Articles by Kim Young-won

Kim Young-won

-

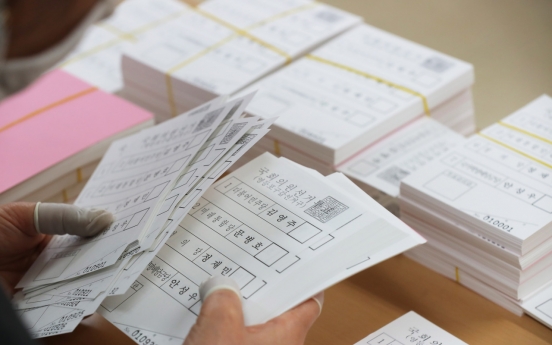

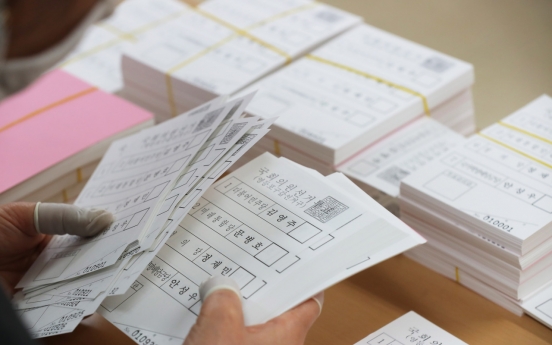

Koreans under self-quarantine may be allowed to vote in general elections

South Korean citizens under self-quarantine at home are likely to be allowed to cast their ballots in next week’s general elections scheduled Wednesday, according to the disaster control agency. “Government agencies and related organizations have been discussing measures on how to enable those being quarantined at home to exercise their voting rights at the upcoming April 15 elections,” said Kim Kang-lip, a senior official at the Korea Central Disaster and Safety Countermea

Social Affairs April 11, 2020

-

Businesses brace for liquidity crisis by selling assets

Facing a looming liquidity crunch due to the coronavirus crisis, South Korean companies have sold off their assets, including real estate and equities, to keep enough cash in their vaults, according to the Korea Exchange on Thursday. From January to April 7, 29 companies sold a combined 1.5 trillion won ($1.23 billion) worth of tangible assets, compared to 481.6 billion won worth assets sold by 18 companies during the same period last year, the bourse operator said. Most of the asset sales we

Market April 9, 2020

-

Individual investors bet on oil price recovery

With oil prices sinking, individual investors in South Korea are increasingly opting for investments linked to oil prices, according to the Korea Exchange on Wednesday. The stock market operator noted that the combined value of 10 oil-linked exchange-traded funds and exchange-traded notes that individuals bought last month jumped more than ninefold from the previous month to reach 1.42 trillion won ($1.16 billion). Kodex WTI Crude Oil Futures ETFs, in particular, attracted 421.4 billion wo

Market April 8, 2020

-

[Market close-up] Market eyes KDB's bail-out plan on coronavirus-hit companies

A number of companies in South Korea, both big and small, are standing on the edge of a cliff due to a liquidity crisis stemming from the ongoing virus pandemic. With dark clouds hovering, the Korea Development Bank, a state-owned development policy bank that finances industrial projects, is bending over backward to prop up Korea Inc., injecting vast amounts of emergency public funds into cash-strapped businesses. The industry is keenly watching the next moves of KDB Chairman Lee Dong-gull,

Market April 7, 2020

![[Market close-up] Market eyes KDB's bail-out plan on coronavirus-hit companies](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/04/07/20200407000645_0.jpg&u=20200407184707)

-

Jeonse prices on rise as demand for house purchases falls

The average price for the jeonse -- a real estate term unique to South Korea that refers to a property lease -- in Seoul has surpassed 460 million won ($375,000) for the first time, continuing the recent upward trend, data showed Monday. According to the Korea Appraisal Board, a property assessment agency, the average jeonse prices in the capital have been rising since July to reach 460.7 million won as of March. Separate data from property services platform KB Kookmin Bank Liiv On also sho

Market April 6, 2020

-

No. of small biz owners in default rose 7.5% from Q2 to Q4 last year

The number of small business owners who were unable to repay credit loans prolonged an upward trend last year and remains likely to expand further this year, due to the novel coronavirus spread, data showed Sunday. The number of small business owners who are in default came in at 35,806 in the fourth quarter last year, up from 35,567 in the third quarter and 33,292 in the second quarter, according to data compiled by credit rating firm NICE Credit Information Service. Given that some 2.09 mi

Market April 6, 2020

-

S. Korea to post negative GDP growth due to coronavirus: reports

South Korea is likely to post negative economic growth this year due to the novel coronavirus pandemic, data showed Sunday. The average estimate of the nation’s gross domestic product growth for this year recently came to negative 0.9 percent, drastically down from the previous suggestion of around 2 percent. The forecasts were tallied from 11 global financial services firms, including Standard Chartered, UBS, Morgan Stanley, Nomura Holdings and Credit Suisse. The plunge is attributed

Market April 5, 2020

-

Temasek sells Celltrion stake in block deal

Ion Investments, an affiliate of Singaporean investment firm Temasek Holdings, sold millions of shares of Korean biosimilar giant Celltrion and its distribution affiliate Celltrion Healthcare in a block deal before markets opened, according to news reports Thursday. The Singapore-based investment firm sold 2.57 million shares, or 1.9 percent, of Celltrion, and 2.21 million shares, or 1.5 percent, of Celltrion Healthcare via the block trading deal. The stock price of Celltrion fell 8.08 perc

Market April 2, 2020

-

Hyundai Capital’s global assets surpass W50tr

Hyundai Capital said Wednesday that assets of its global offices surpassed 50 trillion won ($40.9 billion) in value for the first time since it launched its first overseas branch in the US in 1989. The Seoul-headquartered auto financier said its global branches owned 50.8 trillion won of financial assets last year, double that of the domestic market. Hyundai Capital’s global branches also posted a record pretax income of 766.3 billion won. “The company’s standardized busin

Market April 1, 2020

-

[Exclusive] Meritz Securities bond sale raises W1.2tr on path to become ‘mega IB’

Asset management firm Meritz Securities recently sold more than a trillion won of property bonds in a bid to meet government rules that require securities firms to lower debt guarantees, according to sources Tuesday. The Seoul-based firm last week sold bonds worth 1.2 trillion won ($983 million) to institutional investors and insurance firms, sources said. Some of the buyers are said to include KDB Life Insurance, IBK Pension Insurance, and Tongyang Life Insurance. The l

Market March 31, 2020

![[Exclusive] Meritz Securities bond sale raises W1.2tr on path to become ‘mega IB’](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/03/31/20200331000553_0.jpg&u=20200331180050)

-

메리츠종금증권, 1조원 규모 부동산PF매각

메리츠종금증권이 최근 약 1조원이 넘는 부동산 프로젝트파이낸싱(PF) 일부를 생명보험사와 손해보험사 등에 매각했다. 이번 매각은 내년 7월부터 부동산PF 채무보증 규모를 자기자본의 100%이내로 축소 해야 하는 규정을 따르기 위한 움직임으로 보인다. 또한 올해 초대형투자은행(IB) 신청을 앞두고 선제적으로 금융시장 규정들을 따르기 위한 움직임으로 해석되고 있다. 31일 업계에 따르면 최근 메리츠종금증권이 1조 2천억원 규모의 부동산PF를 손해보험과 생명보험사 등에 매각했다고 밝혔다. 인수자로는 KDB생명, IBK연금보험, 동양생명 등이 거론 되고 있다. 익명을 요구한 업계관계자는 “코로나바이러스로 인해 위험이 상대적으로 낮은 투자자산을 원하는 투자자들에게 초우량자산을 매각 한 것,”이라고 밝히며, “앞으로 추가 부동산PF 매각이 예정되어 있다,”라고 말했다. 메리츠종금증권의 채무보증 규모는 지난해 말 약 8조원으로 자기자본금액 약 3

한국어판 March 31, 2020

-

Chaotic market puts fate of Korean M&As to test

Over the past few months since the outbreak of the novel coronavirus, some employees of Hyundai Development Company, a local real estate developer under the pan-Hyundai empire, have been walking on thin ice. The market is facing a pandemic test, they said, pointing out the company’s landmark deal to acquire Asiana Airlines, the nation’s second-largest air carrier. The market hit by once-in-a-generation crisis could undermine the financial soundness of the company, not to mention

Market March 30, 2020

-

Mirae Asset takes lead in local pension fund industry

Mirae Asset Global Investments, a Korean asset management firm, has been cementing its leadership in the local personal pension fund market with assets under its management continuing to grow this year. Personal pension and retirement pension funds operated by Mirae Asset have reached a combined 7.59 trillion won ($6.3 billion), or 3.63 trillion won and 3.96 trillion won, respectively. As of this year, the pension funds had increased by 500 billion won, the highest increase in the local mark

Market March 29, 2020

-

NPS contemplates stance on fate of Hanjin KAL chairman

South Korea’s state pension fund said Wednesday that it will take a final stance Thursday on the family feud centering on management control of Hanjin KAL, holding company of Hanjin Group which runs Korean Air. A trust management committee under the state-run National Pension Service, which holds 2.9 percent stake in Hanjin KAL, will decide on its vote on the reappointment of Cho Won-tae, chairman of Hanjin Group, at a shareholders meeting scheduled Friday. It is widely expected that

Market March 25, 2020

-

Business loans soar in March amid looming coronavirus recession

As the COVID-19 pandemic is expected to cause an economic contraction worldwide, South Korean conglomerates, the main locomotives of the nation’s economy, are increasingly borrowing money from banks in a bid to improve liquidity, according to data Tuesday. The loan balance of Korean conglomerates at five banks -- KB Kookmin Bank, Shinhan Bank, Woori Bank, Hana Bank and NH Bank -- came in at 78.7 trillion won ($62.9 billion) as of Friday, up 1.78 trillion won from late February. T

Market March 24, 2020

Most Popular

-

1

Actor Jung Woo-sung admits to being father of model Moon Ga-bi’s child

-

2

Wealthy parents ditch Korean passports to get kids into international school

-

3

Man convicted after binge eating to avoid military service

-

4

First snow to fall in Seoul on Wednesday

-

5

Final push to forge UN treaty on plastic pollution set to begin in Busan

-

6

Industry experts predicts tough choices as NewJeans' ultimatum nears

-

7

Korea to hold own memorial for forced labor victims, boycotting Japan’s

-

8

Nvidia CEO signals Samsung’s imminent shipment of AI chips

-

9

Job creation lowest on record among under-30s

-

10

Opposition chief acquitted of instigating perjury

![[Market close-up] Market eyes KDB's bail-out plan on coronavirus-hit companies](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/04/07/20200407000645_0.jpg&u=20200407184707)

![[Exclusive] Meritz Securities bond sale raises W1.2tr on path to become ‘mega IB’](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/03/31/20200331000553_0.jpg&u=20200331180050)