns. The latest figure compiled by think tanks and brokerages put the combined debt of the Korean government, state-run and private firms and households at 3,283 trillion won ($2.9 trillion) at the end of June this year, up 5.7 percent from 3,106 trillion won a year earlier.

Nov. 14, 2011

-

‘Korea to maintain efforts to improve fiscal health’

South Korea will continue its efforts to keep its fiscal health in good shape amid growing global economic uncertainties and worries over rising demand for welfare spending, a senior Finance Ministry official said Monday.“As the economy keeps recovering, our fiscal status is improving fast and it also seems it is remaining in better shape than other advanced nations,” Vice Finance Minister Yoo Sung-kull told a fiscal policy conference jointly hosted by the World Bank and the state-run Korea Deve

Nov. 14, 2011

-

Real bank deposit rates fall to record low

Bank deposit rates in South Korea, when adjusted for inflation and taxes, declined to a record low in the third quarter, spurring concern they may further weigh on weak household savings, data compiled by the central bank showed Monday. The average real deposit rate at local banks, which exclude the inflation rate and taxes levied on interest income, stood at negative 1.63 percent in the third quarter, the lowest since the Bank of Korea began compiling the related data in 1996, according to the

Nov. 14, 2011

-

Local banks’ earnings could fall more than 10% next year

South Korean banks’ earnings are likely to fall 11 percent next year from this year as the cooling economic growth and slowing loan expansion will undercut their bottom lines, data showed Sunday.The combined net income of four major banking groups and two lenders are likely to reach 11.5 trillion won ($10.2 billion) for next year, down from 12.9 trillion won projected for this year, according to an estimate made by financial information provider FnGuide.Korean banks are expected to post stellar

Nov. 13, 2011

-

Banks’ long-term foreign borrowing soars in Oct.

South Korean banks’ mid- and long-term foreign borrowing sharply increased in October as lenders rushed to secure foreign currency in a bid to brace against global financial woes, the financial watchdog said Sunday.A total of 12 local banks refinanced 299.3 percent of their maturing mid- and long-term foreign debt through fresh borrowing last month, up from 186.6 percent in September, according to the Financial Supervisory Service.The rollover rate gauges the percentage of fresh overseas borrowi

Nov. 13, 2011

-

Regulator set to curb individuals’ derivatives trading

South Korea’s financial watchdog said Sunday it is mulling a set of measures to limit retail investors’ trading of derivatives in a bid to keep them from suffering heavy losses.Currency margin trading is viewed as one of the riskiest derivatives for retail investors as losses from their excessive bets on currency volatility have increased, prompting the financial watchdog to study steps to curb it.Margin trading allows investors to place heavy bets on currency volatilities with a relatively smal

Nov. 13, 2011

-

Shares expected to climb as Italy moves to stabilize fiscal woes

South Korean stocks are forecast to gain ground next week as Italy moves to stabilize its fiscal woes, analysts here said Saturday.Stock market analysts said the move by Italian lawmakers to reform its pension plan and dispose of state assets will send the right message to investors and help reduce the European country’s debt that stands at 120 percent of its gross domestic product.The effort follows similar action taken by Greece, Portugal and Spain to ward off disasters that could destabilize

Nov. 13, 2011

-

Card sales competition resurges despite warning

Samsung, Hyundai, Shinhan in campaign to attract more customersCredit card companies are fighting another marketing war despite financial regulators’ warnings against signing up too many customers.The industry’s big three ― Shinhan Card, Hyundai Card and Samsung Card ― have taken the initiative in the issuance competition. Other companies, such as KB Kookmin, Lotte and Hana-SK, are set to follow the move. In particular, Samsung Card, the third-largest issuer, has been aggressive in developing ne

Nov. 13, 2011

-

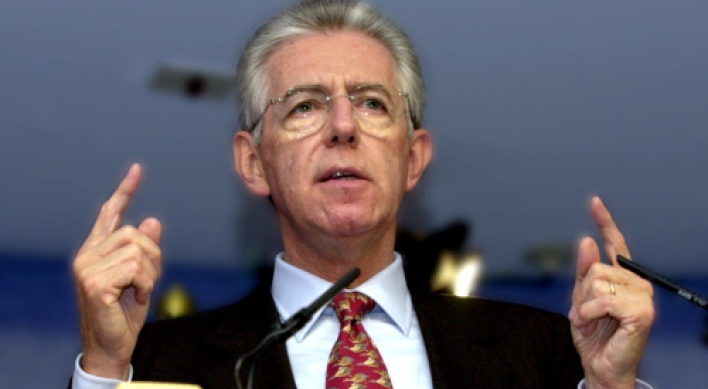

Monti tipped to lead Italy after Berlusconi quits

ROME (AFP) - Italy starts forming a new government Sunday after the momentous resignation of Silvio Berlusconi, with economist Mario Monti tipped as the man to lead the country through its debt crisis.In this July 17, 2002 file photo, European Union Commissioner for Competition Mario Monti speaking

Nov. 13, 2011

-

Household finance squeezed with growing debt: report

A government report showed Friday a steep deterioration in household finances, citing a much faster rate of debt growth than asset increases.A joint report by the Statistics Korea, the Bank of Korea, and the Financial Supervisory Services said the average household debt expanded 12.7 percent to 52.05 million won ($46,143) for a year ending March, outgrowing the 7.5 percent expansion of total assets to 297.65 million won per household on average.People with mortgages saw a particularly tight sque

Nov. 11, 2011

-

Seoul shares up 2.77% on European optimism

South Korean stocks finished 2.77 percent higher on Friday as investor sentiment was boosted by eased Italian debt woes, analysts said. The local currency rose against the U.S. dollar.The benchmark Korea Composite Stock Price Index jumped 50.2 points to 1,863.45, rebounding from a massive 94-point fall on the previous session. Trading volume was light at 291.7 million shares worth 5.15 trillion won ($4.57 billion) with gainers leading losers 682 to 170.“The European Central Bank bought Italian b

Nov. 11, 2011

-

Ex-KDB chief, execs probed over takeover

Prosecutors said Friday they have opened an investigation into several executives of the state-run Korea Development Bank, including former chairman Min Euoo-sung, on suspicion of incurring massive losses to the bank in a 2009 acquisition of a life insurance firm.Min and several other incumbent and former KDB executives are under suspicion of taking over Kumho Life Insurance Co. for an above-market price, inflicting losses to the bank run with taxpayers’ money, the financial sector bureau of the

Nov. 11, 2011

-

Insurer loan surges, boosting default rate

Insurance firms saw their loans grow at the fastest pace in two years as a result of the authorities’ tight control on bank loans, data showed on Friday. According to the Financial Supervisory Service, Korea’s insurers lent a combined 95.5 trillion won ($84.2 billion) to companies and households as of the end of the third quarter, up 4.1 trillion won, or 4.45 percent from the previous quarter. The rapid growth marked the highest level since September 2009, when the figure reached 4.75 percent. T

Nov. 11, 2011

-

BOK holds rate steady for 5th month

Gov. Kim rules out immediate rate cut; emphasis on inflation softenedThe Bank of Korea held benchmark rates steady, as expected, for the fifth straight month on Friday, amid heightened fears about the eurozone’s sovereign debt crisis that is spreading from Greece to Italy. Gov. Kim Choong-soo and his fellow Monetary Policy Committee policymakers unanimously decided to freeze the rate at 3.25 percent, a decision partly affected by the inflation falling last month. “As long as current economic sit

Nov. 11, 2011

-

Gov't to raise state-run companies wages by 3 pct in 2012

South Korea's government said Friday that it will raise wages of state-run companies by a maximum 3 percent in 2012 to reflect the general rise in living expenses. The finance ministry said a committee governing public sector management passed the increase motion after reviewing demands

Nov. 11, 2011

-

BOK freezes key rate at 3.25 percent for 5th month

South Korea's central bank left the key interest rate unchanged on Friday for the fifth straight month in the face of the deepening eurozone debt crisis and moderated inflation growth.Bank of Korea (BOK) Gov. Kim Choong-soo and his fellow policymakers froze the benchmark seven-day repo rate at 3.25

Nov. 11, 2011

-

Insurer loan default rate goes up in Q3

The default rate on loans extended by South Korean insurance companies inched up in the third quarter from three months earlier, due mainly to a rise in overdue corporate loans, the financial watchdog said Friday.The average ratio of overdue loans came to 1.18 percent of total lending by local life

Nov. 11, 2011

-

KOSPI tumbles on Italian woes

Seoul shares lost 4.94 percent to 1,813.25 Thursday on deepening woes over Europe’s debt crisis as soaring borrowing costs in Italy renewed fears that the region’s currency union may be breaking up. The benchmark KOSPI opened sharply lower, with losses led by bank and oil refiners, tracking worsening performance of market indices across Asia and the U.S. The local currency lost 1.5 percent to close at 1,134.2 won against the U.S. dollar. “It wasn’t a surprise that investors cut their holdings, e

Nov. 10, 2011