Most Popular

-

1

Actor Jung Woo-sung admits to being father of model Moon Ga-bi’s child

-

2

Wealthy parents ditch Korean passports to get kids into international school

-

3

Man convicted after binge eating to avoid military service

-

4

First snow to fall in Seoul on Wednesday

-

5

Final push to forge UN treaty on plastic pollution set to begin in Busan

-

6

Korea to hold own memorial for forced labor victims, boycotting Japan’s

-

7

Nvidia CEO signals Samsung’s imminent shipment of AI chips

-

8

Job creation lowest on record among under-30s

-

9

NK troops disguised as 'indigenous' people in Far East for combat against Ukraine: report

-

10

Opposition leader awaits perjury trial ruling

-

IBK to offer lowest lending rates: CEO

Industrial Bank of Korea CEO Cho Joon-hee unveiled his business policy to lower the maximum interest rate on loans to below 10 percent next year.Under the CEO’s commitment, the state-run bank is poised to provide the lowest lending rates in the local commercial banking sector.“We are pushing for the loan rate cut as households and enterprises are expected to suffer a heavier financial burden amid gloomy predictions over the 2012 economy,” Cho told reporters.To make up for curtailed profit from t

Dec. 8, 2011

-

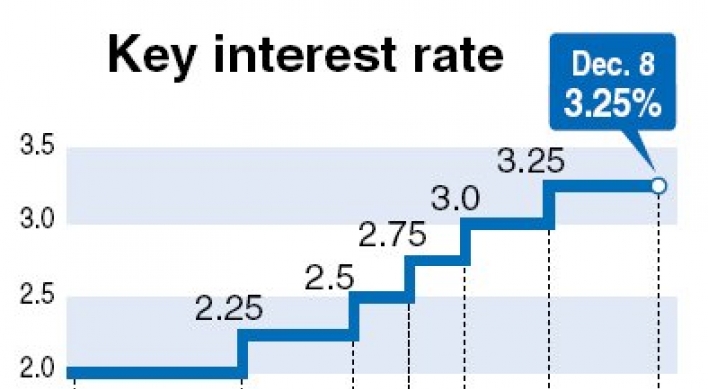

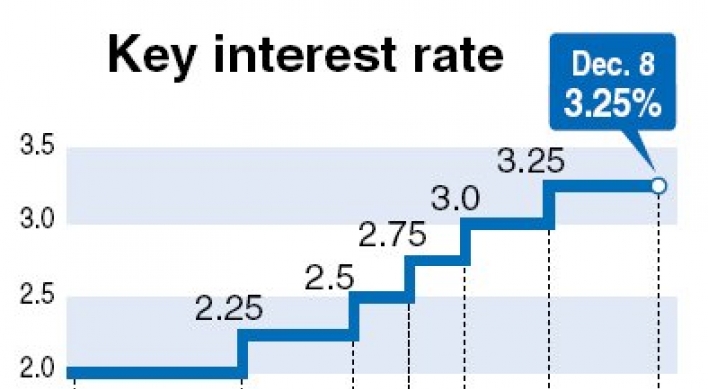

Korea freezes key rate for 6th month

The Bank of Korea held the benchmark rates steady for the sixth straight month Thursday, citing the deepening eurozone debt crisis abroad and slowing exports at home. The monetary policy committee led by Gov. Kim Choong-soo unanimously agreed to freeze the rate at 3.25 percent, a move aimed at helping Asia’s fourth-largest economy fight the external risks that threaten its export-oriented growth. “Downside risks to growth are high, due mostly to the sovereign debt crisis in Europe and to the pos

Dec. 8, 2011

-

College opens way to high-income farmers

Graduates of Korea National College of Agriculture and Fisheries earned 65.15 million won on average last year, twice as much as other farmers and even higher than the average pay at top 100 conglomerates, the university said Thursday.The government-funded university said almost one in five earned 100 million won in the past year and 71.3 percent of the total took home more than 30 million won.“What differentiates our graduates from other farmers is that every student in their second year of col

Dec. 8, 2011

-

Shares down on Europe woes

South Korean stocks slumped 0.37 percent on Thursday as investor sentiment remained fragile due mainly to weak hopes for an upcoming European summit, analysts said. The local currency fell against the U.S. dollar.The benchmark KOSPI declined 7.03 points to 1,912.39. Trading volume was heavy at 420.1 million shares worth 5.86 trillion won ($5.18 billion), with gainers outpacing decliners 425 to 397.“Investors are doubtful whether the European summit on Friday will bring about substantial developm

Dec. 8, 2011

-

Bank holding firms’ capital ratio slips in Q3

The capital adequacy ratio of South Korean bank holding companies fell in the third quarter, due to an increase in risk-weighted assets such as equities and loans, the financial regulator said Wednesday.The average capital adequacy ratio of nine local bank holding companies, including top player Woori Finance Holdings Co., stood at 13.54 percent as of the end of September, down 0.24 percentage point from three months earlier, according to the Financial Supervisory Service. The figure comes after

Dec. 7, 2011

-

Money supply growth hits 8-month high in Oct.

The growth of South Korea‘s money supply rose to an eight-month high in October as bank lending remained brisk and the current account surplus widened, the central bank said Wednesday.South Korea’s M2, a narrow measure of the money supply, amounted to 1,742.6 trillion won ($1.5 trillion) in October, up 4.4 percent from a year earlier, according to the Bank of Korea.In October, M2 growth quickened from a 4.2 percent on-year expansion tallied in September and marked its sharpest growth since 5 per

Dec. 7, 2011

-

Banks‘ household loans grow slower in Nov.

South Korean banks’ household loans grew at a slower pace in November than the previous month as mortgage loan growth eased, affected by the government‘s efforts to curb household debts, the central bank said Wednesday.Local banks’ household loans, including home-backed and credit loans, reached 453.2 trillion won ($402 billion) as of the end of November, up 1.4 trillion won from the previous month, according to the Bank of Korea.The November growth slowed from a 3.2 trillion won gain in October

Dec. 7, 2011

-

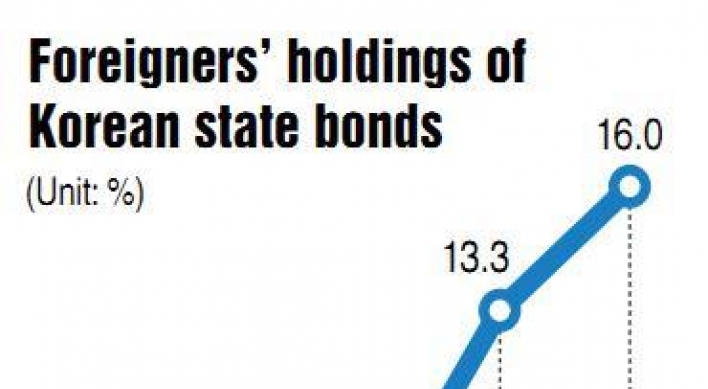

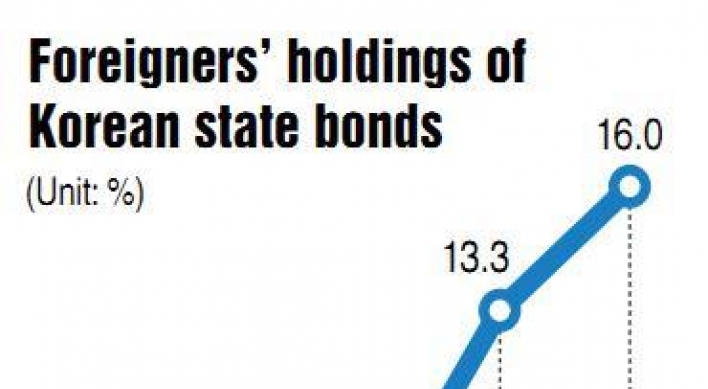

Foreign ownership of Korean state bonds hits a record 16%

Foreign investors have been raising their holdings in Korean government bonds, data showed on Wednesday, amid mixed reactions about its impact on the Korean economy. According to data from the Financial Supervisory Service and the Korea Financial Investment Association, the amount of listed government bonds owned by foreign investors reached 63.06 trillion won ($55.9 billion) at the end of November, accounting for 16 percent of total government bond ownership. The record-high foreign bond owners

Dec. 7, 2011

-

Outstanding loans by private lenders surge

Private lenders saw their outstanding loans snowball by more than 1 trillion won ($877 million) in the first six months of the year.Outstanding loans extended by private lenders reached 8.63 trillion won at the end of June, up 14.2 percent from 7.56 trillion won at the end of December 2010, according to the Financial Supervisory Service.The number of borrowers in the industry also increased by 267,000 from about 2.2 million to 2.47 million during the period, the FSS said.Credit-based lending acc

Dec. 7, 2011

-

Shares close higher on eased Europe woes

South Korean stocks rose 0.87 percent on hopes that European leaders will take strong actions to deal with the lingering debt problems at a summit later this week, analysts said. The local currency climbed against the U.S. dollar.The benchmark KOSPI gained 16.6 points to 1,919.42. Trading volume was moderate at 396.5 million shares worth 5.7 trillion won ($5.06 billion) with gainers leading losers 577 to 256.“Hopes are high that European leaders will move to change rules to force eurozone countr

Dec. 7, 2011

-

Korean economy to grow 3.5% in 2012, Goldman Sachs says

The Korean economy should grow 3.5 percent next year, slowing from an earlier estimate of 3.7 percent due to the eurozone debt crisis, and expand 4.1 percent in 2013, Goldman Sachs said on Wednesday. “There are many factors at work, and it’s true that people read confusion out of the current situation, but there won’t be a repeat of the 2008 turmoil,” said Kwon Goo-hoon, chief economist at Goldman Sachs, at a press briefing in Seoul.In the short term, a bearish mood will prevail in the first hal

Dec. 7, 2011

-

Workforce to shrink to half of population by 2060: report

The proportion of the country aged 15-64 will shrink to 49.7 percent by 2060, a government report said Wednesday.Statistics Korea said the shrinkage of the “economically active” population will be gradual as the working population began shrinking in the past five years for the first time in history.The number of working age people, standing at 35.98 million, or 72.8 percent of the population now, will increase to 37.04 million until 2016, and decline to 21.87 million, or 49.7 percent of the coun

Dec. 7, 2011

-

NPS mulls raising investment money from abroad: chief

South Korea’s national pension fund service has proposed a plan to the government to secure U.S. dollars from abraod to be used for overseas investments, its chief said Tuesday, raising hopes for the stabilization of the local currency market.“The National Pension Service has proposed a plan to the government to raise U.S. dollars for overseas investment from abroad instead of from the local foreign exchange market,” NPS chairman Jun Kwang-woo told the Yonhap News Agency during a telephone inter

Dec. 6, 2011

-

Foreign IBs say BOK may cut rate next year

A growing number of major foreign investment banks have forecast South Korea’s central bank will lower its key interest rate next year as inflationary pressure loses steam, a report showed Tuesday.The Bank of Korea froze the seven-day repo rate at 3.25 percent for the fifth straight month in November, citing downside growth risks such as Europe’s sovereign debt crisis and continued global financial market jitters.While some foreign investment banks were still betting the BOK will stand pat on th

Dec. 6, 2011

-

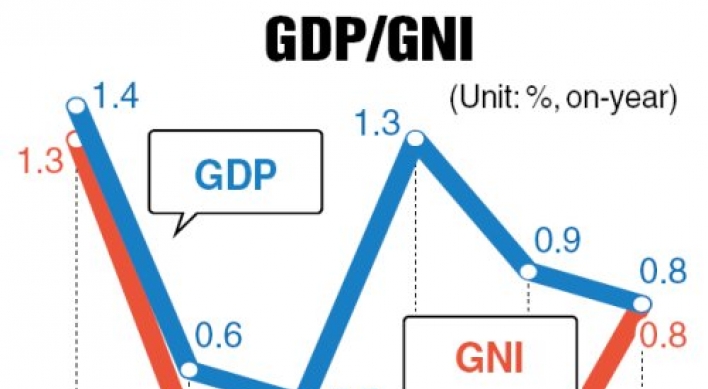

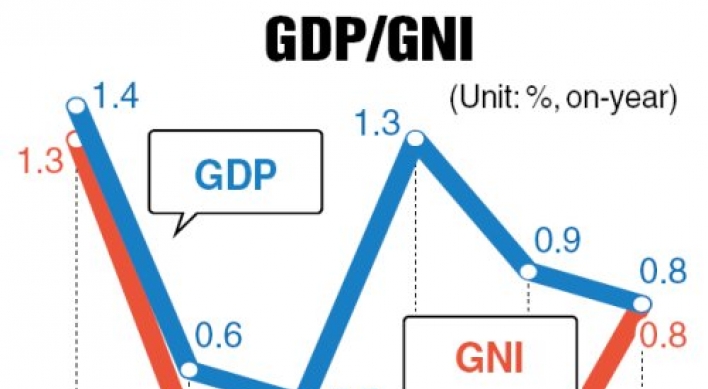

Korea’s growth slows to 0.8 percent in Q3

South Korea’s economy grew a seasonally adjusted 0.8 percent in the July-September period from the previous quarter, marking the slowest pace in three quarters amid growing worries over weakening domestic demand, revised central bank data showed Tuesday.Growth of the country’s gross domestic product, a key gauge of economic performance, was up from an earlier estimate of 0.7 percent, according to the Bank of Korea, but extended its downward trend for the second straight quarter after 1.3 percent

Dec. 6, 2011

-

Shares drop on eurozone woes

South Korean stocks slid 1.04 percent on Tuesday as investor sentiment was muted after Standard & Poor’s said it may downgrade the credit ratings of 15 eurozone countries, analysts said. The local currency fell against the U.S. dollar.The benchmark KOSPI lost 20.08 points to 1,902.82. Trading volume was moderate at 379.3 million shares worth 4.58 trillion won ($4.04 billion) with losers outnumbering gainers 579 to 252.“The threat of a downgrade made investors reluctant to increase risky assets a

Dec. 6, 2011

-

Brokerages blast capital gains tax plan

Securities companies claim new tax could drive away investorsAs the country’s policymakers began to discuss imposing a capital gains tax on shares to increase tax revenues, domestic brokerages expressed concerns about its negative impact on Tuesday.Although the debate is just getting started among politicians, securities houses are voicing their worries as the stakes couldn’t be higher if the current system is modified. The key point of contention is whether the fallout of a capital gains tax wo

Dec. 6, 2011

-

State agency advised to halt lottery sales

The gaming industry’s government supervisor has advised the lottery issuing authority to stop sales of lottery tickets to stem the boom brought on by the launch of pension-style lottery payments in July, officials said Monday. The National Gaming Control Commission has appealed to the Korea Lottery Commission, the lotto-operating agency under the Finance Ministry, to consider halting sales of all tickets out of concern that the government could be seen as instigating gambling. But the KLC will n

Dec. 5, 2011

-

KEB union threatens walkout against merger

Unionized workers of Korea Exchange Bank have mapped out a plan for a general strike, calling on Hana Financial Group to scrap its preliminary deal with Lone Star Funds.Their plan comes after Hana Financial signed a revised preliminary deal to take over KEB from Lone Star over the weekend.Despite the two parties’ recent agreement to lower the takeover price, the KEB union said it is against Hana’s move to pay Lone Star huge management premiums.“According to the situation, we could choose to stag

Dec. 5, 2011

-

Central bank head rules out eurozone support

South Korea’s central bank currently has no plans to tap into its foreign exchange reserves to help the eurozone tackle its debt crisis, the bank’s chief said Monday.“First, it is necessary to watch whether Europe can handle its problems by itself,” Bank of Korea Gov. Kim Choong-soo told reporters on the sidelines of an international conference, stressing a wait-and-see approach on possible support measures for the debt-mired region.Kim’s remarks come after China announced it will not use its am

Dec. 5, 2011