Articles by Park Ga-young

Park Ga-young

gypark@heraldcorp.com-

Startup incubator D.camp generates ripple effect worth W6.7tr, 32,000 jobs

D.Camp, a non-profit foundation established by 19 banks to foster startups, said on Thursday it has created a trickle-down effect worth 6.7 trillion won ($6.01 billion) in the past three years. The foundation spent a total of 188.7 billion won to support the startup ecosystem for three years from 2018, with a total investment of 2.43 trillion won from the private sector, said Park Nam-gyoo, a business administration professor at Seoul National University at an online press conference. Park,

Market Jan. 29, 2021

-

Kakao Pay to halt part of service due to unsolved large shareholder issue

Kakao Pay is expected to halt its integrated personal data management services after failing to obtain a license from the financial authorities, the company said Thursday. The move could leave the firm lagging behind rivals, which are aggressively tapping into the business area. The fintech arm of mobile giant Kakao said its asset management service, which allows users to keep track of all their bank accounts, credit card records and insurance policies, will cease Feb. 5. Other companies that

Market Jan. 28, 2021

-

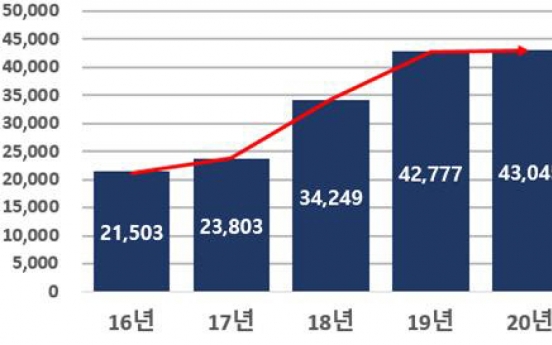

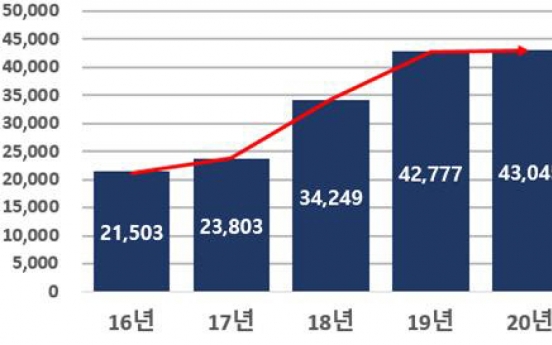

Venture investment hits record high in 2020

South Korea’s venture investment set records in 2020 both in the number of deals and their value, despite the fallout from the coronavirus pandemic, the Ministry of SMEs and Startups announced Wednesday. The country’s investment in startups reached 4.30 trillion won ($3.89 billion) in 2020, adding 26.8 billion won, or 0.6 percent, from the previous year. The number of investment deals also hit a record high of 4,231 while the number of invested companies logged an all-time high

Market Jan. 27, 2021

-

Retail investors push Kosdaq above 1,000 for first time in 20 years

South Korea’s tech-heavy Kosdaq rose above 1,000 points Tuesday for the first time in 20 years, before wiping out earlier gains in the afternoon. The secondary index inched up as much as 8.10 points to 1,007.40 points in the morning, for the first time since Sept. 14, 2000, then turned negative to close at 994.00 points, 0.53 percent lower than the previous day. The Kosdaq began at 1,000 points on July 1, 1996 and rose as high as 2834.40 points on March 10, 2000 before plummeting to 99

Market Jan. 26, 2021

-

Kakao Bank to recruit over 100 workers in H1

Kakao Bank, South Korea’s leading Internet-only bank, said on Monday that it is hiring more than 100 employees in its push to ramp up digital innovation. The lender said it plans to hire experienced talent in eight areas -- financial IT development, risk management, business development, service plan, compliance, audit, and customer services -- in the first half of the year. After the latest talent hunting, the company’s headcount, which currently stands at 937, will exceed 1

Economy Jan. 25, 2021

-

[Herald Interview] Meet ant investors' YouTube guru

Kim Dong-hwan, the founder of a market and economic YouTube show “Three Pros” had never imagined that his channel would have 1 million subscribers, a tenfold increase, just within a year. “Three Pros: With Economic God” provides daily market updates and analysis of industries and economy and is hosted by three “pros” in the field: Kim, Lee Jin-woo and Jung Young-jin. The channel has recorded more than 200 million views so far and attracts as many as 60,000

Economy Jan. 24, 2021

![[Herald Interview] Meet ant investors' YouTube guru](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2021/01/24/20210124000138_0.jpg&u=20210125090913)

-

Upbit launches digital currency exchange in Thailand

Upbit, a South Korean digital asset exchange, said Thursday that its Thailand unit was up and running after receiving the necessary licenses from regulators. The Thailand Securities and Exchange Commission recently granted approval for Upbit Thailand in four business areas -- digital asset exchange and brokerage and digital token exchange and brokerage -- with Upbit Thailand being fully operational as of Wednesday, the company said. “It is a very exciting time for the digital asset indu

Market Jan. 21, 2021

-

Toss seeks talent to gear up for competition

Viva Republica, the operator of leading finance app Toss, on Wednesday announced that it plans to add 330 new staff in the first quarter ahead of the launch of an internet-only bank and an online securities arm later this year. The latest hunt for talent comes as the 6-year-old startup prepares to become the country‘s third internet-only bank, expected to launch in July, and to kick off the mobile securities firm Toss Securities next month. With five units under its umbrella, including f

Market Jan. 20, 2021

-

Dunamu introduces digital asset fear-greed index

Dunamu, a South Korean blockchain and fintech company, said Tuesday that it has developed an indicator that measures volatility of digital asset market to help investors make decisions. The digital asset fear-and-greed index reflects market sentiment in five different levels, from ”extreme fear“ to ”extreme greed.” The index gauges market volatility with trading price and transaction volume every five minutes. “As many domestic digital asset investors use gl

Market Jan. 19, 2021

-

[Feature] Fear of missing out: Psychology behind Kospi rally

The nickname “ants” has been used to describe South Korean retail investors, as a diligent but minor group seeking profit from the market with little in the way of knowledge or funds. The recent stock craze that pushed up the nation‘s main bourse Kospi, however, shows how those minor players are transforming. Armed with abundant funds and wider access to limited information thanks to advanced technology, the ants are marching toward the territory of the institutional and for

Market Jan. 18, 2021

![[Feature] Fear of missing out: Psychology behind Kospi rally](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2021/01/18/20210118000851_0.jpg&u=20210118183454)

-

Mirae Asset chairman stresses innovation

Park Hyun-joo, chairman and founder of South Korea’s Mirae Asset Group, on Thursday urged analysts to explore innovative companies, stressing shifting investment strategies focusing on the growth potential of companies rather than assessment of the manufacturing value chain. At an online investment strategy meeting, Park referred to unexpected innovations that could have a significant impact on the market, saying that the markets are transitioning from a focus on the value chain to innova

Market Jan. 14, 2021

-

[Market Close-up] Kospi’s dizzy new heights: Asset bubble or market reality?

As South Korea’s main bourse continues its upward movement backed by an unprecedented buying spree by individual investors, some analysts said Tuesday warned that it might be overheating. “The level of return on equity calls for a cautious approach at the moment. You could say the market is heading upward for many reasons, but it’s too fast,” said Kim Han-jin, a senior analyst at KTB Investment and Securities. ROE is the rate of return on the capital provided by the c

Market Jan. 12, 2021

![[Market Close-up] Kospi’s dizzy new heights: Asset bubble or market reality?](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2021/01/12/20210112000854_0.jpg&u=20210113140458)

-

Credit loans soar again amid relaxed rules, bullish market

Credit loans climbed back up in the first week of 2021, fueled by a bullish stock market and eased bank loan rules, data showed Sunday. The total credit loan balance of the major five commercial banks -- KB Kookmin, Shinhan, KEB Hana, Woori and NH Honghyup -- stood at 134.1 trillion won ($122.6 billion) as of Jan. 7, adding 453 billion won from 133.6 trillion won at the end of 2020. The number of new credit loans via overdraft accounts almost doubled from 1,048 on Dec. 31 to 1,960 on Jan. 7.

Market Jan. 10, 2021

-

Korean venture capital E& leads merger of clinical stage biotech firms

E& Investment, a South Korean venture capital that specializes in the bio and health care sectors, said Thursday that NeuroBo Pharmaceutical, in which the company owns a 40 percent stake, had acquired a US COVID-19 treatment developer. NeuroBo, a Nasdaq-listed clinical-stage biotechnology company, on Dec. 31 acquired ANA Therapeutics, which is developing a treatment for COVID-19 that is currently in phase two and three clinical trials. “This is an exciting and transformative

Market Jan. 7, 2021

-

Retail investors, hopes of recovery open up era of Kospi 3000

An estimated 10 million retail investors, a weak dollar and hope for recovery pushed the benchmark Kospi above the 3,000-point threshold on Wednesday in what could be a new era for the local stock market. Analysts say many factors have driven the rally, including the weak dollar and anticipation for improved corporate earnings, but the biggest force may be legions of small investors, known locally as “ants.” The “ant warriors,” who purchased 60 trillion won ($52.22 bi

Market Jan. 6, 2021

Most Popular

-

1

Korea to take action if currency falls more

-

2

[KH Explains] Why Yoon golfing is so controversial

![[KH Explains] Why Yoon golfing is so controversial](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/13/20241113050608_0.jpg&u=)

-

3

Samsung stocks fall to 4-year low

-

4

Govt. cracks down on wedding industry

-

5

Suneung retakes hit record amid med school expansion

-

6

Proactive, calm approach needed in response to Trump 2.0

-

7

NewJeans sets 14-day deadline for Ador to meet demands, including return of Min Hee-jin

-

8

[KH Explains] For Korean automakers, Chinese EVs may loom larger than Trump’s tariffs

![[KH Explains] For Korean automakers, Chinese EVs may loom larger than Trump’s tariffs](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/14/20241114050537_0.jpg&u=20241114162436)

-

9

[Graphic News] Tainan predicted top destination for South Koreans in 2025

![[Graphic News] Tainan predicted top destination for South Koreans in 2025](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/13/20241113050807_0.gif&u=)

-

10

NewJeans reassure fans after giving ultimatum to Ador

![[Herald Interview] Meet ant investors' YouTube guru](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2021/01/24/20210124000138_0.jpg&u=20210125090913)

![[Feature] Fear of missing out: Psychology behind Kospi rally](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2021/01/18/20210118000851_0.jpg&u=20210118183454)

![[Market Close-up] Kospi’s dizzy new heights: Asset bubble or market reality?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2021/01/12/20210112000854_0.jpg&u=20210113140458)

![[KH Explains] Why Yoon golfing is so controversial](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/13/20241113050608_0.jpg&u=)

![[KH Explains] For Korean automakers, Chinese EVs may loom larger than Trump’s tariffs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/14/20241114050537_0.jpg&u=20241114162436)

![[Graphic News] Tainan predicted top destination for South Koreans in 2025](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/13/20241113050807_0.gif&u=)