Most Popular

-

1

Actor Jung Woo-sung admits to being father of model Moon Ga-bi’s child

-

2

Wealthy parents ditch Korean passports to get kids into international school

-

3

First snow to fall in Seoul on Wednesday

-

4

Man convicted after binge eating to avoid military service

-

5

Trump picks ex-N. Korea policy official as his principal deputy national security adviser

-

6

Final push to forge UN treaty on plastic pollution set to begin in Busan

-

7

Korea to hold own memorial for forced labor victims, boycotting Japan’s

-

8

S. Korea not to attend Sado mine memorial: foreign ministry

-

9

Nvidia CEO signals Samsung’s imminent shipment of AI chips

-

10

Toxins at 622 times legal limit found in kids' clothes from Chinese platforms

-

Asiana takeover deal falls through, creditors to inject more funds for stabilization

Creditors of Asiana Airlines announced Friday that they would pull the plug on a stalled deal to sell the cash-strapped airline to property developer HDC Hyundai Development Co. after 10 months of negotiations. They also decided to inject an additional 2.4 trillion won ($2.02 billion) in industrial stabilization funds to normalize operations at the air carrier for another disposal attempt. “Today, Kumho Industrial Co. has notified HDC Hyundai Development Co. that the merger and acquisiti

Sept. 11, 2020

-

Seoul stocks almost flat on valuation concerns

South Korean shares closed nearly flat on Friday amid growing valuation woes in the financial markets. The Korean won fell against the US dollar. The benchmark Korea Composite Stock Price Index (KOSPI) rose 0.21 points, or 0.01 percent, to close at 2,396.69. Trading volume was moderate at about 872 million shares worth some 11.9 trillion won ($10 billion), with gainers outnumbering losers 456 to 377. Foreigners sold a net 164 billion won, while retail investors purchased a net 451 billion won

Sept. 11, 2020

-

[Contribution] Chinese listed companies are coming home

The Korea Herald is running a regular contribution series written by senior investment strategists at Standard Chartered Group Wealth Management. -- Ed. Investors in Asia are cheering the prospect of more Chinese companies listed in the US seeking a dual listing in Hong Kong. The catalyst for the acceleration in this trend is legislation which is likely to pass through the US Houses of Congress. The US legislation, Holding Foreign Companies Accountable Act, has two components that has raise

Sept. 11, 2020

![[Contribution] Chinese listed companies are coming home](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2020/07/12/20200712000094_0.jpg&u=20200911154111)

-

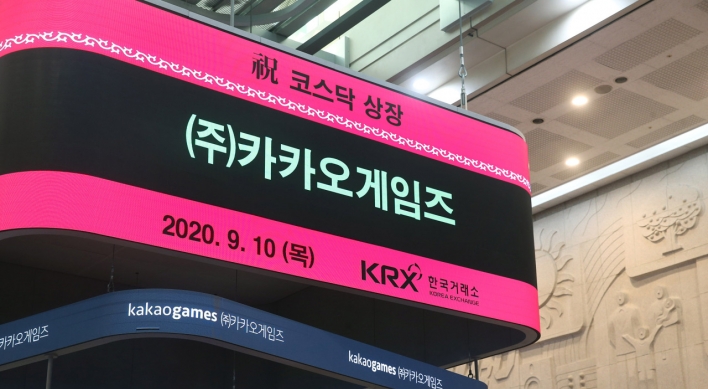

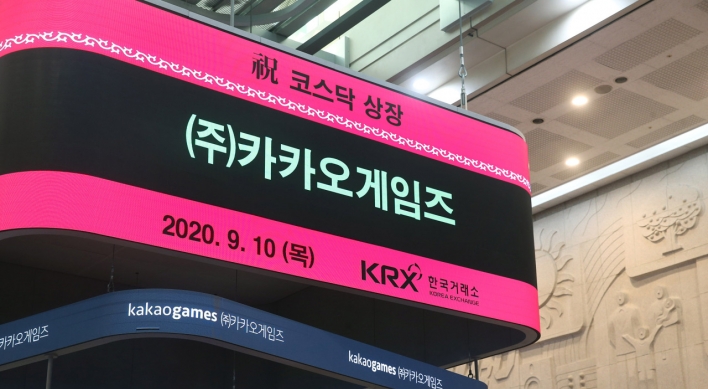

Kakao Games shares soar for 2nd day in row, leaps to No. 3 on Kosdaq

Kakao Games continued its bullish run on the Kosdaq market, with shares spiking by a daily permissible limit of nearly 30 percent for a second consecutive day Friday. As soon as trading began, the company’s stock price reached 81,100 won ($68.22) per share, up 18,700 won or 29.97 percent from the previous session’s close. It was more than triple the offering price of 24,000 won. The price also maintained throughout the day. It soon rose into the third most valuable stock on the Ko

Sept. 11, 2020

-

Seoul stocks open tad lower on Wall Street losses

South Korean shares opened slightly lower Friday, tracking overnight losses on Wall Street. The benchmark Korea Composite Stock Price Index (KOSPI) fell 3.73 points, or 0.16 percent, to 2,392.75 in the first 15 minutes of trading. The KOSPI's decline is largely attributed to the US tech retreat and unimproved jobless benefits data from last week. The tech-laden Nasdaq composite fell 221.97 points, or 1.99 percent, to 10,919.59 on Thursday (New York time). The Dow Jones Industrial Average l

Sept. 11, 2020

-

Rebound unlikely in sectors reeling from COVID-19

Domestic industrial sectors that are reeling from the coronavirus fallout in South Korea are unlikely to see a drastic rebound and probably face longer-lasting financial strain, officials of credit rating agency the Korea Investors Service said Thursday. Korean businesses dedicated to auto parts manufacturing, oil refining, hotels, duty-free shops, theaters and aviation are seeing a negative credit outlook and facing heightened financial pressure, making them subject to credit downgrading in t

Sept. 10, 2020

-

Hyundai Card issues W450b green bonds

Hyundai Card, the credit card company under automotive giant Hyundai Motor Group, said Thursday that it has issued 450 billion won ($379 million) in green bonds to fund alternative energy and environmental projects. The won-denominated bonds that mature in one year and two months to 10 years are sold only to Korean institutional investors. The company issued the same bonds in August last year. Proceeds from the green bonds will be used in providing financing for eco-friendly vehicles, such

Sept. 10, 2020

-

Seoul stocks rebound on US tech rally, another stimulus measure

South Korean shares closed higher Thursday in sync with the overnight Wall Street rebound and on the back of another stimulus measure amid the pandemic. The Korean won rose against the US dollar. The benchmark Korea Composite Stock Price Index (KOSPI) rose 20.67 points, or 0.87 percent, to close at 2,396.48. Trading volume was moderate at about 1.1 billion shares worth some 15.6 trillion won ($13.2 billion), with gainers outnumbering losers 596 to 232. Foreigners bought a net 381 billion won

Sept. 10, 2020

-

Standard Chartered CEO mentors university students in S. Korea

London-based Standard Chartered Bank CEO Bill Winters mentored Korean university students seeking careers in finance in an contact-free manner as part of his monthlong visit to the country, the lender’s Korean subsidiary said Thursday. Winters and 13 university students on Wednesday discussed issues related to social finance, changes in the financial environment in the post-COVID-19 era and the “fourth industrial revolution” in the program via videoconferencing, Standard Char

Sept. 10, 2020

-

Kakao Games makes stellar stock market debut, lands No. 5 on Kosdaq

Kakao Games, the gaming arm of Korean mobile messenger giant Kakao, made a strong market debut on the tech-heavy Kosdaq on Thursday, trading at more than double its initial public offering price. Shares of Kakao Games began trading at 48,000 won ($40.50), twice the offering price. The opening price of a newly listed stock is determined between 8:30 a.m. and 9 a.m. in the first trading session and it can reach up to 200 percent of its IPO price, according to the nation’s sole bourse oper

Sept. 10, 2020

-

No. of reported offshore account holders jumps 24%

The number of foreign account holders that reported to the National Tax Service surged 24 percent on-year to 2,685 worth nearly 60 trillion won, data showed Thursday. In June, 1,889 residents of Korea reported accounts to NTS, each holding a balance of 4.2 billion won on average, while 796 Seoul-based corporations documented accounts, with an average balance of 65.2 billion won. Their total account balance came to 59.9 trillion won ($50.5 billion), down 2.6 percent from the previous year. The n

Sept. 10, 2020

-

Seoul stocks open sharply higher on Wall Street rebound

South Korean shares opened sharply higher Thursday, tracking an overnight rebound on Wall Street. The benchmark Korea Composite Stock Price Index (KOSPI) rose 26.48 points, or 1.11 percent, to 2,402.29 in the first 15 minutes of trading. The index got off to a strong start after a 1.09 percent fall the previous session. Tech shares soared, taking a cue from a rebound in US tech heavyweights. The tech-laden Nasdaq composite rose 293.87 points, or 2.71 percent, to 11,141.56 on Wednesday (New

Sept. 10, 2020

-

TVXQ’s Yunho stars in Shinhan’s campaign for millennials

K-pop duo TVXQ’s Yunho was featured in a promotional video for Shinhan Financial Group’s campaign promoting healthy lifestyles for millennials, launched Wednesday. Participants in the three-month social media campaign will receive five tasks to complete every two weeks, designed to “boost their confidence” in areas tied to hobbies, perceptions of the environment and society, talent, exercise and networking. They can then upload photos or videos on social media showing

Sept. 9, 2020

-

COVID-19 changing how Korean LPs think about infrastructure bet

Even before the pandemic, South Korean institutional investors pursued safe bets in infrastructure investment, given their tendency to work with top-tier external partners to manage their money and to join the final round of fundraising for those external partners. They became more conservative in the wake of COVID-19, representatives of Korean institutional investors said Tuesday at Infrastructure Investor Seoul Summit Virtual Experience 2020, hosted by the London-based financial intelligence

Sept. 9, 2020

-

Seoul stocks dip over 1% on Wall Street-triggered sell-offs

South Korean shares dipped more than 1 percent Wednesday, as investors dumped market heavyweights following a plunge in the US stock market. The Korean won fell against the US dollar. The benchmark Korea Composite Stock Price Index (KOSPI) fell 26.1 points, or 1.09 percent, to close at 2,375.81. Trading volume was moderate at about 929 million shares worth some 15.2 trillion won ($12.8 billion), with losers outnumbering gainers 618 to 240. Foreigners sold a net 117 billion won, extending the

Sept. 9, 2020

-

KDB chief likely to take second term

Lee Dong-gull, chairman of South Korea’s largest state-run lender the Korea Development Bank, has de facto clinched his second term in office, officials said Wednesday. Once the presidential office Cheong Wa Dae makes it official, Lee is to become the first KDB leader in 26 years to serve two consecutive terms and the fourth to do so in the state-run bank’s 65-year history. Speculation about the KDB’s leadership had been rampant as no plausible candidates were in sight wh

Sept. 9, 2020

-

KDB finalizes acquisition of Indonesian financial firm Tifa Finance

The state-run Korea Development Bank said on Wednesday that it has recently completed the process to acquire the Indonesian company Tifa Finance. The latest takeover, which is in line with the government’s drive to beef up economic and geopolitical relations with countries in Southeast Asia, is aimed at expanding operations in the local market. In December, the Korean bank signed a contract to acquire an 80.65 percent stake in the Indonesian financial company from DSU Group, a manufact

Sept. 9, 2020

-

Mirae Asset Daewoo’s customer assets surpass W300tr amid stock investment boom

Korean brokerage firm Mirae Asset Daewoo said Wednesday that its customer deposits exceeded 300 trillion won ($252 billion) as of end-August, amid growing interest in stock investments in times of ultralow interest rates. At the end of last month, the securities firm’s customer deposits neared 301 trillion won, up more than 60 trillion won from the 239 trillion won recorded at the end of last year. The customer deposits include retail and corporate investors’ money put in their s

Sept. 9, 2020

-

Mirae Asset set to acquire Amazon logistics centers in US: sources

Mirae Asset Global Investments, the asset management arm of South Korean financial group Mirae Asset, was selected as a preferred bidder to acquire Amazon’s logistics centers in the US for $17 million, according to local industry sources Wednesday. The three logistics centers, located in Indiana, Ohio and North Carolina, have been put on sale by Scannell Properties, a US real estate development firm, they said. The centers handle Amazon’s last-mile delivery. While Amazon is set to

Sept. 9, 2020

-

FSC to provide safeguards for heavy debtors

To help delinquent debtors get back on their feet, Korean authorities plan to draft new legislation that enables them to request a debt restructuring program to financial institutions and have a mediator in the process, the Financial Services Commission said Wednesday. The “consumer credit bill” can force local lenders to cease debt collection activities, upon the debtor‘s request, and offer a revised version of a repayment program within 10 working days. Currently, borrowe

Sept. 9, 2020

![[Contribution] Chinese listed companies are coming home](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2020/07/12/20200712000094_0.jpg&u=20200911154111)