Articles by Son Ji-hyoung

Son Ji-hyoung

consnow@heraldcorp.com-

Busan-based VC to control mask inventory app operator Carelabs

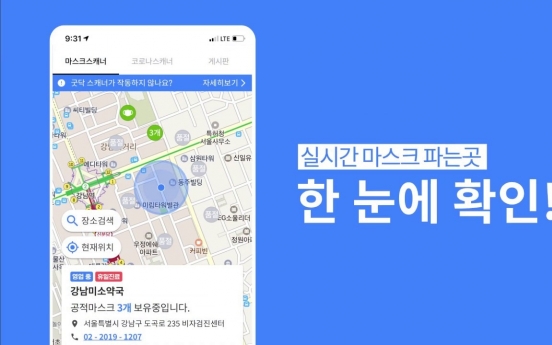

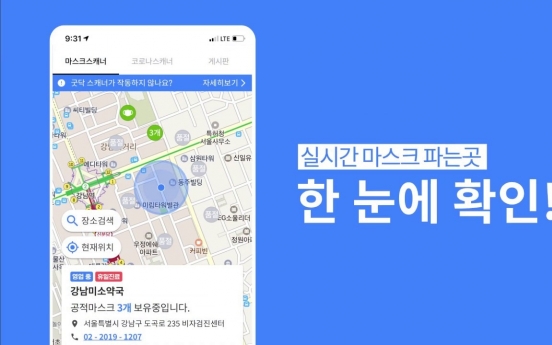

Busan-based venture capital Maple Investment Partners has been selected as the preferred bidder to become the largest stakeholder of Carelabs, a South Korean company listed on the development stock bourse Kosdaq, a regulatory filing showed Friday. Carelabs operates a mobile app Gooddoc, which allows users to track the nearest hospitals and drugstores. The app began to feature real-time face mask inventory tracking function earlier in March. Facing a mounting fallout of COVID-19 here and the c

Market March 13, 2020

-

Assetplus ex-CEO returns to top post

Assetplus Investment Management said Wednesday it has named Edward Yang as its new CEO following a shareholders meeting. This marks Yang’s return to the top post in four years -- he served in the top post from June 2012 to May 2016. After his term, he has since led Assetplus’s strategic business division. Yang said he would focus on the firm’s digital marketing scheme that would allow the asset manager to draw retail investments into its funds through mobile trading platfor

Market March 11, 2020

-

Heung-A Shipping to undergo KDB-led debt restructuring

South Korea’s No. 5 shipping firm Heung-A Shipping is planning a corporate workout program as its maritime cargo operations have faltered, with snowballing debt, a regulatory filing showed Wednesday. The company’s board has approved a debt restructuring scheme by the policy lender Korea Development Bank, one of its key creditors, to “improve its finances and normalize business operations.” Under the KDB-led financial rescue package, creditors will take control of the t

Market March 11, 2020

-

NPS to be no barrier for Hyosung chairman to extend term

Despite the National Pension Service’s efforts to actively interfere in the management decisions of scores of domestic companies as a major shareholder, it is likely to leave Hyosung Group untouched. The NPS has yet to change the shareholding purpose of Hyosung Corp., holding firm of the family-controlled conglomerate, to “general investing” from “nonengagement investing,” which would otherwise have allowed it to have a say in issues related to executive salaries

Market March 10, 2020

-

Shinhan Card to buy Hyundai Capital’s W500b assets for rental car biz

Shinhan Card said Tuesday it is poised to buy parts of Hyundai Capital’s assets related to its long-term car rental services for around 500 billion won ($417.3 million). The assets will be composed of vehicles under the South Korean carmaker -- Hyundai, Kia and Genesis -- which Hyundai Capital rents to consumers, as well as rental consumers. The final acquisition price will differ depending on shareholder approval. The two companies signed the deal Monday for the transaction scheduled

Market March 10, 2020

-

Coronavirus puts Korean venture firms on edge

The coronavirus fear is increasing financial burdens on listed South Korean venture firms as they are facing more calls for cash redemption from investors. Investors in firms listed on Korea’s development bourse Kosdaq have cashed out their combined 361.3 billion won ($303.4 million) investment in mezzanine bonds -- convertible bonds and bond warrants -- from January until Friday, prior to their due maturity date, according to regulatory filings. This marked a 48.4 percent increase on-y

Market March 8, 2020

-

[Exclusive] Lutronic faces lawsuit in US for alleged trade secrets theft

The US subsidiary of South Korea’s Lutronic is facing a lawsuit for allegedly misappropriating trade secrets through former employees of Cutera it hired recently, according to documents reviewed by The Korea Herald. Aesthetic laser equipment maker Cutera -- listed on Nasdaq -- claimed that forensic research results showed that Lutronic Aesthetic had poached 13 employees, encouraging them to steal trade secrets and destroy evidence until February. In return, they were rewarded with stock o

Market March 5, 2020

![[Exclusive] Lutronic faces lawsuit in US for alleged trade secrets theft](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/03/05/20200305000643_0.jpg&u=20200305155917)

-

SK Networks shares spike on W1.3tr fuel retailer sell-off

SK Networks shares rose sharply Thursday on anticipations that its decision to divest its energy retailer unit for 1.3 trillion won ($1.1 billion) would improve the balance sheet. Its shares closed 14.5 percent higher on Kospi bourse compared to the previous session. Analysts said the price was buoyed by expectations that SK Networks would mitigate its debt burden from its acquisition of AJ Rent A Car in December 2019, carry out a 100 billion won share buyback and overhaul the trading firm&rsq

Market March 5, 2020

-

Woori, Hana face W36.5b fine, 6-month suspension for DLF fiasco

South Korea’s top financial regulator on Wednesday slapped a combined 36.5 billion won in ($30.8 million) fines on Woori Bank and Hana Bank, along with a six-month ban on attracting investors‘ money into privately pooled funds. The Financial Services Commission’s final decision indicates that the authorities held the banks responsible for their lack of internal control, as they failed to protect retail investors from potential risks implied in the structured products known as

Market March 4, 2020

-

Cape Industries faces proxy war over directors, dividends

South Korea’s ship engine parts maker Cape Industries is facing a proxy fight as its activist shareholders are opposing the firm’s excessive compensation to executives despite piling losses. The investor group, led by KH Investment, has proposed a cut on Cape’s four executives pay to half -- 1.5 billion won ($1.3 million) maximum if combined -- and recommended candidates for outside directors and auditors. The alliance is also demanding the first dividend payout of the group

Market March 3, 2020

-

KCGI woos Delta Air Lines for Hanjin control

A coalition led by South Korea’s activist private equity fund Korea Corporate Governance Improvement called Delta Air Lines a “partner” in its pursuit for a control over Hanjin Group and its crown jewel Korean Air in a note Monday. This reflects KCGI’s drastic turn from the previous week when the activist investor questioned Delta’s increase in Hanjin KAL stake -- to 11 percent in February -- as the family-controlled Hanjin Group had entered into a proxy battle tha

Market March 2, 2020

-

Stocks of firms selling coronavirus testing kits soar

Shares of South Korean companies dedicated to novel coronavirus testing kits soared on Monday, amid rising demand. Local diagnostic kit makers are launching devices that detect coronavirus infections, which allow authorities to test over 10,000 people a day as of current -- from around 1,000 two weeks prior. One of them is Seegene, a maker of the real-time polymerase chain reaction analysis assays. The Seoul-based company closed at 40,400 won ($33.8) per share, up 10.7 percent Monday, on the

Market March 2, 2020

-

KDB picks 2 external partners to back W120b for supply chain autonomy

State-run Korea Development Bank said Friday it had chosen two external partners to operate funds with a combined 120 billion won ($99.2 million) of public money to support South Korea’s drive for supply chain autonomy. The two partners are BNW Investment-Industrial Bank of Korea consortium and SKS Private Equity-Korea Investment Private Equity group. These were among nine applicants to manage the funds. Each group is mandated to attract at least 40 billion won investment from the priva

Market Feb. 28, 2020

-

Hanwha Asset to raise W510b capital in cross-border push

Hanwha Asset Management said Friday it planned to raise 510 billion won ($421.7 million) capital from its parent Hanwha Life Insurance, which would bring its total capital to over 700 billion won -- the second-largest for an asset management company in South Korea. The fresh capital will be used to enhance overseas alternative investment capacity through acquisitions of foreign asset management firms, expand its overseas units, create a digital infrastructure and nurture more investment opportu

Market Feb. 28, 2020

-

Korean IPOs in February defy coronavirus fears

The initial public offerings of South Korean firms in February were largely successful, despite the impact of the new coronavirus on the domestic stock market. This month through Friday, five companies -- Sunam, Lemon, Kencoa Aerospace, JNTC, Seoul Viosys -- wrapped up IPOs, raising a combined 192.1 billion won ($158.1 million). Four out of five, except for Kencoa Aerospace, were more than successful. The offered prices of the four companies were set at, or beyond, the upper cap of the price

Market Feb. 28, 2020

Most Popular

-

1

Industry experts predicts tough choices as NewJeans' ultimatum nears

-

2

Jung's paternity reveal exposes where Korea stands on extramarital babies

-

3

Seoul city opens emergency care centers

-

4

Opposition chief acquitted of instigating perjury

-

5

Samsung entangled in legal risks amid calls for drastic reform

-

6

[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg&u=20241126161719)

-

7

[Exclusive] Hyundai Mobis eyes closer ties with BYD

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg&u=)

-

8

Agency says Jung Woo-sung unsure on awards attendance after lovechild revelations

-

9

[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance

![[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050072_0.jpg&u=)

-

10

Why S. Korean refiners are reluctant to import US oil despite Trump’s energy push

![[Exclusive] Lutronic faces lawsuit in US for alleged trade secrets theft](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/03/05/20200305000643_0.jpg&u=20200305155917)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg&u=20241126161719)

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg&u=)

![[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050072_0.jpg&u=)