Most Popular

-

1

Jung's paternity reveal exposes where Korea stands on extramarital babies

-

2

Samsung entangled in legal risks amid calls for drastic reform

-

3

Heavy snow alerts issued in greater Seoul area, Gangwon Province; over 20 cm of snow seen in Seoul

-

4

[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg&u=20241126161719)

-

5

Agency says Jung Woo-sung unsure on awards attendance after lovechild revelations

-

6

[Health and care] Getting cancer young: Why cancer isn’t just an older person’s battle

![[Health and care] Getting cancer young: Why cancer isn’t just an older person’s battle](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050043_0.jpg&u=20241126145342)

-

7

Seoul blanketed by heaviest Nov. snow, with more expected

-

8

K-pop fandoms wield growing influence over industry decisions

-

9

[Graphic News] International marriages on rise in Korea

![[Graphic News] International marriages on rise in Korea](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050091_0.gif&u=)

-

10

Korea's auto industry braces for Trump’s massive tariffs in Mexico

-

Korean economy mired in growing debt, slowing exports

In a meeting with reporters last week, Finance Minister Choi Kyung-hwan dismissed warnings that the Korean economy may be facing its worst ever conditions as exaggerated.“Some have said our economy is heading toward a grave crisis, but all data are showing Korea is doing better than most of its peer countries under difficult situations,” he said.Choi, who concurrently serves as deputy prime minister for economic affairs, argued that if exports had not fallen, Asia’s fourth-largest economy could

Dec. 14, 2015

-

Seoul shares sink 1% on deepening oil rout

South Korean stocks tumbled 1.07 percent Monday as investors shunned risky assets out of fears that plunging crude oil prices will protract the global economic slowdown. The local currency sharply fell against the U.S. dollar. The benchmark Korea Composite Stock Price Index lost 20.80 points to 1,927.82. Trade volume was moderate at 425.67 million shares worth 4.02 trillion won ($3.39 billion), with losers far outnumbering winners 697 to 150. "Investors view the sharp fall in prices of oil and

Dec. 14, 2015

-

Seoul shares down 1% in late morning trade

South Korean stocks tumbled 1.02 percent late Monday morning as a further slump in oil prices dampened investor sentiment here. The benchmark Korea Composite Stock Price Index shed 19.91 points to 1,928.71 as of 11:20 a.m. On Friday, benchmark U.S. crude fell more than 3 percent to a fresh seven-year low after the International Energy Agency warned that the supply glut will continue well into next year. The news also sent the Dow Jones industrial average skidding 1.76 percent and the Nasdaq tu

Dec. 14, 2015

-

Fears of capital outflow may be overblown

With U.S. interest rates soon expected to enter an upcycle from the current near-zero levels, emerging markets have already seen a sizable outflow of global capital, with Korea being among the most affected, recent data shows. Yet, local financial authorities and some economists are playing down the probability of a massive capital flight from Korea, citing a moderate pace expected in the U.S. monetary tightening and Korea’s relatively sound economic fundamentals.“Even if the U.S. Federal Reserv

Dec. 13, 2015

-

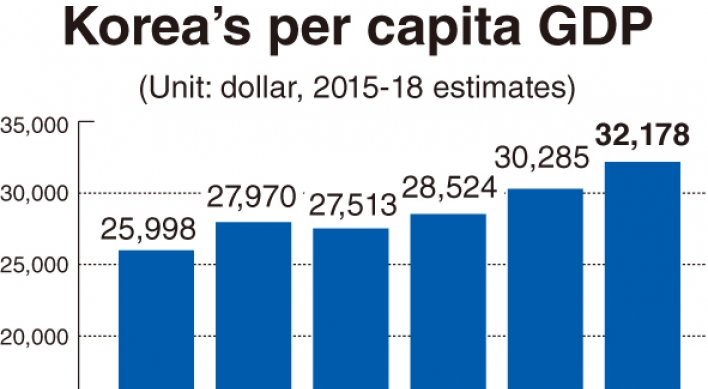

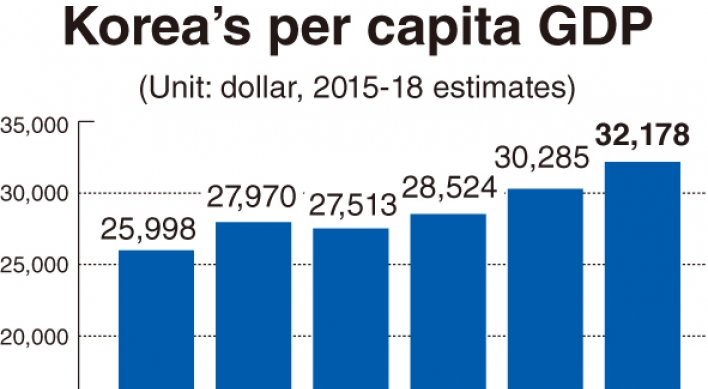

Korea far from per capita GDP goal of $30,000

With the year 2015 drawing to an end, Korea finds itself still distanced from achieving the long-awaited goal of $30,000 per capita gross domestic product. In fact, the country is seen to remain farther from the landmark figure this year than last year.All major economic organizations and research institutes at home and abroad forecast that Korea’s per capita GDP in 2015 will drop below the 2014 level, marking the first decrease since 2009 when the nation was struggling to contain the fallout fr

Dec. 13, 2015

-

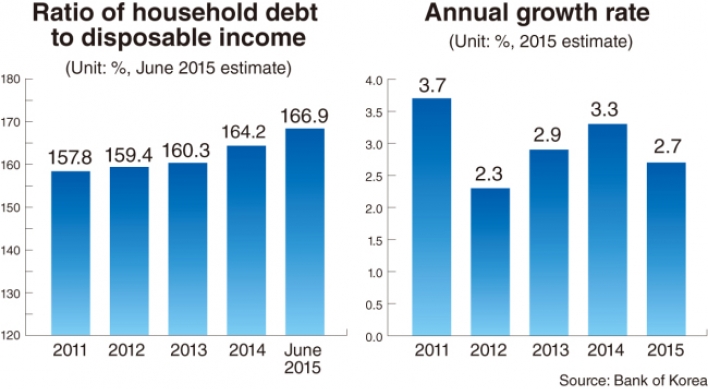

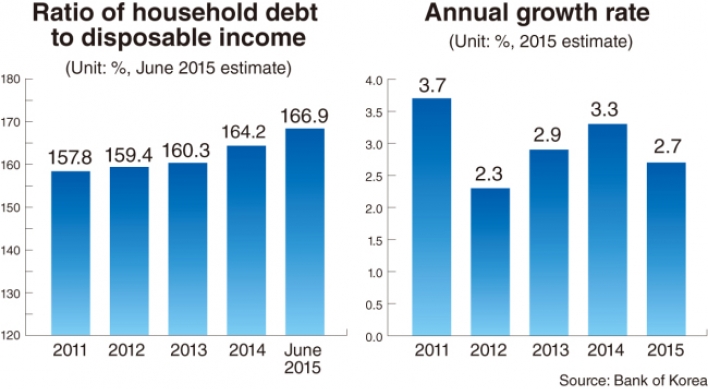

IMF warns of Korea’s household debt

Korea’s fast-growing household debt increases potential threats for a credit cut and repercussions from future rate hikes, economists of the International Monetary Fund said Friday. In the aftermath of the global financial crisis, the steep increase in household and corporate debt in the Asian private sectors accelerated growth, but with potential aftereffects. “If the debt keeps going up, it can become a major risk for the Asian economies, which calls for (government) interventions to downsiz

Dec. 11, 2015

-

Korea's foreign currency deposits fall in Nov.

Foreign currency deposits at South Korean banks fell in November from a month earlier as local firms withdrew money to pay back bonds, the central bank said Friday.Outstanding foreign currency-denominated deposits held by local residents reached $62.31 billion as of end-November, down $1.09 billion from the previous month when the country had the largest amount of deposits since June, according to the Bank of Korea.Those holding the deposits include firms and foreign nationals who have stayed in

Dec. 11, 2015

-

Trade minister vows to improve Korea's investment climate

South Korea's trade minister met Friday with members of the European Chamber of Commerce in Korea to exchange views on how best to improve business investment conditions in the country.At the breakfast meeting in Seoul, outlined to European businessmen measures taken by the government to ease restrictions and reform outdated rules that will make it easier for foreign companies to invest in Asia's fourth-largest economy.He stressed that such efforts are ongoing so that overall conditions will get

Dec. 11, 2015

-

Korea prepared for U.S. rate hike

The looming monetary tightening in the U.S. is unlikely to have a major immediate impact on Korea, Bank of Korea Gov. Lee Ju-yeol said Thursday, as the central bank held its key rate steady at a record low level. “The (BOK’s) Monetary Policy Board reached a consensus on a rate freeze, with signs of ailing domestic demand, expectations of a U.S. rate hike and other related global uncertainties,” Lee said in a press briefing at the bank’s headquarters in central Seoul. Bank of Korea Gov. Lee Ju

Dec. 10, 2015

-

Korea to allow brokerages, insurers to engage in FX trading

South Korea is seeking to allow local brokerages and insurers to engage in foreign exchange transactions starting in late February, the government said Thursday.The finance ministry said it will revise the country's Foreign Exchange Transaction Act to remove many restrictions, which will expand the scope of the financial market and create more business opportunities.In the past, only large commercial banks were allowed to engage in FX businesses, although non-financial companies were allowed res

Dec. 10, 2015

-

Foreigners dump Korean shares ahead of imminent Fed rate hike

Foreign investors have been in a selling binge of local stocks as they reduced risky bets ahead of a looming U.S. rate hike, market watchers said Thursday.Offshore investors offloaded 243 billion won ($207 million) worth of shares traded on the main KOSPI market on Wednesday, extending their selling spree to a sixth consecutive day, according to the Korea Exchange. Since the beginning of this month, they have sold a total of 1.38 trillion won of local stocks. Together with the shares listed on

Dec. 10, 2015

-

Insurers' financial status improves in Q3

The financial health of South Korean insurance companies improved in the third quarter from three months earlier on higher returns from bond investments on the back of lower interest rates, the financial watchdog said Thursday.The risk-based capital ratio of 56 life and non-life insurers averaged 284.8 percent at the end of September, up 6.6 percentage points from the previous quarter, according to the Financial Supervisory Service.The latest figure marked a sharp rebound from a 23.9 percentage

Dec. 10, 2015

-

Hanmi Science best performing stock of 2015

(123RF)Hanmi Science Co. was the top performer on the local stock market this year, thanks to the two multitrillion-won deals clinched by its pharmaceutical subsidiary, data revealed Wednesday. Hanmi Science shares closed at 140,000 won ($120) on the benchmark KOSPI on Tuesday, posting a stunning 806.15 percent hike from 15,450 won recorded on Dec. 30, the final trading day last year. The company holds a 41.37 percent stake in Hanmi Pharmaceutical, the country’s largest drugmaker and this year’

Dec. 9, 2015

-

NH Financial VP tapped to head NH Bank

Lee Kyung-seobNH Financial Group has picked its incumbent vice president Lee Kyung-seob as the new CEO of its banking arm NH Bank, the country’s fourth-largest banking group by assets said Wednesday. The group’s special CEO selection committee, meeting earlier in the day, decided to recommend Lee, its vice president since January last year, as the sole candidate for the job. The appointment is subject to endorsement by the board of directors and shareholders, who are likely to approve it without

Dec. 9, 2015

-

Seoul shares nearly flat in late-morning trade

South Korean stocks finished almost unchanged Wednesday as investors remained cautious amid dropping oil prices and a looming U.S. rate hike. The local currency fell against the U.S. dollar. The benchmark Korea Composite Stock Price Index fell 0.8 point, or 0.04 percent, to 1,948.24. Trade volume was slim at 366.3 million shares worth 3.6 trillion won ($3.05 billion), with decliners outnumbering gainers 492 to 310. "Investors became more conservative due to rising uncertainties in emerging mar

Dec. 9, 2015

-

Mobile ad spending skyrockets in Korea

Despite a sluggish domestic economy, mobile advertising has rapidly grown in South Korea thanks to widespread usage of smartphones and advanced mobile platform, data showed Wednesday. Once regarded as uncharted territory, mobile ad spending is estimated at 940 billion won ($798.3 million) this year, soaring about 1,800 times since 2010 when the data were first compiled by Digieco, an economic research institute run by mobile carrier KT. The PC advertisement budget is estimated at 2.4 trillio

Dec. 9, 2015

-

Seoul shares open higher on large-cap gains

South Korean stocks started a whisker higher Wednesday led by gains in large-cap shares like techs and retailers. The benchmark Korea Composite Stock Price Index gained 3.11 points, or 0.16 percent, to 1,952.15 in the first 15 minutes of trading. Market bellwether Samsung Electronics rose 0.4 percent and chipmaker SK hynix advanced 0.83 percent. Leading retailer Lotte Shopping jumped 4.22 percent and Shinsegae remained flat. The local currency was trading at 1,178.45 won against the U.S. dol

Dec. 9, 2015

-

Seoul shares down 0.75% on falling oil prices

South Korean shares dipped 0.75 percent Tuesday as a free-fall in oil prices dampened investors' appetite for risky assets. The local currency declined to a two month low against the U.S. dollar. The benchmark Korea Composite Stock Price Index fell 14.63 points to 1,949.04. Trade volume was slim at 399.5 million shares worth 3.57 trillion won ($3.03 billion), with losers far outnumbering gainers 643 to 186. "Investors are seeking safer investments as the global crude prices hit a near seven-yea

Dec. 8, 2015

-

Moody’s upgrades Kyobo Life to ‘A1’

Moody’s Investors Service has upgraded the insurance financial strength rating of Kyobo Life Insurance Co. to “A1” from “A2,” the South Korean insurance firm said Tuesday. The rating outlook is stable. Some of Moody’s “A1” players in insurance include Prudential, Dai-ichi, Meiji Yasuda and Manulife. Moody’s “A1” banks include Morgan Stanley Bank, Goldman Sachs, Bank of America and Citibank. “The rating upgrade reflects Kyobo Life’s proven track record of maintaining a good level of profitability

Dec. 8, 2015

-

Seoul shares down 0.37% in late-morning trade

South Korean stocks traded 0.37 percent lower late Tuesday morning as investors remained cautious after crude prices plunged to a near seven-year low. The benchmark Korea Composite Stock Price Index lost 7.2 points to 1,956.47 as of 11:20 a.m. Oil refineries traded in negative territory, with industry leader SK Innovation falling 2.33 percent and No. 3 S-Oil dropping 0.39 percent. Lotte Chemical slid 0.42 percent, and Kumho Petro Chemical dipped 2.09 percent. The local currency was changing

Dec. 8, 2015

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg&u=20241126161719)

![[Health and care] Getting cancer young: Why cancer isn’t just an older person’s battle](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050043_0.jpg&u=20241126145342)

![[Graphic News] International marriages on rise in Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050091_0.gif&u=)