Articles by Choi Si-young

Choi Si-young

siyoungchoi@heraldcorp.com-

Watchdog to look into stock options row at Kakao Pay

The Financial Supervisory Service is looking to scrutinize whether executives’ decision to exercise stock options that prompted a stock plunge at Kakao Pay was a sign of risk management deficiencies the financial services firm should address, according to an FSS official. The CEO and two other executives at Kakao Pay stepped down Thursday amid criticism that their exercise of stock options in December last year, a month after the firm listed, brought an unwarranted stock dip. The C

Market Jan. 21, 2022

-

LG Energy Solution IPO brings record fees

An 11-member brokerage syndicate underwriting an initial public offering of LG Energy Solution next week is expected to raise a whopping 89 billion won ($75 million) in management fees following the record-breaking retail bids, made on Tuesday and Wednesday, according to regulatory filings on Thursday. The fees account for 0.7 percent of 12.7 trillion won that the electric vehicle battery maker is expected to raise from a total of 42.5 million shares priced at 300,000 won apiece. Separately, th

Market Jan. 20, 2022

-

Kakao’s spinoff IPOs losing momentum

Kakao, one of South Korea’s two largest internet giants along with Naver, is seen as holding back its plans to float shares of key subsidiaries in listings, amid looming market disappointment over controversial sell-offs by executives. Earlier this month, CEOs of Kakao Pay and KakaoBank were accused of driving down stock prices with sell-offs that critics say should not have taken place right after their listings when their shares ran high. This prompted regulators to vow greater protecti

Market Jan. 20, 2022

-

LG Energy Solution IPO draws record retail bids

Over 114 trillion won ($95.5 billion) in cash deposits from about 4.4 million retail investors flowed into a mega initial public offering by LG Energy Solution during a two-day subscription that ended Wednesday, reflecting explosive interest in the company’s market debut. The world’s second-largest battery maker has already attracted the highest amount of deposits from a total of 1,988 domestic and foreign institutional investors, which pledged some 15,000 trillion won in total to b

Market Jan. 19, 2022

-

Retail subscriptions open for LG Energy Solution IPO

LG Energy Solution is offering retail investors the opportunity to submit bids for its shares ahead of what could potentially be South Korea’s biggest-ever initial public offering next week, having already attracted vastly oversubscribed institutional bids to the tune of some 15,000 trillion won ($12.6 trillion). The world’s second-largest battery maker for electric vehicles is offering a little over 10 million shares -- nearly a quarter of the 42.5 million shares in total -- to ret

Market Jan. 17, 2022

-

LG Energy Solution IPO may be behind stock market retreat

The benchmark Kospi and junior Kosdaq have retreated for the past month as investors offloaded a combined 9.4 trillion won ($7.8 billion) in shares in what many see as stepping up preparations for a battery maker listing, which is expected to set a record later this month. LG Energy Solution, the world’s second-largest battery maker after China’s CATL, is expected to raise 12.7 trillion won in its initial public offering set for Jan. 27, with shares priced 300,000 won each, at the t

Market Jan. 16, 2022

-

Gov’t plays down EU decision to block Korean shipbuilders’ merger

The South Korean government said Thursday that a decision by the European Union to block the merger between the two local shipbuilders – Hyundai Heavy Industries and Daewoo Shipbuilding & Marine Engineering – may have a limited impact, citing a recovery in global ship orders. “The industry is seeing much better conditions than in 2019 and we will continue searching for the right ‘civilian’ operator for DSME,” the government said in a statement jointl

Industry Jan. 13, 2022

-

Naver, Kakao stocks dip by double digits

Naver and Kakao, Korea’s two largest online service providers, saw their market caps shrink 7 trillion won each ($5.8 billion) for the last two weeks amid persistent market fluctuations over a potential rate hike by the US Federal Reserve and growing uncertainty over their growth and management ethics. The US Fed has hinted that it will reduce its overall asset holdings sooner than expected because of unabated inflation. But the hike speculation, which is dragging down shares of

Market Jan. 11, 2022

-

LG battery arm vows to edge past Chinese rival

LG Energy Solution said Monday that it would soon outcompete its bigger Chinese rival in the global race to develop electric vehicle batteries, amid market anticipation that the South Korean battery maker’s market debut will set a record later this month. “We’ve received more orders. We'll be overtaking our rival. And the market capitalization gap between us -- LG Energy Solution and CATL -- will also shrink. I certainly see opportunities,” LG Energy

Market Jan. 10, 2022

-

[Newsmaker] Woori Bank pulls back Osstem funds amid theft probe

Woori Bank, one of five major local banks, said Friday it had stopped selling funds involving Osstem Implant, whose shares were suspended from trading on the Kosdaq after an employee was arrested for having allegedly stolen funds equal to 91 percent of the company’s equity as of last year. “It’s a precautionary measure to protect our investors and we do not know at this point when we will begin selling the funds again,” a Woori Bank official said, adding five funds

Economy Jan. 7, 2022

![[Newsmaker] Woori Bank pulls back Osstem funds amid theft probe](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2022/01/07/20220107000575_0.jpg&u=20221118161454)

-

K Auction to make stock debut this month

K Auction, South Korea’s second-largest auction house by revenue, said Thursday that it plans to go public on Jan. 24, in what its chief said will be the first step to take on its bigger rival Seoul Auction. “A transparent platform that will maximize the positive impact of art and outcompete our rival, that’s what we have in mind,” K Auction CEO Do Hyun-soon said at an online conference. Seoul Auction began trading on the junior Kosdaq exchange in 2008. K Auction, whic

Economy Jan. 6, 2022

-

Investors seek suit over Osstem theft case

Individual investors are seeking legal action for damages caused by an employee at Osstem Implant who was arrested Wednesday for having allegedly stolen 188 billion won ($156 million) from the Kosdaq-listed company. The stolen money accounted for 91 percent of the company’s equity as of last year. The shares of the implant maker, worth a little over 2 trillion won in market value, were suspended from trading Monday after the company reported the massive theft to police. “There is

Economy Jan. 6, 2022

-

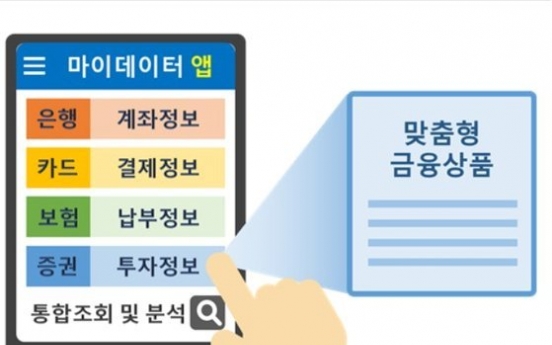

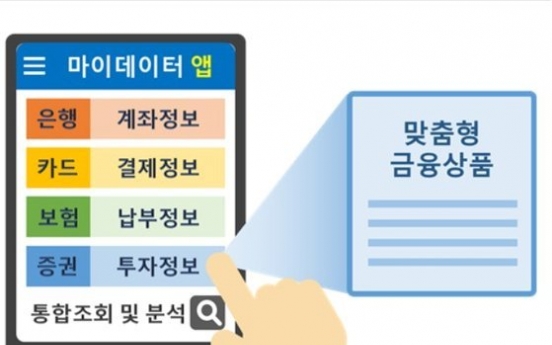

All-in-one banking service launched

South Korea’s financial institutions -- including banks, brokerages and credit card companies -- launched an all-in-one banking service Wednesday for customers to manage their financial data spread across financial firms in one place. Called “MyData,” the service was put on a trial run in December before 33 financial institutions officially started offering it this week to help customers make more informed financial decisions looking at their account balances, loans and insura

Economy Jan. 5, 2022

-

ShinhanCard launches ‘first’ NFT service

ShinhanCard said Tuesday it had launched a nonfungible token service for clients to store their pictures using the digital assets -- a first by a local financial company. NFTs are authenticated by blockchain, a record of transactions kept on networked computers that serves as a public ledger for verifying ownership. Each NFT has a unique digital signature and digital objects, like images and videos, are traded as NFTs. “Our clients wouldn’t have to worry about making the actual tra

Economy Jan. 4, 2022

-

Seoul shares kick off 2022 with investor optimism

The key benchmark Kospi and junior Kosdaq opened higher on Monday after their last trading session on Thursday, amid strong retail demand and foreign buying betting on a pandemic recovery. The Kospi, which ended at 2,977.65 for its final trading session in 2021, closed at 2,988.77, while the Kosdaq ended at 1,037.83, slightly up from 1,033.98 from the previous session. The rebound was backed by retail investors and foreigners, who snatched up a net 519 billion won ($435 million) and 266 billi

Market Jan. 3, 2022

Most Popular

-

1

Dongduk Women’s University halts coeducation talks

-

2

Russia sent 'anti-air' missiles to Pyongyang, Yoon's aide says

-

3

Defense ministry denies special treatment for BTS’ V amid phone use allegations

-

4

OpenAI in talks with Samsung to power AI features, report says

-

5

Two jailed for forcing disabled teens into prostitution

-

6

South Korean military plans to launch new division for future warfare

-

7

Gold bars and cash bundles; authorities confiscate millions from tax dodgers

-

8

Teen smoking, drinking decline, while mental health, dietary habits worsen

-

9

Kia EV9 GT marks world debut at LA Motor Show

-

10

North Korean leader ‘convinced’ dialogue won’t change US hostility

![[Newsmaker] Woori Bank pulls back Osstem funds amid theft probe](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2022/01/07/20220107000575_0.jpg&u=20221118161454)