Most Popular

-

1

Jung's paternity reveal exposes where Korea stands on extramarital babies

-

2

Samsung entangled in legal risks amid calls for drastic reform

-

3

Heavy snow alerts issued in greater Seoul area, Gangwon Province; over 20 cm of snow seen in Seoul

-

4

[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg&u=20241126161719)

-

5

Agency says Jung Woo-sung unsure on awards attendance after lovechild revelations

-

6

[Health and care] Getting cancer young: Why cancer isn’t just an older person’s battle

![[Health and care] Getting cancer young: Why cancer isn’t just an older person’s battle](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050043_0.jpg&u=20241126145342)

-

7

Seoul blanketed by heaviest Nov. snow, with more expected

-

8

K-pop fandoms wield growing influence over industry decisions

-

9

[Graphic News] International marriages on rise in Korea

![[Graphic News] International marriages on rise in Korea](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050091_0.gif&u=)

-

10

Korea's auto industry braces for Trump’s massive tariffs in Mexico

-

Citibank opens high-tech wealth management center

Citibank Korea CEO Park Jin-hei operates the bank’s interactive touch screen kiosk. Citibank KoreaCitibank Korea has opened a wealth management center that features digital innovation and a wide array of services in downtown Seoul, the bank said Tuesday. The Citigold Banpo Center is equipped with intuitive touch screens and high-definition media walls to promote customer engagement with its products and services.The bank also expanded its asset management system by launching a new service called

Dec. 29, 2015

-

Debt is Korea’s biggest economic problem: FSC

Yim Jong-yongFinancial Services Commission Chairman Yim Jong-yong pinpointed household and corporate debt as the biggest potential problems for the Korean economy, calling for “fierce reforms” to guard against them. “The debt problem, (particularly) of households and corporates, is the biggest risk to our economy,” the chief financial regulator said in his year-end press meeting in central Seoul, Tuesday. Korea’s economy faces multiple challenges, including an uncertain global economic outlook,

Dec. 29, 2015

-

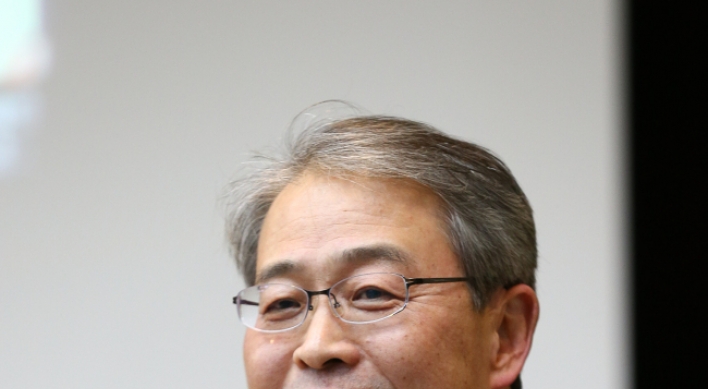

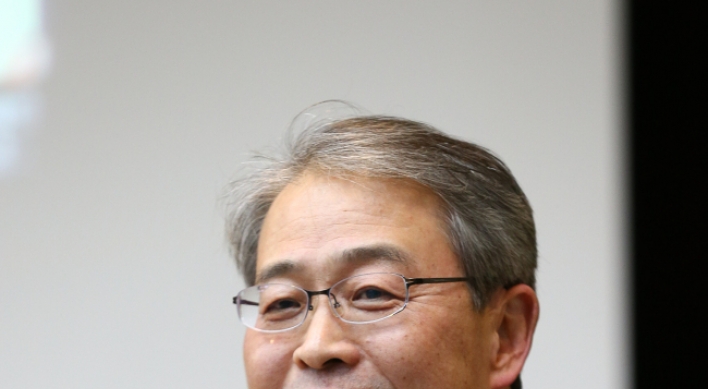

Debt is Korea’s biggest economic setback: FSC chief

Financial Services Commission Chairman Yim Jong-yong attends his year-end press meeting in central Seoul, Tuesday. (FSC)Financial Services Commission Chairman Yim Jong-yong pinpointed household debt and corporate debt as the biggest potential problems for the Korean economy, calling for “fierce reform” to guard against it. “The debt problem, (particularly) household debt and corporate debt, is the biggest risk in our economy,” the chief financial regulator said in his year-end press meeting in

Dec. 29, 2015

-

Seoul shares edge up on pharmaceutical, retail gains

South Korean stocks rose marginally high on Tuesday, propped up by rallies in pharmaceutical and retail companies. The local currency lost against the greenback.The benchmark Korea Composite Stock Price Index added 2.25 points, or 0.11 percent, to end at 1,966.31. Trade volume was thin at 394.49 million shares worth 3.76 trillion won ($3.21 billion), with winners beating losers 461 to 368.The market started lower and moved in and out of positive terrain. Propping up the market are individual inv

Dec. 29, 2015

-

Seoul shares down 0.3% in late morning trade

South Korean stocks traded 0.3 percent lower late Tuesday morning as institutional and foreign investors trimmed their holdings. The benchmark Korea Composite Stock Price Index lost 5.89 points to 1,958.17 as of 11:20 a.m.Tech giant Samsung Electronics was among marked decliners, trading down 1.73 percent. Bank and insurance companies also weighed on the market. SK Group shares traded bearish after media reports over its chairman's plan to divorce his long-estranged wife. SK Telecom plunged 5 pe

Dec. 29, 2015

-

Market cap of Korea's 3rd bourse skyrockets

South Korea's young venture-driven stock market saw its market capitalization more than double over the past year, data showed Tuesday, on the back of the government's push to foster small- and medium-sized companies.The Korea New Exchange had a market cap of 3.6 trillion won (US$3.08 billion) as of Monday, soaring from 1.4 trillion won posted at end-2014, data compiled by bourse operator Korea Exchange showed.It also marked a giant leap from 0.9 trillion in 2013, when the market first opened it

Dec. 29, 2015

-

Seoul shares start lower on financial, telecom losses

South Korean stocks opened lower Tuesday, led by declines in financial, telecom and other large-cap shares.The benchmark Korea Composite Stock Price Index shed 6.13 points, or 0.31 percent, to 1,957.93 in the first 15 minutes of trading.Blue-chip shares opened in negative terrain, with institutions and foreign investors trimming their holdings. Financial and telecom issues were leading the downward move. The local currency was trading at 1,167.65 won against the U.S. dollar as of 9:15 a.m., down

Dec. 29, 2015

-

Banks' loan delinquency rate edges up in Nov.

The delinquency rate for loans extended by South Korean banks edged up in November from a month earlier due to a rise in soured loans taken out by large firms, the financial watchdog said Tuesday.The average delinquency rate for bank loans stood at 0.74 percent at the end of November, up 0.04 percentage point from a month earlier, according to the Financial Supervisory Service.From a year earlier, however, the figure dropped 0.15 percentage point, it noted. Loans with both the principal and inte

Dec. 29, 2015

-

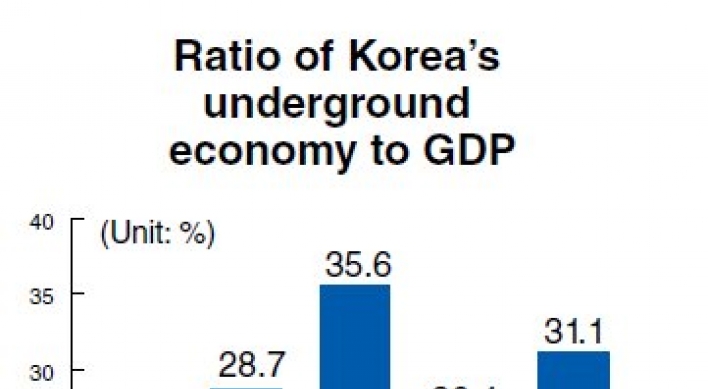

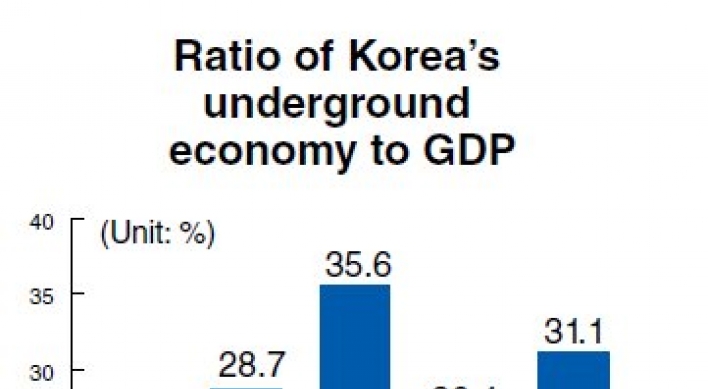

Underground economy still huge

Shortly after President Park Geun-hye took office in early 2013, her administration announced a plan to collect an additional 27.2 trillion won ($23.3 billion) in tax revenue over the next five years by shedding light on underground business activities. The envisioned tax revenue was part of a scheme for financing Park’s welfare programs without raising tax rates as she promised during her election campaign.In a parliamentary audit of the National Tax Service in September, taxation officials sai

Dec. 28, 2015

-

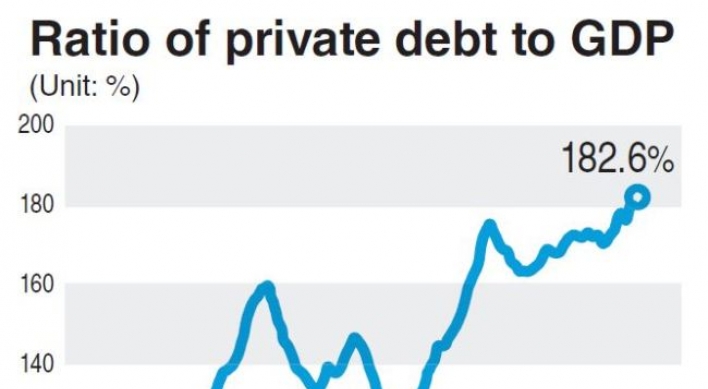

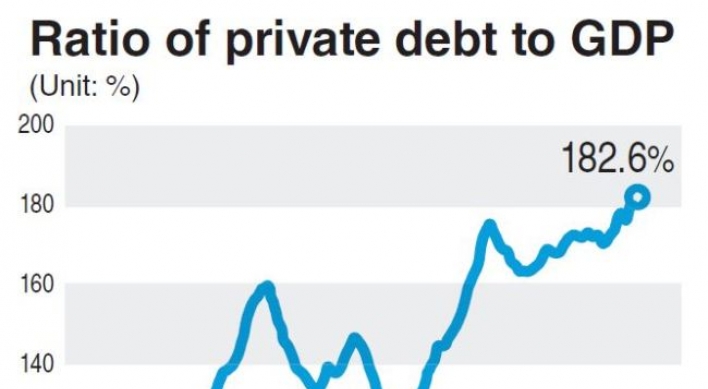

Private debt’s ratio to GDP exceeds 180%

South Korea’s private sector debt reached a record high in proportion to its gross domestic product at nearly double the national economic output in the third quarter this year, data from the Bank of Korea showed Monday. Loans extended to households and private companies stood at a record 182.6 percent of the country’s GDP at the end of September, hitting the highest level in the country’s history, the data noted. The country’s private debt-to-GDP ratio remained under 180 percent through the fir

Dec. 28, 2015

-

Mirae Asset still thirsty for growth

Mirae Asset Financial Group chairman Park Hyeon-joo speaks at a press conference in Seoul on Monday. (Yonhap)Park Hyeon-joo, the founding chairman of Mirae Asset Financial Group, said Monday the proposed acquisition of Korea’s second-largest brokerage KDB Daewoo Securities will bring his self-built empire one step closer to becoming Asia’s leading investment bank, calling it “a perfect fit” for Mirae Asset. “The value of Daewoo Securities depends on the synergy it would bring to its proposed buy

Dec. 28, 2015

-

Seoul shares fall 1.34% on Samsung losses

South Korean stocks tumbled 1.34 percent on Monday as top conglomerate Samsung's affiliates retreated after the regulator's call to resolve cross shareholding issues. The local currency rose against the greenback.The benchmark Korea Composite Stock Price Index shed 26.59 points to end at 1,964.06. Trade volume was thin at 389.69 million shares worth 3.75 trillion won ($3.22 billion), with losers outnumbering winners 548 to 278.Losses by Samsung affiliates dragged the index down after the Fair Tr

Dec. 28, 2015

-

Think tank calls for tougher rules against cross shareholding

A state-run think tank on Monday called for fresh measures to prohibit what it calls new and dubious ways to set up cross-shareholding arrangements by large conglomerates, also urging efforts to unwind existing schemes.In a policy report, the Korea Development Institute noted that cross shareholding among subsidiaries of large companies with more than 5 trillion won ($4.28 billion) in total assets have been prohibited July 2014 when the related law went into effect.The report, however, claimed m

Dec. 28, 2015

-

Park calls for measures to boost domestic consumption

President Park Geun-hye pushed on Monday for measures to bolster domestic spending next year to aid in getting South Korea's economic growth back on track.The government expects the local economy to grow 3.1 percent next year while most private think tanks forecast that the economy could hover below 3 percent due to sluggish growth in exports and weak consumer spending."We need to come up with measures to boost domestic consumption," Park said in a meeting with senior secretaries at Cheong Wa Da

Dec. 28, 2015

-

Seoul shares down 0.7% in late morning trade

South Korean stocks traded 0.69 percent lower late Monday morning as investors took to the sidelines ahead of the ex-dividend day.The benchmark Korea Composite Stock Price Index retreated 13.83 points to 1,976.82 as of 11:20 a.m.After starting a tad lower, the market faced downward pressure as foreigners and individuals offloaded risky assets amid a lack of market-moving leads. Their sell-off offset institutions' year-end buying on the eve of the ex-dividend date, or the day when all shares boug

Dec. 28, 2015

-

[Newsmaker] Mirae Asset to shake up brokerage industry

In South Korea where many family-run conglomerates hold the whip hand over much of the economy, the self-made billionaire Park Hyeon-joo’s bold step to create the country’s biggest brokerage has come into the spotlight after his successful bid to acquire KDB Daewoo Securities. Mirae Asset Financial Group chairman Park Hyeon-joo. (Yonhap)When a consortium of Mirae Asset Securities and Mirae Asset Global Investments was chosen as the preferred bidder to take over the country’s second-largest broke

Dec. 27, 2015

![[Newsmaker] Mirae Asset to shake up brokerage industry](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2015/12/27/20151227000120_0.jpg&u=20160124172102)

-

Banks to remove over 100 bank outlets next year

Five mainstream banks in South Korea plan to shut down more than 100 branches next year amid the growing popularity of on-line banking services, industries sources said Saturday.Woori Bank, the No. 2 lender, is moving to close up to 40 of its 958 outlets across the country in 2016 as the financial company seeks to remove less profitable units."It could still change because we have not made a final decision, but about 30 to 40 outlets will be closed down," a bank official said. NH Nonghyup Bank,

Dec. 26, 2015

-

China-led AIIB to start providing loans in mid-2016

The Chinese-led Asian Infrastructure Investment Bank (AIIB) is expected to start offering loans to foreign countries in the middle of next year, a Chinese state media outlet reported on Saturday. The AIIB was formally established on Friday and its board of directors will hold its first meeting at an opening ceremony set for Jan. 16-18 next year, according to China's finance ministry.Citing Chinese Finance Minister Lou Jiwei, the state-run China Daily said the AIIB is expected to grant its first

Dec. 26, 2015

-

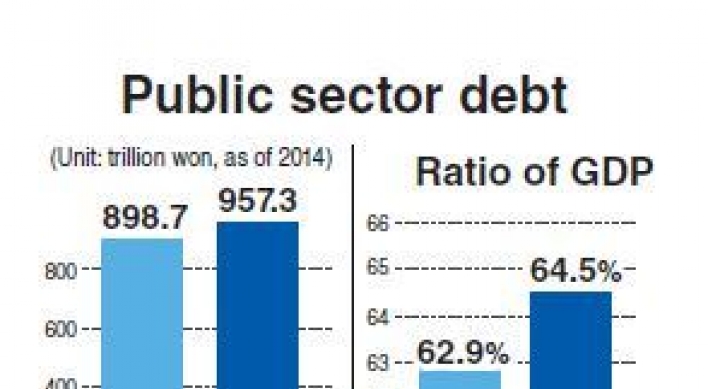

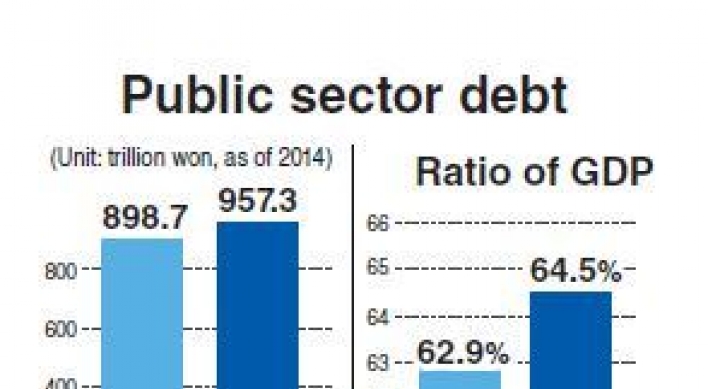

Public debt growth outpaces GDP

Korea’s public-sector debt relative to gross domestic product is much smaller than advanced countries, but it is growing faster than the economy, government data showed Thursday. The Korean government and nonfinancial public institutions owed 957.3 trillion won ($816 billion) to creditors at the end of 2014, up 6.5 percent from a year ago, the Finance Ministry said in a report. The pace of debt growth was faster than the 3.3 percent of the Korean economy last year. The debt was tantamount to 64.

Dec. 24, 2015

-

Tough time to be a central banker, says BOK chief

Bank of Korea Gov. Lee Ju-yeol (Yonhap)A little less than a decade ago, the job of a central banker could be described as important but simple: With one tool -- short-term interest rate -- they targeted inflation. In a downturn economy, when signs of low inflation emerged, they loosened the monetary policy, lowering interest rates. In an upcycle, they prevented economic overheating and high inflation with monetary tightening by raising the rates. Nowadays, the job is much more complex, with s

Dec. 24, 2015

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg&u=20241126161719)

![[Health and care] Getting cancer young: Why cancer isn’t just an older person’s battle](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050043_0.jpg&u=20241126145342)

![[Graphic News] International marriages on rise in Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050091_0.gif&u=)

![[Newsmaker] Mirae Asset to shake up brokerage industry](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2015/12/27/20151227000120_0.jpg&u=20160124172102)