Most Popular

-

1

Dongduk Women’s University halts coeducation talks

-

2

Defense ministry denies special treatment for BTS’ V amid phone use allegations

-

3

OpenAI in talks with Samsung to power AI features, report says

-

4

Russia sent 'anti-air' missiles to Pyongyang, Yoon's aide says

-

5

Two jailed for forcing disabled teens into prostitution

-

6

Trump picks ex-N. Korea policy official as his principal deputy national security adviser

-

7

S. Korea not to attend Sado mine memorial: foreign ministry

-

8

South Korean military plans to launch new division for future warfare

-

9

Kia EV9 GT marks world debut at LA Motor Show

-

10

Gold bars and cash bundles; authorities confiscate millions from tax dodgers

-

1 in 10 SMEs seek buyers as heirs refuse to inherit: survey

One out of 10 small and midsize company owners are selling their firms because their children are refusing to take over the family business, preferring a cash inheritance by selling the companies their parents built, a survey showed Tuesday. According to Korea M&A Exchange, a platform that mediates buyers and sellers of small and medium-sized enterprises, of the 5,481 business owners looking for buyers, 515 said they were looking for new owners to take over their firms as their children di

Nov. 9, 2021

-

Seoul stocks inch up on institutional buying

South Korean stocks edged up Tuesday after a choppy session, led by institutional buying. The Korean won rose against the US dollar. The benchmark Korea Composite Stock Price Index (Kospi) added 2.26 points, or 0.08 percent, to 2,962.46 points. Trading volume was moderate at about 699 million shares worth some 9.6 trillion won ($8.1 billion), with gainers outnumbering losers 540 to 317. Institutions bought a net 274 billion won, while foreigners sold 138 billion won. Retail investors offloade

Nov. 9, 2021

-

Citigroup’s retail closure in Korea to cost max W1.8tr: reports

The US-based global banking giant Citigroup will reportedly spend up to $1.5 billion, or 1.8 trillion won, on the withdrawal of its retail business in South Korea, according to news reports Tuesday. The group said in a regulatory filing that its expenditure on severance pay for employees at the Korean subsidiary’s retail banking operations will range between $1.2 billion and $1.5 billion. It will pay the envisioned personnel costs in phases by the end of next year, the Wall Street Jour

Nov. 9, 2021

-

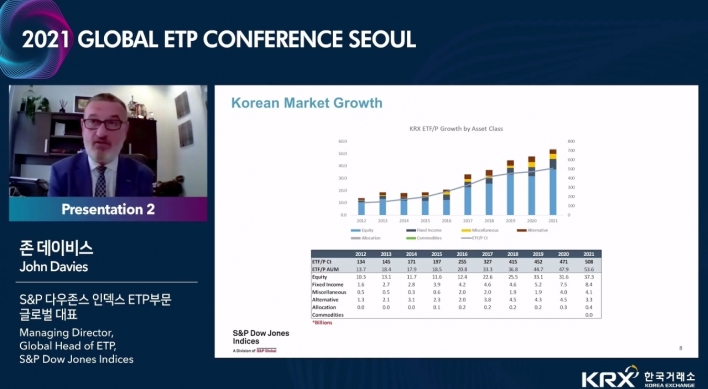

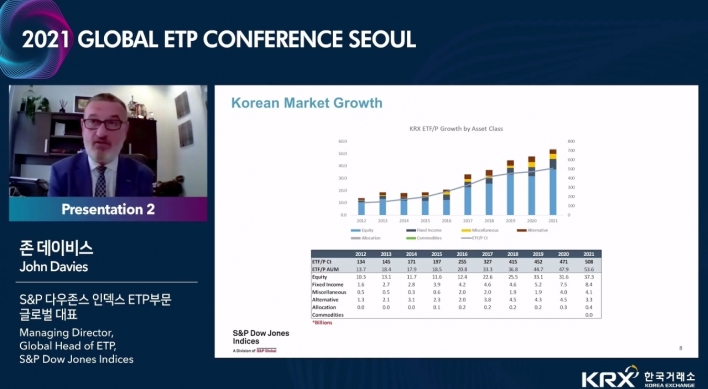

S&P ETP expert says Korean ETF market is growing in healthy way

South Korea’s exchange-traded fund market is getting very competitive and growing in a healthy way, in line with local asset management firms’ fierce competition, an executive from S&P Dow Jones Indices said Tuesday. “The Korean ETF market’s 10-year compound annual growth rate is around 25 percent, which is way above the global market’s rate of growth of 16 percent,” John Davies, global head of exchange-traded products at S&P Dow Jones Indices, said

Nov. 9, 2021

-

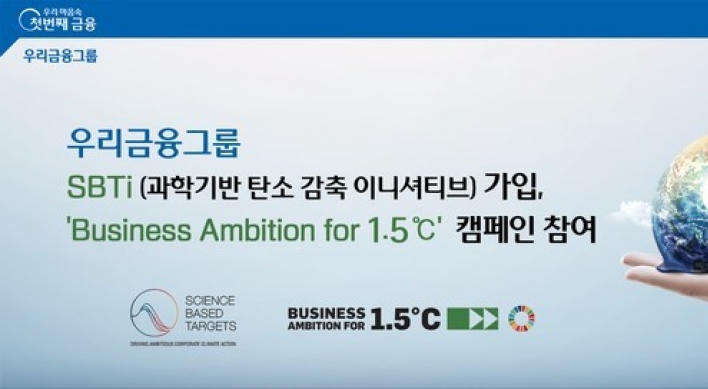

S. Korean banking groups race for global ESG approval

With carbon neutrality pledges and awareness in sustainability reshaping markets and industries around the globe, South Korean bank giants are in a fierce race to win global recognition on their respective drives designed to adopt environmental, social and governance values. KB Financial Group, the nation’s No.1 banking group by assets, said last month that it was officially endorsed by the Science Based Targets Initiative, stressing that it has become the first financial institution in A

Nov. 9, 2021

-

Family office TCK wins asset management license

Seoul-based family office Topor & Co. Korea, co-led by investment banking professional and TV celebrity Mark Tetto, said Tuesday the company has obtained an asset management license in South Korea to expand services for its client base. The move is aimed at expanding its current client offerings to include the privately placed fund business for qualified professional investors under Korean law, TCK said. In line with the move, TCK was rebranded as Topor & Co. Korea Asset Management in

Nov. 9, 2021

-

Seoul stocks rebound on Wall Street gains

South Korean stocks opened higher Tuesday as investor sentiment was uplifted by overnight gains on Wall Street. The benchmark Korea Composite Stock Price Index (Kospi) rose 24.47 points, or 0.83 percent, to 2,984.67 points in the first 15 minutes of trading. Overnight, the Dow Jones Industrial Average added 0.29 percent amid market optimism that the economic recovery is able to accommodate the inflation risks. The tech-heavy Nasdaq composite rose 0.07 percent. In Seoul, top cap Samsung Electr

Nov. 9, 2021

-

Yoon & Yang partners with Cadmus to meet new demand for legal services

South Korean full-service law firm Yoon & Yang said Monday it has partnered with US-based consulting service company Cadmus Group to address the new demand for legal services in the wake of Korea’s toughening regulation over occupational safety. The partnership will allow Yoon & Yang to assist Korean companies with identifying risks and help them be better prepared for their disaster response mechanism, Yoon & Yang said in a statement. Under a memorandum of understanding si

Nov. 8, 2021

-

Seoul stocks down for 2nd day on bio losses

South Korean stocks lost for the second straight session Monday as financial, bio and tech stocks plunged. The Korean won rose against the US dollar. The benchmark Korea Composite Stock Price Index (Kospi) fell 9.07 points, or 0.31 percent, to close at 2,960.2 points. Trading volume was moderate at about 551 million shares worth some 10.2 trillion won ($8.6 billion), with gainers outnumbering losers 502 to 352. Foreigners sold a net 122 billion won, while retail investors bought 366 billion w

Nov. 8, 2021

-

Korbit adopts P2E scheme to upgrade metaverse platform

Korbit, a local cryptocurrency exchange, said Monday that it adopted a “play to earn” scheme as part of efforts to upgrade its nascent metaverse platform. Play to Earn, commonly known as P2E, is a system in which players can gain rewards for playing games within the platform. Korbit’s attempt to incorporate P2E is a move meant to attract not only cryptocurrency traders, but also to reflect growing interest in the metaverse. “In Korbit Town, people without any exposur

Nov. 8, 2021

-

The hits keep coming: 2022 set for parade of blockbuster IPOs

South Korea’s initial public offering market is expected to regain momentum as a number of big players are set to go public next year. But the stock market needs to gain its upward momentum first to revive investor interest, according to investment banking sources and market experts Monday. Some mega deals, such as lithium-ion battery maker LG Energy Solution, local builder Hyundai Engineering, and online grocery delivery platforms SSG.com and Market Kurly, are getting ready for listings

Nov. 8, 2021

-

[Herald Interview] Landmark Seoul hotels become homes, offices

Reeling from diminishing demand for cross-border business and tourism in the COVID-19 pandemic, South Korea’s hotel industry has been undergoing a drastic transition in recent months. Landmark hotels in Seoul are turning into residential apartments and offices through redevelopment projects as owners look for a more lucrative business. At the same time, others are looking to upgrade their accomadations to ultraluxury brands, both foreign and local, according to a local real estate profe

Nov. 8, 2021

![[Herald Interview] Landmark Seoul hotels become homes, offices](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2021/11/08/20211108000241_0.jpg&u=20211109180245)

-

Would insurers pay out if ‘Squid Game’ happened in real life?

The megahit Netflix series “Squid Game” depicts a dystopian world where 456 people compete in a series of extreme survival games on a remote island. The sole winner takes all the prize money, while everyone else bites the dust. In the real world, all the “Squid Game” deaths would be eligible for insurance coverage, according to a local insurance company. The question is whether those death benefits would differ depending on how the player died, it added. According to a

Nov. 8, 2021

-

Seoul stocks open lower on tech, financial slump

South Korean stocks opened lower Monday on losses in financial, bio and tech stocks. The benchmark Korea Composite Stock Price Index (Kospi) fell 23.41 points, or 0.79 percent, to 2,945.86 points in the first 15 minutes of trading. Stocks got off to a weak start amid foreign and institutional sell-offs. Market bellwether Samsung Electronics edged up 0.14 percent to 70,300 won, while No. 2 chipmaker SK hynix retreated 2.34 percent to 104,500 won. Hyundai Motor, the country's largest carmaker,

Nov. 8, 2021

-

Citibank Korea committed to supporting ESG drive in corporate sector

Citibank Korea, the South Korean unit of Citigroup, has ramped up efforts to gain an upper hand in sustainable financing, focused on environmental, social and governance factors, to support local companies’ ESG management, the lender said Sunday. Sustainable financing refers to a bank’s financial services, ranging from loans to bonds, designed to provide financial support for sustainable economic activities and projects of private companies or public entities. The prolonged COVID-19

Nov. 7, 2021

-

Banks in Korea to see mass voluntary retirement this year

South Korea’s banking sector is expected to no longer guarantee job security the way it once did. This year, the industry is seeing a mass exodus of its workforce, with lenders offering lucrative early retirement packages to accelerate digitalization of banking services and trim down their physical operations for the transition, data showed Sunday. The Korea Herald looked at individual employment data from six banks released this year. Along with Citibank Korea shutting down its consume

Nov. 7, 2021

-

Blockbuster IPO shares fear price fall this week as lockups expire

Stocks that began trading through blockbuster initial public offerings this year might see a downturn in stock prices as lockup periods that hindered large shareholders from selling expire this week, according to market insiders Sunday. A stock lockup is a device to prevent large shareholders from selling their shares too quickly and causing a sudden change in stock prices after a company goes public. Institutional investors are expected to trade roughly 11 trillion won ($9.3 billion) worth o

Nov. 7, 2021

-

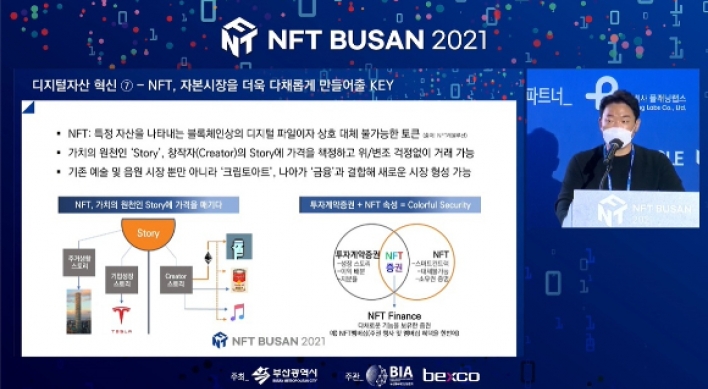

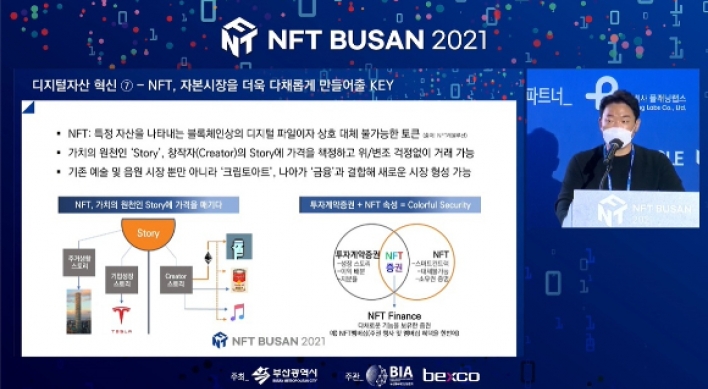

Why are NFTs more disruptive than cryptocurrencies?

Nonfungible tokens, otherwise known as NFTs, are more disruptive than cryptocurrencies because of its potential to be applied to a plethora of sectors, blockchain experts said last week. “At the moment, the cryptocurrency market, which is a fungible market, outscales the NFT market, but the cryptocurrency market still falls within the realm of conventional finance. On the other hand, NFTs present an unlimited potential to expand beyond existing conceptions of financial assets,” Kim

Nov. 7, 2021

-

With assessment of NFTs done, financial companies actively seek opportunites

Rather than discussing the question of whether non-fungible tokens are a fad, traditional financial institutions are instead asking how they can be incorporated within their business models, according to speakers from major financial firms who gathered at a three-day conference on NFTs. The tokens are digital counterparts of real-world assets, largely visual art and music. More importantly, each NFT is unique, with ownership being traced and protected through blockchain technology. Given that

Nov. 6, 2021

-

KOSPI likely to move in tight range next week on policy uncertainties

South Korea's benchmark stock index is likely to move in a tight range next week, although volatility may increase due to policy uncertainties, analysts said. The benchmark Korea Composite Stock Price Index (closed at 2,969.27 points Friday, nearly unchanged from 2,970.68 points a week ago. The KOSPI fluctuated as investors waited and digested the U.S. Federal Reserve's meeting results, particularly its stance over potential rate hikes. According to the FOMC meeting results, the US central b

Nov. 6, 2021

![[Herald Interview] Landmark Seoul hotels become homes, offices](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2021/11/08/20211108000241_0.jpg&u=20211109180245)