Most Popular

-

1

Trump picks ex-N. Korea policy official as his principal deputy national security adviser

-

2

S. Korea not to attend Sado mine memorial: foreign ministry

-

3

First snow to fall in Seoul on Wednesday

-

4

Wealthy parents ditch Korean passports to get kids into international school

-

5

Man convicted after binge eating to avoid military service

-

6

Actor Jung Woo-sung admits to being father of model Moon Ga-bi’s child

-

7

Toxins at 622 times legal limit found in kids' clothes from Chinese platforms

-

8

[Weekender] Korea's traditional sauce culture gains global recognition

![[Weekender] Korea's traditional sauce culture gains global recognition](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050153_0.jpg&u=20241123224317)

-

9

BLACKPINK's Rose stays at No. 3 on British Official Singles chart with 'APT.'

-

10

Korea to hold own memorial for forced labor victims, boycotting Japan’s

-

BlackRock emerges as LG Display blockholder

BlackRock, the world’s largest asset manager, owned over 5 percent of Seoul-based LG Display ordinary shares as of January without the purpose of shareholder engagement, a filing showed Sunday. BlackRock Fund Advisor, a fully owned subsidiary of BlockRock, and its 13 specially related parties held a combined 17.8 million common shares in the South Korean company for 375.1 billion won ($335.7 million) as of Jan. 22. They have some 100,000 shares in the form of American depositary receipts

Jan. 31, 2021

-

Number of overdraft accounts on rise amid bull market

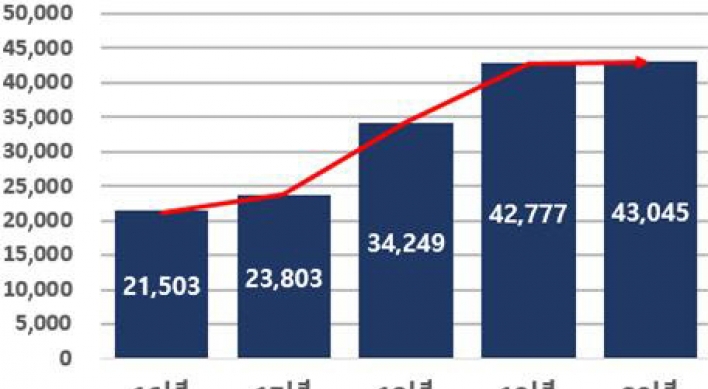

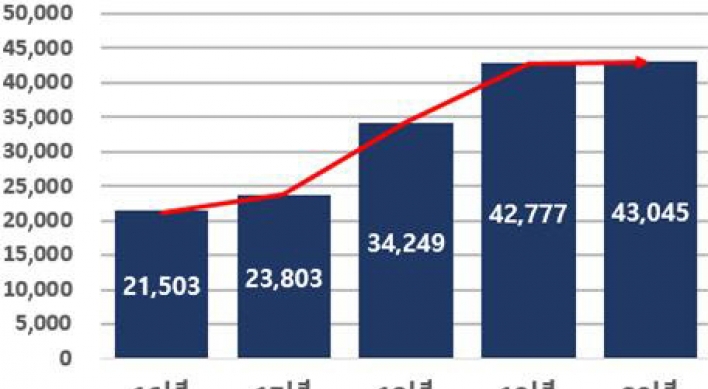

The number of new credit loans via overdraft accounts has been on a sharp rise as South Korean retail investors are scrambling to borrow money for stock investment, fueled by a recent market bull run, industry data showed Sunday. The five major banks here -- KB Kookmin, Shinhan, Hana, Woori and NH NongHyup -- saw their customers open a total of 43,143 overdraft accounts between Jan.1-28, which equates to a combined average of nearly 2,000 daily. The overdraft balance surged by 1.21 trillion w

Jan. 31, 2021

-

S. Korean retail investors buy net W26tr worth of stocks in Jan.

South Korean retail investors snapped up a net 25.8 trillion won ($23 billion) worth of local stocks in January alone, data showed Sunday, in the latest sign of their relentless buying spree. Individual investors bought a net 22.3 trillion won worth of stocks in the main market and a net 3.5 trillion won of shares in the secondary-KOSDAQ market in January, according to the data compiled by the bourse operator Korea Exchange. The figure amounted to 40 percent of their total net stock purchases,

Jan. 31, 2021

-

Seoul stocks tipped to remain under selling pressure next week

South Korean stocks are likely to come under selling pressure next week following this week's choppy trading, as market volatility is expected to remain high over massive foreign selling and profit-taking. The benchmark Korea Composite Stock Price Index closed at 2,976.21 points Friday, down 5.24 percent from a week ago. The index crashed below the 3,000-point level for the first time since surpassing the psychologically important threshold on Jan. 7. The fall was largely attributed to for

Jan. 30, 2021

-

Short sellers under siege everywhere have it really bad in Korea

Retail investors hell-bent on watching stocks go up have made life miserable for short sellers around the world. In South Korea, the government is piling on too. Lawmakers who oversee the country’s $2 trillion stock market are discussing plans to extend one of the world’s longest bans on short selling, amid pressure from mom-and-pop punters who drive more than two thirds of daily trading. Calls to make the 10-month ban permanent are mounting. More than 203,000 people have signed a

Jan. 30, 2021

-

Stock markets decline for four straight sessions on foreign sellout

South Korea’s stock markets fell for four consecutive sessions on Friday, driven by foreign investors‘ sellout. The benchmark Korea Composite Stock Price Index began the day in positive territory but fell below 3,000 points for the first time since Jan. 6 when it recorded 2,976.21 points. The index plunged 3.03 percent, or 92.84 points, to 2,976.21 points on Friday, marking the largest daily decline since Aug. 20, 2020. Foreign and institutional investors sold a net of 1.43 tri

Jan. 29, 2021

-

Mirae Asset Daewoo logs over W1tr in operating profit

South Korean brokerage firm Mirae Asset Daewoo said Friday its consolidated operating profit exceeded 1 trillion won last year, making it the first Korean financial company to reach the milestone Its consolidated group operating profit surged by 52 percent to 1,104 trillion won ($988 million) in 2020, while its profit before tax increased 26 percent to 1.12 trillion won. It posted 818.3 billion won in net profit, a 23 percent on-year increase. The company said it ushered in an era of over 1

Jan. 29, 2021

-

Kospi dips by 3% to below 3,000 on foreign dumping

The South Korean benchmark stock index plunged below the 3,000-point threshold Friday on massive foreign dumping, largely generated by valuation concerns over local stocks and a liquidity squeeze in China. The Korean won rose against the US dollar. The benchmark Korea Composite Stock Price Index (KOSPI) lost 92.84 points, or 3.03 percent, to close at 2,976.21 points, registering the largest daily loss since Aug. 20 last year. Trading volume was high at about 972 million shares worth some 23.8

Jan. 29, 2021

-

Startup incubator D.camp generates ripple effect worth W6.7tr, 32,000 jobs

D.Camp, a non-profit foundation established by 19 banks to foster startups, said on Thursday it has created a trickle-down effect worth 6.7 trillion won ($6.01 billion) in the past three years. The foundation spent a total of 188.7 billion won to support the startup ecosystem for three years from 2018, with a total investment of 2.43 trillion won from the private sector, said Park Nam-gyoo, a business administration professor at Seoul National University at an online press conference. Park,

Jan. 29, 2021

-

Eximbank funds $160m for hospital, R&D center in Uzbekistan

The Export-Import Bank of Korea said Friday it had agreed to extend a $160 million loan as part of the Economic Development Cooperation Fund to Uzbekistan to build a hospital and a research and development center there. The deal was a result of a bilateral online summit held between South Korean President Moon Jae-in and Uzbek President Shavkat Mirziyoyev held Thursday, Eximbank said. Of the total loan, $120 million would be funneled to the construction of a general hospital in Tashkent, whi

Jan. 29, 2021

-

LG Energy Solution accelerates IPO push as it picks lead managers

LG Energy Solution Ltd. has picked the lead managers for its listing on the Seoul bourse after a spin-off from its parent LG Chem Ltd., according to industry sources, which is expected to be one of this year's mega IPO deals. The battery unit wholly owned by LG Chem Ltd. has named KB Securities and Morgan Stanley as the lead managers for its IPO and also selected five brokerages, including Shinhan Investment Corp. Daishin Securities Co., as bookrunners for the IPO, according to them. "The

Jan. 29, 2021

-

Seoul stocks open higher on bottom-fishing

South Korean shares rebounded Friday due to bottom-fishing, led by tech and chemical advances. The benchmark Korea Composite Stock Price Index (KOSPI) rose 13.88 points, or 0.45 percent, to 3,082.93 in the first 15 minutes of trading. The key stock index rebounded after losing 4.4 percent in total in the past three sessions, as investors speculate a stock price hike in the volatile markets. Market bellwether Samsung Electronics added 0.96 percent, with No. 2 chipmaker SK hynix gaining 2.85 pe

Jan. 29, 2021

-

KIM spruces up 3 equity funds to meet diverse investor needs

Seoul-based investment house Korea Investment Management said Thursday that it has rebranded three open-ended equity funds to cater to the diversified needs of South Korean retail investors. The three open-ended equity funds have ditched their respective strategies and shifted their focus to the domestic technology sector; to sectors benefiting from the Korean New Deal initiative, such as batteries, biotechnology, internet and games; and to environmental, social and governance factors. Accor

Jan. 28, 2021

-

Seoul stocks dip nearly 2% on massive foreign selling

South Korean stocks dipped almost 2 percent Thursday on massive foreign selling, generated by results of the Federal Open Market Committee (FOMC) meeting. The Korean won rose against the US dollar. The benchmark Korea Composite Stock Price Index (KOSPI) fell 53.51 points, or 1.71 percent, to close at 3,069.05 points. Trading volume was moderate at about 1.3 billion shares worth around 22.7 trillion won ($20.3 billion), with losers outnumbering gainers 768 to 114. Foreigners sold a net 1.6 tri

Jan. 28, 2021

-

Kakao Pay to halt part of service due to unsolved large shareholder issue

Kakao Pay is expected to halt its integrated personal data management services after failing to obtain a license from the financial authorities, the company said Thursday. The move could leave the firm lagging behind rivals, which are aggressively tapping into the business area. The fintech arm of mobile giant Kakao said its asset management service, which allows users to keep track of all their bank accounts, credit card records and insurance policies, will cease Feb. 5. Other companies that

Jan. 28, 2021

-

S. Korea's daily FX turnover dips 5% last year amid won's gain

The daily foreign exchange (FX) trading by banks in South Korea fell 5.3 percent on-year in 2020 as the local currency rose against the US dollar, central bank data showed Thursday. The daily FX turnover came to an average $52.8 billion last year, down $2.93 billion from the previous year, according to the data by the Bank of Korea (BOK). The BOK said the drop in the daily FX turnover came as the won's gain reduced demand to hedge risks with FX derivative trading. The Korean currency apprecia

Jan. 28, 2021

-

FSC recommends banks to keep dividends below 20% of earnings

South Korea’s top financial regulator said Thursday it has decided to advise major banks to maintain their dividend payouts below 20 percent of net income during the first half of this year in response to the prolonged economic fallout of COVID-19. Under the latest guidance by the Financial Services Commission, local lenders are expected to cut payments to shareholders by about 5 to 7 percentage points. Last year, the country’s four major banking groups -- KB Financial, Shinha

Jan. 28, 2021

-

Dutch investor NNIP says Korean bonds have less upside potential than EM peers

Netherlands-based investor NN Investment Partners said Thursday the search for yield will make emerging markets the most attractive destination for bond investors, but that South Korea was not likely to be their first choice. “Although Korea is part of the emerging market universe in indices, it is much closer to the developed than many other emerging market universe,” Valentijn van Nieuwenhuijzen, chief investment officer of NNIP, said in a teleconference with Korean reporters. &

Jan. 28, 2021

-

Seoul stocks open sharply lower on US slump

South Korean stocks opened sharply lower Thursday, taking a cue from overnight drops on Wall Street. The benchmark Korea Composite Stock Price Index fell 49.67 points, or 1.59 percent, to 3,072.89 in the first 15 minutes of trading. Foreign selling increased as the US Fed did not announce new measures to quicken the economic recovery. Overnight, the tech-heavy Nasdaq composite retreated 2.61 percent, with the Dow Jones Industrial Average and the S&P 500 closing down 2.05 percent and 2.57

Jan. 28, 2021

-

Venture investment hits record high in 2020

South Korea’s venture investment set records in 2020 both in the number of deals and their value, despite the fallout from the coronavirus pandemic, the Ministry of SMEs and Startups announced Wednesday. The country’s investment in startups reached 4.30 trillion won ($3.89 billion) in 2020, adding 26.8 billion won, or 0.6 percent, from the previous year. The number of investment deals also hit a record high of 4,231 while the number of invested companies logged an all-time high

Jan. 27, 2021

![[Weekender] Korea's traditional sauce culture gains global recognition](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050153_0.jpg&u=20241123224317)