Most Popular

-

1

Dongduk Women’s University halts coeducation talks

-

2

Defense ministry denies special treatment for BTS’ V amid phone use allegations

-

3

OpenAI in talks with Samsung to power AI features, report says

-

4

Russia sent 'anti-air' missiles to Pyongyang, Yoon's aide says

-

5

Two jailed for forcing disabled teens into prostitution

-

6

Trump picks ex-N. Korea policy official as his principal deputy national security adviser

-

7

S. Korea not to attend Sado mine memorial: foreign ministry

-

8

South Korean military plans to launch new division for future warfare

-

9

Kia EV9 GT marks world debut at LA Motor Show

-

10

Gold bars and cash bundles; authorities confiscate millions from tax dodgers

-

Most bond experts eye rate freeze in Oct.: poll

Nearly nine in 10 bond mavens in South Korea predict the central bank to freeze its key interest for October due mainly to volatile external conditions, a poll showed Thursday. According to the survey of 200 bond experts by the Korea Financial Investment Association, 87 percent of the 100 respondents forecast the Bank of Korea (BOK) to hold its policy rate steady at a rate-setting meeting slated for next week. The number of standpatters was up from 67 in August. In contrast, 13 bond experts, dow

Oct. 7, 2021

-

S. Korea to implement market-stabilizing steps if needed: official

South Korea plans to implement measures to stabilize the market in a timely manner if needed as market volatility has increased amid external economic risks, a senior government official said Thursday. First Vice Finance Minister Lee Eog-weon said the Korean financial market has been "excessively" volatile in recent sessions despite the country's strong macroeconomic fundamentals. South Korea's benchmark index, the Kospi, nosedived nearly 2 percent and the Korean currency fell to a 14-

Oct. 7, 2021

-

Seoul stocks open higher on bargain hunting

South Korean stocks opened higher Thursday as bargain hunters sought oversold stocks on expectations of a rebound. The benchmark Korea Composite Stock Price Index (Kospi) rose 31.54 points, or 1.08 percent, to 2,939.85 points in the first 15 minutes of trading. The key stock index got off to a strong start after three days of losses. Market kingpin Samsung Electronics added 0.98 percent, but No. 2 chipmaker SK hynix retreated 0.73 percent. Internet portal operator Naver jumped 2.41 percent, and

Oct. 7, 2021

-

S. Korea sells $1.3b of FX bonds at 2nd-lowest rates

South Korea said Thursday it has sold about $1.3 billion worth of foreign exchange stabilization bonds at the second-lowest ever rates amid solid demand. The government sold US dollar-denominated bonds worth $500 million with a maturity of 10 years and five-year euro-denominated debts worth $700 million, according to the finance ministry. The dollar bonds carry a yield of 1.769 percent, or 25 basis points more than the rate of US 10-year Treasuries, while the euro bonds carry a yield of minus 0.

Oct. 7, 2021

-

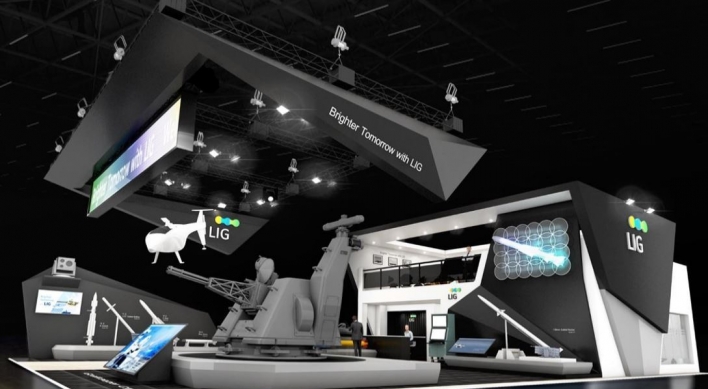

Activist fund invests W100b in LIG Nex1 in ESG push

South Korean activist fund Korea Corporate Governance Improvement has bought 100 billion won ($84 million) in exchangeable bonds issued by weapon system developer LIG Nex1, a filing showed Wednesday. The investment is aimed at improving LIG Nex1’s performance under the criteria of environmental, social and governance responsibility and giving birth to LIG Nex1’s new line of business, according to KCGI. The investment manager did not elaborate on its future ESG strategy for the defe

Oct. 6, 2021

-

Seoul stocks skid for 3rd day to this year's low

South Korean stocks fell nearly 2 percent Wednesday, while the Korean won fell to a 14-month low against the US dollar amid ongoing investor concerns over the debt crises of Chinese property developers and the impasse in the US Congress on raising the debt limit. The benchmark Korea Composite Stock Price Index (KOSPI) fell 53.86 points, or 1.82 percent, to close at 2,908.31 points, the lowest finish since Dec. 30 last year. Trading volume was moderate at about 887.63 million shares worth some

Oct. 6, 2021

-

Shinhan continues investment spree for digital partnership

Shinhan Financial Group said Wednesday it has decided to invest 18 billion won ($15.1 million) into three startups offering cutting-edge technologies as part of its bigger plan to boost the group’s digital capabilities. Three startups that attracted the funding include Galaxy Corp. which owns intellectual property rights to virtual characters for metaverse platforms as well as Xinapse, an artificial intelligence technology-based startup. Shinhan plans to collaborate with the firms to e

Oct. 6, 2021

-

Koreans dump Tesla shares, turn to US health care sector in Q3

South Korea-domiciled investors went on to sell Tesla stocks during the third quarter of this year, and instead turned to health care stocks in the United States, data showed Wednesday. This indicates that Korean investors’ enthusiasm over the growth potential of the Palo Alto, California-based electric vehicle giant since early 2020 has started to wane. Instead, they were seen betting on normalization hopes amid a fight against the COVID-19 pandemic. From July to September, Korean inv

Oct. 6, 2021

-

Seoul stocks open higher on Wall Street gains

South Korean stocks opened higher Wednesday as investor sentiment was uplifted by overnight gains on Wall Street. The benchmark Korea Composite Stock Price Index (KOSPI) rose 11.73 points, or 0.4 percent, to 2,973.90 points in the first 15 minutes of trading. The key stock index got off to an upbeat start, tracking overnight gains on Wall Street that came after sharp losses the previous session. Overnight, the Dow Jones Industrial Average added 0.92 percent, while the tech-heavy Nasdaq compos

Oct. 6, 2021

-

Toss Bank kicks off full operation, targeting low-credit borrowers

Toss Bank, South Korea’s third internet-only bank, commenced full operations on Tuesday, highlighting its user-friendly financial services that differentiate itself from rivals quickly expanding their presence in the emerging market. Under the slogan of “New Banking, New Bank,” the online-only lender showcased its convenient deposit banking and loan service fit for as many users as possible, including thin filers with little credit history and low-credit borrowers. “Ev

Oct. 5, 2021

-

Kospi slumps below 3,000 points for first time in 6 months

South Korea’s key stock index plunged below the 3,000-point threshold Tuesday for the first time in nearly seven months on the back of losses in top-listed firms. The benchmark Kospi tumbled 57.01 points, or 1.89 percent, to close at 2,962.17 points, the lowest closing since March 10, when it marked 2,958.12 points. It was also the first time the index dropped below 3,000 points at the closing bell, when the index closed the session at 2,996.35 on March 24. On the back of high liquidity,

Oct. 5, 2021

-

[Feature] Fractional share trading in S. Korea faces regulatory hurdles

Fractional trading in South Korea will kick off next year, offering retail investors wider access to the nation’s stock market. But the new trading system, if implemented without detailed legal consideration, might cause market disruption among investors, regulators and even legislators, experts say. Some even claim the system might have limited impact in the local stock market for quantitative growth, saying that the market has few “expensive” equity shares that might be sui

Oct. 5, 2021

![[Feature] Fractional share trading in S. Korea faces regulatory hurdles](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2021/10/05/20211005000183_0.jpg&u=20211005180328)

-

S. Korean stock market nosedives to almost 7-month low

South Korean stocks plunged to an almost seven-month low Tuesday, as investor sentiment was weakened by the debt ceiling tussle in the United States and debt crises involving Chinese property developers. The Korean won closed unchanged against the US dollar. The benchmark Korea Composite Stock Price Index (Kospi) tumbled 57.01 points, or 1.89 percent, to close at 2,962.17 points, the lowest finish since March 10. Trading volume was moderate at about 830 million shares worth some 15.1 trillion wo

Oct. 5, 2021

-

Hahn & Co. eyes W300b in partial exit from secondhand car retailer IPO

South Korea-based private equity firm Hahn & Co. is poised to cash in on 306.6 billion won ($258.1 million) from an initial public offering of a fully-owned secondhand car retailer K Car on Wednesday, according to a prospectus Tuesday. The deal is aimed at floating Hahn & Co.’s 25.5 percent stake, or 12.3 million shares, in K Car, plus 1.2 million new shares. The IPO price of K Car, which is valued at 1.2 trillion won, has been fixed at 25,000 won apiece. Hahn & Co.’s

Oct. 5, 2021

-

Digital transformation drives out bank branches, ATMs: data

Amid the rapid digital transformation brought on by the COVID-19 era, local banks have increasingly turned their backs on brick-and-mortar branches and automated teller machines, data showed Wednesday. The number of physical bank branches stood at 6,326 as of the end of June, down 10.9 percent from the end of 2016, when the figure came in at 7,101, according to data from the market watchdog Financial Supervisory Service submitted to Rep. Yoo Dong-soo of the ruling Democratic Party. Meanwhile,

Oct. 5, 2021

-

Seoul stocks open lower on US stock losses

South Korean stocks opened lower Tuesday, as investor sentiment was hurt by overnight losses on Wall Street. The benchmark Korea Composite Stock Price Index (Kospi) slumped 29.05 points, or 0.96 percent, to 2,990.13 points in the first 15 minutes of trading. Seoul stocks got off to a weak start, falling below the 3,000-point level for the first time in about six months. The Korean stock market closed Monday due to an extended holiday tied to the Oct. 3 National Foundation Day. An impasse over th

Oct. 5, 2021

-

IPOs highlight imminent successions at Korean chaebol

South Korean business magnates are gearing up for initial public offerings of conglomerates’ affiliates, in an apparent bid to allow their siblings to cash in on their stock holdings from the proposed exit under the respective business succession plans. Market watchers perceive the moves as the chance to give cash-hungry siblings options to solidify legitimate control over the family-owned conglomerates here, which include buying shares in the group’s key affiliate that stands on t

Oct. 4, 2021

-

Multitenant assets to improve Korean property investors’ resilience: analysis

South Korean investors’ focus could be on multitenant commercial properties as they have greater room for improvement than single-tenant properties under their traditional low-risk strategy amid prospects for post-pandemic uncertainties, a research paper showed Monday. Such assets can help Korean outbound investors seek extra income from investment and stay resilient from economic uncertainties that arise from a projected interest rate hike across the world in the wake of the pandemic re

Oct. 4, 2021

-

Apartment purchases by children surpass W100b in value

A growing number of young South Koreans under 10 years old have purchased apartments across the nation with financial support from their parents, a lawmaker said Monday, raising concerns over inheritance for real estate speculation. The number of apartment purchases by the elementary-school kids and younger came in at 552 from September 2017 to last month, which amounted to 104.7 billion won ($88.2 million), according to data from the Ministry of Land, Infrastructure and Transport submitt

Oct. 4, 2021

-

Online-only lender Toss Bank commences operation

The country’s third internet-only lender Toss Bank is slated to begin operation Tuesday, heating up the competition in the fast-growing online banking market, according to industry sources Monday. The lender, controlled by Viva Republica, the operator of fintech app Toss, will start its banking services, including offering credit loans, savings and deposits, with a primary focus on expanding mid-range interest rate loans. Earlier in June, when the online bank received a final appro

Oct. 4, 2021

![[Feature] Fractional share trading in S. Korea faces regulatory hurdles](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2021/10/05/20211005000183_0.jpg&u=20211005180328)