Articles by Kim Young-won

Kim Young-won

-

Hanhwa’s Lifeplus brand wins iF design awards

Lifeplus, a joint brand of South Korean conglomerate Hanhwa Group’s financial businesses, bagged two awards at the world’s prestigious International Forum Design Award 2020, according to Hanhwa Life, an insurance firm and a key subsidiary, on Wednesday. The brand, launched in 2017 for the conglomerate’s financial units -- including life insurance, general insurance, stock brokerage and asset management -- won the awards in the two categories of communication design a

Market Feb. 12, 2020

-

NPS posts highest return on investment since 2010

South Korea’s state pension fund National Pension Service said on Tuesday that it posted the highest return on investment in 10 years in 2019 largely due to the bullish stock markets here and abroad. The state-run pension fund marked an estimated rate of return of 11 percent last year, raking up a whopping 70 trillion won ($59 billion), according the NPS. The yield is the largest since 2010 when the fund operator marked 10.37 percent. In 2018, the NPS posted a negative yield of 0.

Market Feb. 11, 2020

-

Lime likely to release result of audit on its funds: FSC

Hedge fund operator Lime Asset Management will likely announce the amount of losses made by some of its troubled funds next week, according to the Financial Services Commission on Friday. The audit process on Lime’s now frozen funds, being conducted by audit firm Samil PricewaterhouseCoopers, has reportedly completed and the result is scheduled to be sent to the fund operator today. “The audit seems to have taken more time than expected because necessary documents and data have

Market Feb. 7, 2020

-

S. Korea to control supply of masks, hand sanitizers

Finance Minister Hong Nam-ki said on Friday that the ministry will implement measures to control the supply and distribution of masks and hand sanitizers next week, warning that the government would impose harsh penalties on those hoarding the products. “The government will take stricter measures to prevent illegal activities that could risk the public health and stoke concerns among the people,” said the finance minister, who chaired a meeting with officials at the ministry on t

Market Feb. 7, 2020

-

Insurance sector speeds up digital transition

Traditional insurance companies in South Korea are speeding up digital transformation of their operations and services to compete with emerging tech-savvy companies that are proliferating in the financial sector. However, their digital strategy also involves industrial crossover partnerships with the emerging competitors, if necessary. Samsung Fire & Marine Insurance, the nation’s largest non-life insurance firm, and Kakao Pay, a fintech spin-off of mobile messenger giant Kakao,

Market Feb. 6, 2020

-

Kakao’s entry into brokerage to vitalize fintech market: reports

Mobile messenger Kakao’s entry into the stock trading market, via its fintech spinoff Kakao Pay, will boost growth of the financial technology sector and the brokerage market, according to local analysts on Thursday. The Financial Services Commissions, South Korea’s financial regulator, on Wednesday approved Kakao Pay’s request to acquire a controlling 60 percent stake in local brokerage Baro Investment & Securities. The stock trader has been renamed to Kakao Pay Securi

Market Feb. 6, 2020

-

Kakao Pay gets green light to acquire local brokerage

The Financial Services Commission, South Korea’s financial regulator, said Wednesday that it has approved fintech firm Kakao Pay’s request to become the largest shareholder of brokerage house Baro Investment & Securities. With that final authorization, the fintech firm will be able to operate stock trading businesses on its own mobile platforms as well as those run by its parent firm, mobile messenger giant Kakao. Last year the Kakao fintech spinoff submitted an application

Market Feb. 5, 2020

-

Hana Bank considers acquiring stake in local bank in Myanmar

Hana Bank, one of the largest commercial banks in South Korea, said Tuesday it is considering acquiring a stake in a local bank in Myanmar. The Southeast Asian nation has recently started allowing foreign financial companies to run operations, to a limited extent. “While having applied at the local financial authorities in Myanmar for launching a branch in the local market, Hana Bank is also considering to acquire a stake in a major local bank,” said a spokesperson from Hana Fi

Market Feb. 4, 2020

-

Credit card firms vigilant over fear of new coronavirus spread

Responding to the quick spread of the new coronavirus, South Korea’s credit card issuers are running a hotline with the Korea Centers for Disease Control and Prevention, according the Credit Finance Association Tuesday. Through the emergency communication line, the KCDC makes real-time requests to card companies for payment records to identify the places visited by the infected -- both Korean citizens and foreign nationals. Health authorities are allowed to access the payment informat

Market Feb. 4, 2020

-

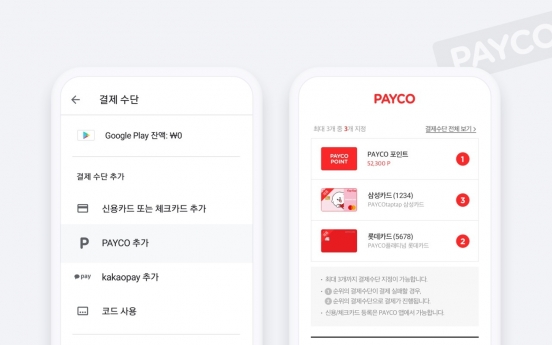

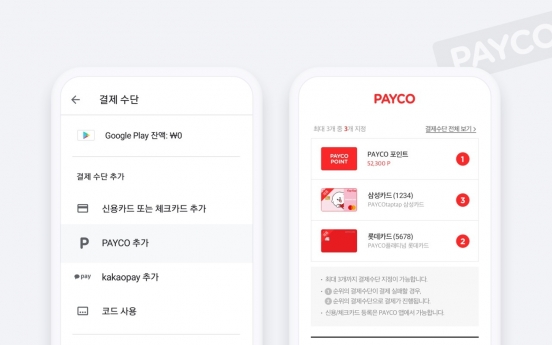

NHN, Google expand mobile payment partnership

NHN, one of South Korea’s largest internet service providers, said Monday that its credit and debit card-based payment services will be available on tech giant Google’s flagship platforms including Google Play, YouTube and Google Drive. The firm -- based in Pangyo, Gyeonggi Province -- offers a mobile payment solution called Payco, which was already available to a limited extent on the Google platforms. Since November 2017, Payco subscribers have been able to use Payco membershi

Market Feb. 3, 2020

-

Leadership vacuum at Woori and Hana inevitable due to FSS’ heavy sanctions

Financial giant Woori Financial Group said Friday that it has delayed the process to select CEO candidates for its banking unit Woori Bank. The announcement came after the nation’s financial watchdog Financial Supervisory Service decided the day before to impose sanctions on top executives of Woori Financial Group and Hana Financial Group. “The company has decided to readjust the schedule for shortlisting CEO candidates due to recent changes,” the financial conglomerate sai

Market Jan. 31, 2020

-

Investments in Korean startups hit record high

The startup market here saw record investments of 4.28 trillion won ($3.61 billion) last year, according to the Ministry of SMEs and Startups on Thursday. The figure was up from 2.38 trillion won in 2017. Of the total, private funds invested 1.48 trillion won, or 35 percent, of money injected into the local startup industry. By segment, smart health care companies received 617.2 billion won, while sharing-economy businesses and financial technology firms attracted 276.1 billion won and 12

Market Jan. 30, 2020

-

Median apartment price in Seoul jumps 50% under Moon govt

The median price of apartments in Seoul surpassed the 900 million won ($760,000) threshold in January for the first time, according to commercial bank KB Kookmin Bank on Thursday. The bank’s monthly report on real estate prices showed that the median price of Seoul apartments reached 912.2 million won as of this month, a record high since comparable data started to be compiled in December 2008. A housing unit with a market value of 900 million won or more, categorized as an “exp

Market Jan. 30, 2020

-

FSC vows to beef up risk assessment for financial firms

Eun Seong-soo, chairman of the Financial Services Commission, said Wednesday that the financial regulator will come up with measures to monitor risks of financial conglomerates in a comprehensive manner. “The FSC will keep trying to establish sophisticated risk assessment rules for financial conglomerates, which will not overlap with the existing regulations in the financial sector,” said the FSC chairman in a meeting jointly organized by financial think tanks Korea Institute of Fi

Economy Jan. 29, 2020

-

[KH Explains] TRS, leverage scheme behind hedge fund debacle in Korea

The recent brouhaha surrounding hedge fund company Lime Asset Management is stoking concerns about a potential liquidity crunch across the financial market in South Korea. At the heart of the controversy is what is called a total return swap. Simply put, a TRS is a financial deal that helps fund operators like Lime Asset enjoy leverage. For instance, a hedge fund can acquire underlying assets, including bonds, equities, commodities and mortgage-backed securities, in partnership with a cash-r

Market Jan. 29, 2020

![[KH Explains] TRS, leverage scheme behind hedge fund debacle in Korea](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/01/29/20200129000651_0.jpg&u=20200129172505)

Most Popular

-

1

Actor Jung Woo-sung admits to being father of model Moon Ga-bi’s child

-

2

Wealthy parents ditch Korean passports to get kids into international school

-

3

Man convicted after binge eating to avoid military service

-

4

First snow to fall in Seoul on Wednesday

-

5

Final push to forge UN treaty on plastic pollution set to begin in Busan

-

6

Industry experts predicts tough choices as NewJeans' ultimatum nears

-

7

Korea to hold own memorial for forced labor victims, boycotting Japan’s

-

8

Nvidia CEO signals Samsung’s imminent shipment of AI chips

-

9

Job creation lowest on record among under-30s

-

10

Opposition chief acquitted of instigating perjury

![[KH Explains] TRS, leverage scheme behind hedge fund debacle in Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/01/29/20200129000651_0.jpg&u=20200129172505)