Most Popular

-

1

Actor Jung Woo-sung admits to being father of model Moon Ga-bi’s child

-

2

Wealthy parents ditch Korean passports to get kids into international school

-

3

Man convicted after binge eating to avoid military service

-

4

First snow to fall in Seoul on Wednesday

-

5

Final push to forge UN treaty on plastic pollution set to begin in Busan

-

6

Korea to hold own memorial for forced labor victims, boycotting Japan’s

-

7

Nvidia CEO signals Samsung’s imminent shipment of AI chips

-

8

Job creation lowest on record among under-30s

-

9

NK troops disguised as 'indigenous' people in Far East for combat against Ukraine: report

-

10

Opposition leader awaits perjury trial ruling

-

IMM PE in talks to buy Kolmar Korea’s pharma operations, CMO

IMM Private Equity is conducting due diligence as it looks to buy some of the operations of cosmetics-to-pharmaceutical business group Kolmar Korea, according to Kolmar Korea on Thursday. The South Korean investment house is proposing to buy Kolmar Korea Holdings’ contract manufacturing subsidiary Kolmar Pharma and Kolmar Korea’s pharmaceutical division, except for CJ Healthcare. They are roughly valued at a combined 750 billion won ($628.6 million). Kolmar Korea sa

Feb. 20, 2020

-

Mirae Asset Daewoo’s overseas ETF wrap account sales surpass W100b

South Korean brokerage firm Mirae Asset Daewoo said Thursday its wrap account attracted a record net inflow of 100 billion won ($83.4 million). The fund is the first in Korea to surpass the milestone as a wrap account investing in overseas exchange-traded funds, the company said. A rise in investors’ interest in overseas stock markets and investment in ETFs appear to have driven the increase in sales of Mirae’s Global X Portfolio Wrap Account, it added. Unlike general index inve

Feb. 20, 2020

-

Watchdog chief says he feels sorry over Lime fiasco

The head of South Korea's financial watchdog said Thursday he feels sorry for the controversy surrounding the suspension of fund redemption by the country's largest hedge fund Lime Asset Management Co. Yoon Suk-heun, governor of the Financial Supervisory Service, said in a parliamentary session that he will help the fund come up with and implement its redemption plan. The comments came as the watchdog prepares to launch an inspection into Lime's suspension of fund redemption ear

Feb. 20, 2020

-

Fiscal chief seeks to boost spending amid COVID-19 fallout

Responding to public anxiety over prolonged fallout of the novel coronavirus, the government distinctly turned to all-out countermeasures, marking a turn from its early optimism. But its policy direction that people should resume consumption has raised controversy, as the country continued to see additional cases of infection this week. “(The government) is mobilizing all available policy actions under the grave awareness that (the given circumstances) correspond to an economic emer

Feb. 19, 2020

-

COVID-19, Lime scandal pump brakes on stock rally

The COVID-19 virus entering a new phase here has put the brakes on local stock markets and the attempt for improved performance this year, along with the snowballing Lime Asset Management fiasco that has been sending shockwaves through the local brokerage industry, according to industry sources Wednesday. The local stock market opened high this year amid heighten sentiment for an improved economic outlook. However, intensifying fears on the deadly virus have begun weighing down on investor sen

Feb. 19, 2020

-

Prosecutors raid Lime, Shinhan Investment in misselling probe

Prosecutors on Wednesday raided the headquarters of Lime Asset Management and Shinhan Investment, as part of a probe into alleged misselling of hedge funds that could cause losses of more than 1 trillion won ($845 billion). According to the Seoul Southern District Prosecutors’ Office, it dispatched separate teams of investigators to the headquarters located in Seoul’s financial district of Yeouido around 9 a.m. to secure computer drives and documents linked to the case. The searc

Feb. 19, 2020

-

Hahn & Co. to cash out W27.4b in sale of Ssangyong I&C

Seoul-based private equity house Hahn & Co. on Wednesday agreed to sell its 40 percent stake in IT system integrator Ssangyong Information & Communications for 27.4 billion won ($23 million) by April, in a move to offload noncore businesses of its portfolio firm Ssangyong Cement Industrial. According to regulatory filings Wednesday, the new shareholder group, composed of information technology system integrator Itcen and its affiliate Comtec Systems, will buy the stake for 1,695 won per

Feb. 19, 2020

-

Watchdog to probe investment firms, banks, brokerages over Lime scandal

Looking into a major hedge fund misselling fiasco involving Lime Asset Management, South Korea’s financial watchdog is likely to narrow its focus on three major vendors -- Shinhan Investment, Woori Bank and KEB Hana Bank -- officials said Tuesday. Shinhan Investment is facing additional allegations that it sold the disputed financial products with full awareness of their flaws. The Financial Supervisory Service is slated to kick off its first on-site investigation of the country&rsquo

Feb. 18, 2020

-

Weak earnings, coronavirus fears weigh on Korean firms’ credit

Korean companies are facing imminent threats of credit downgrades, as they face a double whammy of weak 2019 earnings and novel coronavirus fears weighing on the global economy. Some of the firms have already experienced credit rating downgrades by agencies in the past week. Seoul-based NICE Investors Service last week downgraded credit ratings of panel maker LG Display and retailer E-mart by one notch each, as their business prospects are clouded and they are shouldering increased debt. LG

Feb. 18, 2020

-

On brighter chip prospects, market cap of Samsung up 10%

After a strong performance by technology-related stocks such as semiconductors and secondary batteries, the top three Korean conglomerates -- Samsung, LG and SK Group -- saw their market capitalization figures rise this year, data showed Tuesday. According to financial market tracker FnGuide, the combined market cap of Samsung’s 16 listed subsidiaries jumped nearly 10.18 percent from end-December last year to Friday, to about 524.2 trillion won ($440.9 billion), further solidifying

Feb. 18, 2020

-

Jeonbuk Bank’s Cambodian subsidiary posts record-high net profit in 2019

Jeonbuk Bank’s Cambodian subsidiary logged record-high annual net profit last year, marking it as one of the most successful Korean banks operating in the Southeast Asian country, the bank’s holding group JB Financial said Tuesday. Phnom Penh Commercial Bank’s net profit for fiscal 2019 jumped 40.5 percent on-year to 20.7 billion won ($17.4 million), according to JB Financial. PPC Bank was the only commercial lender in Cambodia to post an annual net profit of over 20 billio

Feb. 18, 2020

-

KB Card launches debit card featuring Pengsoo

Credit card issuer KB Card said Monday that it has rolled out a debit card featuring Pengsoo, a popular penguin character. The newly launched card comes in two designs — one with Pengsoo saying “Peng-ca,” and the other with the character trying out different fashion items. Peng-ca comes from the giant penguin’s signature line, “Peng-ha,” meaning “Pengsoo says hi.” As part of its marketing efforts, KB Card will give out stickers of the character

Feb. 17, 2020

-

Bithumb agrees partnership with Chinese peer BitMax

South Korean cryptocurrency exchange Bithumb said Monday that it had signed a memorandum of understanding with Chinese crypto exchange firm BitMax to roll out new crypto services and to tap into global markets together. They also agreed to jointly develop blockchain and cryptocurrency technologies and infrastructure. Founded in 2018 by CEO George Chao, Bitmax has attracted a number of Wall Street financial engineers who used to work for global financial firms, such as Barclays and Deutsche

Feb. 17, 2020

-

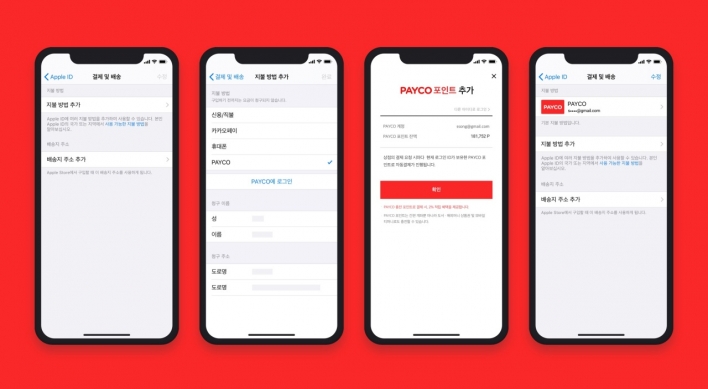

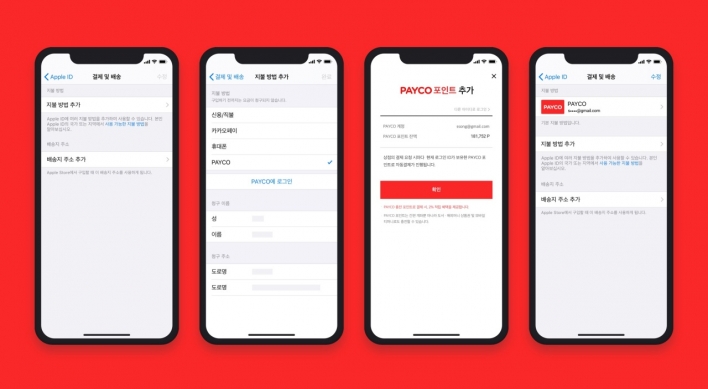

NHN‘s Payco available on Apple platforms

Internet services provider NHN said Monday that its easy-to-use mobile payment service Payco was now available on US tech giant Apple’s platforms, including Apple Store, Apple Music and iCloud. Under the partnership, users can simply link their Payco accounts with their Apple ones via the Apple ID settings, the company said. Once their payment data is registered on one of their Apple devices, Payco subscribers can make online purchases across different iOS-powered gadgets, including t

Feb. 17, 2020

-

Lime investors face tough compensation fight

Investors in beleaguered hedge fund Lime Asset Management are facing a bumpy road to get compensation for their losses. By no later than Friday, every investor in the hedge fund is expected to find out their confirmed individual losses in their combined 1.7 trillion-won ($1.4 billion) investment made under the convoluted master-feeder fund structure -- involving four master funds and 173 feeder funds as of end-2019. The losses of Lime Asset’s feeder funds may vary, but in some cases be

Feb. 17, 2020

-

Hana Bank starts mobile banking service in Hong Kong

Hana Bank said Monday that it will launch its global mobile banking service in Hong Kong, making it the first Korean lender to provide such service in the global financial hub. The Global 1Q app will be available for use in Hong Kong now in addition to countries that include Canada, China, Japan, Indonesia, Brazil, Panama and Vietnam. The service was launched in Canada in 2015. The app automatically recognizes the country of the user’s current location, allowing easy access to the ser

Feb. 17, 2020

-

Hyundai Capital’s ‘inclusive’ corporate culture wins local support

For a company that operates globally, it can be challenging to build a universal corporate culture while considering the needs of local staff. It has not been an easy task as well for Hyundai Capital, a South Korean auto finance firm, which operates in 11 countries. But its efforts to build an “inclusive” corporate culture and to open communication channels that allow employees to interact closely are key to its global operations, the company said Sunday. The initiative is

Feb. 16, 2020

-

Individual Lime investors face losing entire principal

The entire amount of financial losses stemming from Lime’s funds is expected to rise to more than $1 billion, sparking deep distrust in private fund operatives and concerns over a lack of protective measures for individual investors. Lawsuits for damages and compensation are likely to follow en masse, after an intermediary audit on the hedge fund firm last week by the financial watchdog specified the case as alleged fraud. On Friday, the Financial Supervisory Service said Lime and it

Feb. 16, 2020

-

Woori Bank merges two Cambodian subsidiaries

South Korea’s Woori Bank said Sunday it recently merged two of its Cambodian subsidiaries in an effort to provide comprehensive financial services in the Southeast Asian nation. According to the commercial lender, Cambodian financial authorities approved the merger of Woori Finance Cambodia and WB Finance earlier this month. WB Finance is the surviving entity. Woori Finance Cambodia was established after Woori acquired Cambodia’s microfinance institution Malis Finance for 5 billi

Feb. 16, 2020

-

Lime Asset deliberately deceived investors in awareness of losses: FSS

South Korean fund operator Lime Asset Management and its seller Shinhan Investment deliberately duped investors by concealing their losses and continuing the sale of the related products, the watchdog Financial Supervisory Service said Friday. Based on an intermediary inspection and accounting audit, the FSS estimated that two of the disputed parent funds may suffer losses of up to 730 billion won ($617.5 million). Considering other parent funds yet under inspection, the total amount of investo

Feb. 14, 2020