Articles by Choi Si-young

Choi Si-young

siyoungchoi@heraldcorp.com-

ShinhanCard launches ‘first’ NFT service

ShinhanCard said Tuesday it had launched a nonfungible token service for clients to store their pictures using the digital assets -- a first by a local financial company. NFTs are authenticated by blockchain, a record of transactions kept on networked computers that serves as a public ledger for verifying ownership. Each NFT has a unique digital signature and digital objects, like images and videos, are traded as NFTs. “Our clients wouldn’t have to worry about making the actual tra

Economy Jan. 4, 2022

-

Seoul shares kick off 2022 with investor optimism

The key benchmark Kospi and junior Kosdaq opened higher on Monday after their last trading session on Thursday, amid strong retail demand and foreign buying betting on a pandemic recovery. The Kospi, which ended at 2,977.65 for its final trading session in 2021, closed at 2,988.77, while the Kosdaq ended at 1,037.83, slightly up from 1,033.98 from the previous session. The rebound was backed by retail investors and foreigners, who snatched up a net 519 billion won ($435 million) and 266 billi

Market Jan. 3, 2022

-

Tech firms’ rush into finance puts pressure on banks, regulators

Naver and Kakao -- Korea’s two largest online service providers -- are prompting financial companies to better meet fintech needs and regulators to write rules that are fair to both of them. Naver Financial, a key Naver fintech subsidiary, started offering loans last year to small businesses with Woori Bank. The Naver Financial CEO said last month that he was considering seeking a permit to oversee more banking services to issue insurance and credit cards. Meanwhile, Kakao Pay, a mo

Economy Jan. 2, 2022

-

Kospi wraps up best year on strong earnings, retail demand

Upbeat corporate earnings and robust retail demand set the key benchmark Kospi and junior Kosdaq on track for their best year since trading began on the exchange decades ago. The stock market, which will open Monday after a three-day break, saw the Kospi hitting a record high of 3,305 on July 6, while the Kosdaq soared to trading around 1,000, a first in 20 years. The Kospi closed at 2977.65 on its final trading session in 2021, while the Kosdaq ended at 1033.98. Kospi-listed companies r

Market Dec. 30, 2021

-

NongHyup Bank introduces antiviral pin pad

NongHyup Bank said Wednesday that it has developed a pin pad that kills germs like the coronavirus with a UV light after customers have used it to enter their passcodes. The pad, the first of its kind adopted by a local bank, will be used at NongHyup branches nationwide after a trial run at its key offices in Seoul, the bank said. It added that the pad does not pose health risks. Meanwhile, Lotte Chemical also said it has come up with an antiviral plastic to be used for credit cards issued by

Economy Dec. 29, 2021

-

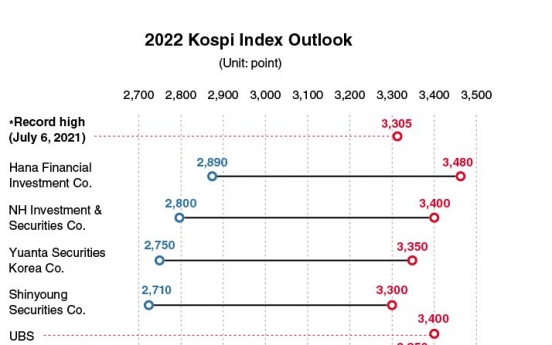

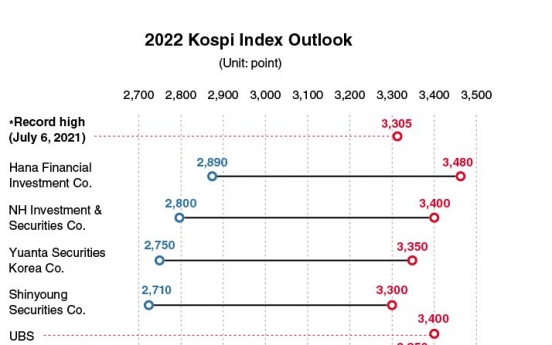

Experts on market 2022: Stocks to rebound, home price rise to slow

South Korean shares could recede early next year but will gradually pick up speed in robust rebound on upbeat corporate earnings and consumer sentiment, while the home price rise will slow but with room for a moderate hike, market experts here said. The benchmark Kospi -- which hit a record high on July 6 this year at 3,305 amid ample liquidity and pandemic recovery hopes -- could reach as high as 3,480 next year, though it could also dive down as low as 2,710, according to analysts citi

Market Dec. 28, 2021

-

Chip, renewable energy sectors set for growth: report

The chip, renewable energy and entertainment industries are set to grow next year, auditing firm Samjong KPMG said Monday in its annual industry forecast report for 24 industries. The supply of system chips will improve as production expands while sales of memory chips next year will not be as strong as this year, because of oversupply, the report said, noting that the South Korean government should work with local chipmakers like Samsung Electronics to localize parts for chip independence. Sa

Economy Dec. 27, 2021

-

BOK signals rate hike as inflation fight drags on

The Bank of Korea said Friday that it would adjust its monetary policy next year in an announcement seen as preparing for a rate hike to dampen inflation. The BOK, which raised the rate to 1 percent after two rate hikes in August and November this year to prop up the pandemic-hit economy, is expected to lift the rate in January when the bank’s seven-member board meets. BOK Gov. Lee Ju-yeol said he would not rule out a hike in the first quarter. “The financial imbalances -- manifes

Market Dec. 24, 2021

-

Shinhan taps ex-IBM director as digital chief officer

Shinhan Financial Group, one of the four banking giants in the country, has named a former IBM managing director as its digital chief officer to accelerate a push to expand its digital services. Kim Myoung-hee, who spent the last 23 years developing digital operations at IBM before joining SK telecom to oversee digital efforts at the country’s largest mobile carrier, is considered one of the leading women experts on digital transformation. Kim was the first senior women chief to lead the

Economy Dec. 24, 2021

-

Investment banks slash Kospi targets amid slow trade

South Korea’s benchmark Kospi faces a long transition to a bullish rally, during which investors will have to navigate uncertainties complicated by supply bottlenecks, a rate hike and a presidential election, according to Goldman Sachs and Morgan Stanley. Goldman Sachs cut the Kospi target to 3,350 from 3,700, changing its view on Korean shares from “overweight” to “marketweight,” saying it would be hard to expect market-beating corporate earnings again next year.

Market Dec. 23, 2021

-

[Photo News] Fostering women leaders

Ham Young-joo (left), vice chairman of Hana Financial Group, congratulates Hong Hwa-jin, leader of the data & investment division at Hana Bank, who led the first 33 participants for the last six months in the group’s program designed to nurture women leaders.

Industry Dec. 23, 2021

![[Photo News] Fostering women leaders](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2021/12/23/20211223000442_0.jpg&u=20211223170937)

-

BOK faces dilemma over inflation, growth

The Bank of Korea appears to be facing a dilemma ahead of its rate decision in January, as producer and consumer prices soar in defiance of anemic growth. Producer prices in November hit a record high, up 0.5 percent on-month and 9.6 percent on-year. The prices have been on a steady rise since November 2020, the longest since May 2011, when they ended a 19-month rally. “The base effect makes the (price) rises look worse than what they actually are. In November last year, oil and raw mate

Economy Dec. 21, 2021

-

Banking giants set to deliver record dividends

South Korea’s four major bank holding firms are expected to hand out record-high dividends this year amid their highest net profit estimates buoyed by pandemic recovery, officials said Monday. The total dividends the four companies -- KB Financial Group, Hana Financial Group, Shinhan Financial Group and Woori Financial Group -- would pay is estimated to be 3.8 trillion won ($3.2 billion), about 26 percent of the combined net profit of 14.6 trillion won. “We were asked to refer to 2

Economy Dec. 20, 2021

-

Mirae Asset Securities chief named ‘person of the year’ by KRX

Mirae Asset Securities Chairman Choi Hyun-man was named person of the year by the Korea Exchange, Korea’s sole bourse operator, for his contribution to the local capital market, officials said Monday. “Chairman Choi heads a leading brokerage company that helped 21 firms go public this year, including game maker Krafton, in what was the biggest initial public offering in 2021,” the Korea Exchange said. The exchange credited its first awardee Choi for becoming the first non-fa

Market Dec. 20, 2021

-

IMM takes 41% stake in GS Power for W1.1tr

Local investment house IMM Investment has acquired a 41 percent stake in GS Power, a subsidiary owned by GS Energy, an energy arm of GS Group, for 1.1 trillion won ($926 million), officials said Friday. GS Energy will maintain a 51 percent majority, after selling 3,136 shares totaling 1.1 trillion won. Last year, GS Energy bought back the 50 percent stake it sold to a local consortium of banks in 2012. A GS Energy official said the sell-off is part of broader efforts to fund ESG projects, whic

Industry Dec. 19, 2021

Most Popular

-

1

Industry experts predicts tough choices as NewJeans' ultimatum nears

-

2

Jung's paternity reveal exposes where Korea stands on extramarital babies

-

3

Seoul city opens emergency care centers

-

4

Opposition chief acquitted of instigating perjury

-

5

Samsung entangled in legal risks amid calls for drastic reform

-

6

[Exclusive] Hyundai Mobis eyes closer ties with BYD

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg&u=)

-

7

[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance

![[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050072_0.jpg&u=)

-

8

Agency says Jung Woo-sung unsure on awards attendance after lovechild revelations

-

9

[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg&u=20241126161719)

-

10

Why S. Korean refiners are reluctant to import US oil despite Trump’s energy push

![[Photo News] Fostering women leaders](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2021/12/23/20211223000442_0.jpg&u=20211223170937)

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg&u=)

![[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050072_0.jpg&u=)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg&u=20241126161719)