Most Popular

-

1

Actor Jung Woo-sung admits to being father of model Moon Ga-bi’s child

-

2

Wealthy parents ditch Korean passports to get kids into international school

-

3

Man convicted after binge eating to avoid military service

-

4

First snow to fall in Seoul on Wednesday

-

5

Final push to forge UN treaty on plastic pollution set to begin in Busan

-

6

Korea to hold own memorial for forced labor victims, boycotting Japan’s

-

7

S. Korea not to attend Sado mine memorial: foreign ministry

-

8

Nvidia CEO signals Samsung’s imminent shipment of AI chips

-

9

Toxins at 622 times legal limit found in kids' clothes from Chinese platforms

-

10

Job creation lowest on record among under-30s

-

K-Growth to earmark W5.4tr risk capital for 2020

South Korea’s state-led fund of funds manager Korea Growth Investment (K-Growth) said Wednesday it plans to earmark a combined 5.4 trillion won ($4.5 billion) risk capital to spur venture investments across the nation in 2020. The company said it aims to raise at least 1 trillion won for its portfolio, adding to the 1.6 trillion won from its flagship fund of funds. The majority of the funds worth 3.3 trillion won will be used to nurture startups for later-stage funding rounds, K-Growth

Feb. 5, 2020

-

Patent applications for masks rise amid health concerns

Patent applications for masks have increased notably in recent years, according to South Korea’s patent administrator, reflecting growing concerns about microfine dust and epidemics, such as the new coronavirus outbreak. The number of patent applications here for antibacterial face masks came to an annual average of 68 during the 2014-2018 period, almost double the figure for the previous five years, the Korean Intellectual Property Office said Tuesday in a release. The individual ann

Feb. 4, 2020

-

S. Korean commercial real estate to prolong boom in 2020: CBRE

Investment in South Korean commercial real estate will remain upbeat this year, with total transactions exceeding 10 trillion won ($8.4 billion), according to leading US-based commercial real estate service provider CBRE on Tuesday. This anticipated yearly figure falls lower than the record-high 16 trillion won seen in 2019, but was on a par with the country’s five-year average. “Record-low interest rates and global economic instability are leading individual investors to focus

Feb. 4, 2020

-

Danaher ordered to offload assets for GE biopharma unit acquisition

Ahead of Danaher’s acquisition of General Electric’s biopharmaceutical unit for $21.4 billion, South Korea’s Fair Trade Commission on Tuesday ordered either of the two firms to divest certain assets in its conditional approval. The latest decision, according to the antitrust watchdog, is meant to thwart monopoly in Korea’s bioprocessing market. The order forces either Danaher or GE’s biopharma unit to sell off the entire eight bioprocessing product assets in Kore

Feb. 4, 2020

-

[News Focus] Watchdog’s final approval of sanctions puts Woori, Hana in tight spot

South Korea’s banking groups accused of misselling high-risk derivative products were treading on thin ice Tuesday, as they seek the best course of action to protect their governance against the financial watchdog’s decision to penalize top executives. Financial Supervisory Service Gov. Yoon Suk-heun on Monday gave his final seal of approval to the sanctions committee’s decision to impose “reprimands and warnings” on Woori Financial Group Chairman and Woori Bank

Feb. 4, 2020

![[News Focus] Watchdog’s final approval of sanctions puts Woori, Hana in tight spot](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2020/02/04/20200204000568_0.jpg&u=20200204183803)

-

Hana Bank considers acquiring stake in local bank in Myanmar

Hana Bank, one of the largest commercial banks in South Korea, said Tuesday it is considering acquiring a stake in a local bank in Myanmar. The Southeast Asian nation has recently started allowing foreign financial companies to run operations, to a limited extent. “While having applied at the local financial authorities in Myanmar for launching a branch in the local market, Hana Bank is also considering to acquire a stake in a major local bank,” said a spokesperson from Hana Fi

Feb. 4, 2020

-

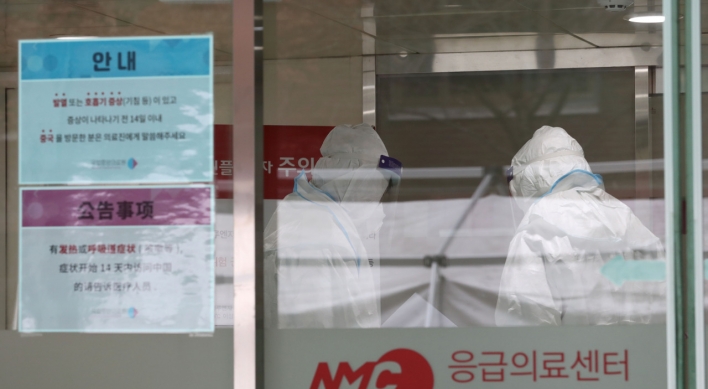

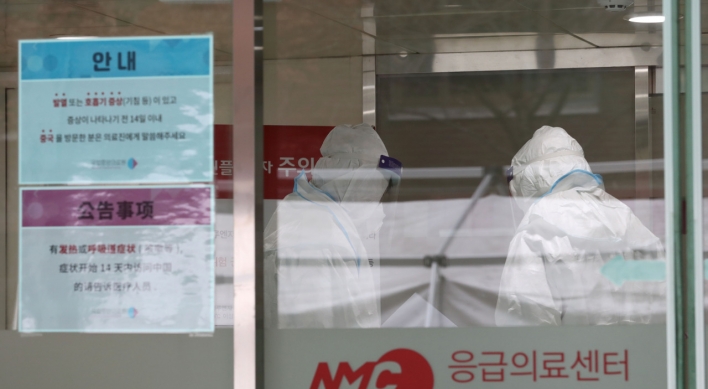

Credit card firms vigilant over fear of new coronavirus spread

Responding to the quick spread of the new coronavirus, South Korea’s credit card issuers are running a hotline with the Korea Centers for Disease Control and Prevention, according the Credit Finance Association Tuesday. Through the emergency communication line, the KCDC makes real-time requests to card companies for payment records to identify the places visited by the infected -- both Korean citizens and foreign nationals. Health authorities are allowed to access the payment informat

Feb. 4, 2020

-

Banks’ private equity funds sold to investors dip 37%

Amid the ongoing controversy regarding the improper sales of derivative-linked products by Korean commercial banks, investors in local lenders’ private equity funds have dipped nearly 37 percent, data compiled by a market operator showed Tuesday. According to the Korea Financial Investment Association, the number of private equity fund accounts sold by local commercial banks tallied 37,409, as of end-December last year. The figure was down 37.1 percent from six months prior. Since July

Feb. 4, 2020

-

KKR to sell its logistics center to Pebblestone Asset Management

Global private equity fund operator Kohlberg Kravis Roberts said Tuesday that it will sell a landmark logistics center to a South Korean real estate asset manager. The US-based company issued a release to confirm that Pebblestone Asset Management is to acquire BLK Pyeongtaek Logistics Center from a KKR-led consortium. The precise amount of the deal was not disclosed. “The rapid growth of e-commerce is transforming South Korea’s logistics sector, creating a growing demand for fully

Feb. 4, 2020

-

Vacation rental management startup snaps up $7m funding

H2O Hospitality, a Korean startup dedicated to vacation rental management in Japan, said Tuesday it has raised $7 million funding from five investors to meet its fast-growing working capital needs on the back of strong growth. Joining the latest round were Samsung Venture Investment, Stonebridge Ventures, IMM Investment, Shinhan Capital and Wonik Investment Partners. The round brought H2O’s total funding to $18 million. The valuation of the firm has jumped threefold since the previous

Feb. 4, 2020

-

Seoul stocks nearly flat after roller-coaster ride on coronavirus fears

South Korean stocks ended nearly flat Monday, with fears of the rapid spread of the new coronavirus weighing down investor sentiments. Stocks on China’s major exchanges plunged on the first trading session after an extended Lunar New Year holiday that lasted from Jan. 24 to Feb. 2, which dragged down local indexes here even further. The benchmark bourse Kospi opened sharply lower at 2,086.61 points -- down 32.40 points, or 1.53 percent, from the previous session. The weak start continu

Feb. 3, 2020

-

Coronavirus scare may derail W250b IPO plans in February

Seven South Korean firms are looking to raise as much as a combined 247 billion won ($206.6 million) through initial public offerings in February, but market watchers are wary as the local stock market grapples with the Wuhan coronavirus scare. While the number of infections in Korea grew to 15 as of Sunday, from just three a week prior, the Korea Exchange’s main bourse, Kospi, dipped 5.7 percent and its development board, Kosdaq, sank 6.3 percent. The companies may have weaker incentive

Feb. 3, 2020

-

Financial sector rolls out support measures for SMEs hit by coronavirus

South Korea’s financial institutions are announcing measures to assist local businesses -- mostly small and medium-sized enterprises, which are likely to bear the brunt of the recent coronavirus outbreak. Commercial banks here are at the forefront of efforts to support small businesses, with many expanding their loan programs and offering discounted interest rates for SMEs. Announcing its support package on Sunday, KB Kookmin said it would offer loans of up to 500 million won ($417,000)

Feb. 3, 2020

-

Electronics comparison startup receives W300m from Kakao Ventures

Consumer Bridge, which runs electronics comparison website Honey Review, said Wednesday it has attracted seed investment of 300 million won ($251,022) from Kakao Ventures, an investment unit of the nation’s largest mobile messenger firm Kakao. The startup was established in October last year by Shin Jae-hyun, a former developer at cryptocurrency exchange platform UPbit and travel information startup MyRealTrip, and Park Seong-hwan, who previously worked for Kakao and fashion startup S

Feb. 3, 2020

-

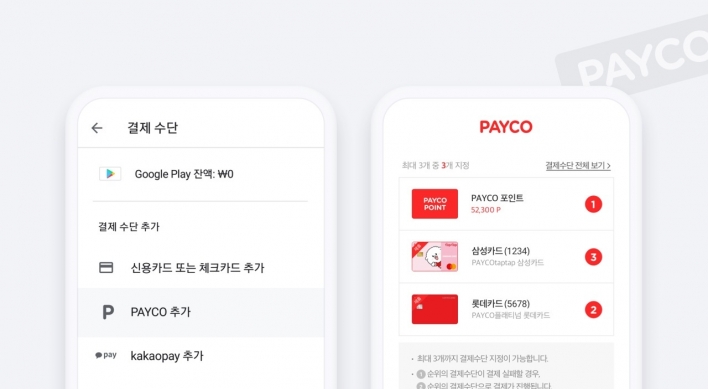

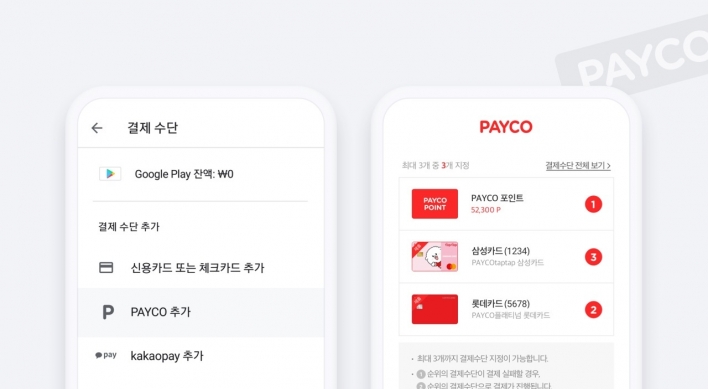

NHN, Google expand mobile payment partnership

NHN, one of South Korea’s largest internet service providers, said Monday that its credit and debit card-based payment services will be available on tech giant Google’s flagship platforms including Google Play, YouTube and Google Drive. The firm -- based in Pangyo, Gyeonggi Province -- offers a mobile payment solution called Payco, which was already available to a limited extent on the Google platforms. Since November 2017, Payco subscribers have been able to use Payco membershi

Feb. 3, 2020

-

Woori Financial faces tough choices over chairman

South Korea’s Woori Financial Group is likely to have a tough week ahead, as the financial watchdog’s recent decision to impose sanctions on its chairman threatens its governance. Woori Financial’s regular board meeting is scheduled Friday, and an intense round of discussions is expected to take place over the fate of Woori Financial Group Chairman and Woori Bank CEO Sohn Tae-seung. The Financial Supervisory Service on Thursday slapped Sohn and Hana Financial Vice Chairman

Feb. 2, 2020

-

Seoul stocks plummet nearly 6% amid spread of new coronavirus

South Korean stocks have fluctuated between losses and gains amid growing fears about the Wuhan coronavirus outbreak around the world. Since health authorities confirmed the first coronavirus case here, Seoul’s benchmark Kospi has dipped nearly 6 percent, according to the nation’s sole stock market operator on Sunday. As of Friday, the Kospi index shed 5.85 percent from Jan. 17, the last trading session before the first case of the virus was confirmed here, the Korea Exchange sai

Feb. 2, 2020

-

Opposition lingers in Shinhan’s Orange Life merger

Shinhan Financial Group’s plans to merge Orange Life Insurance with its wholly owned life insurance unit seemed to have been working out smoothly. However, trouble persists as minority shareholders continue to demand an increase in their dividend payouts. Small shareholders of Orange began making the demand after teaming up with civic activist group the Korea Stockholders Alliance in November, but Shinhan refuses, saying it would constitute a breach of trust with its other shareholders.

Jan. 31, 2020

-

Entertainment firm behind BTS seeks IPO underwriter: report

Big Hit Entertainment, the agency behind K-pop sensation BTS, is seeking an underwriter in the initial step to go public, according to news reports Friday. Big Hit has sent a request for proposal to multiple securities brokerage firms to underwrite its initial public offering, an investment banking source was quoted as saying by local news outlet the Bell. The news report did not clarify which stock market in Korea that Big Hit would choose to be listed. An underwriter is responsible for offer

Jan. 31, 2020

-

Leadership vacuum at Woori and Hana inevitable due to FSS’ heavy sanctions

Financial giant Woori Financial Group said Friday that it has delayed the process to select CEO candidates for its banking unit Woori Bank. The announcement came after the nation’s financial watchdog Financial Supervisory Service decided the day before to impose sanctions on top executives of Woori Financial Group and Hana Financial Group. “The company has decided to readjust the schedule for shortlisting CEO candidates due to recent changes,” the financial conglomerate sai

Jan. 31, 2020

![[News Focus] Watchdog’s final approval of sanctions puts Woori, Hana in tight spot](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2020/02/04/20200204000568_0.jpg&u=20200204183803)