Most Popular

-

1

Actor Jung Woo-sung admits to being father of model Moon Ga-bi’s child

-

2

Wealthy parents ditch Korean passports to get kids into international school

-

3

Man convicted after binge eating to avoid military service

-

4

First snow to fall in Seoul on Wednesday

-

5

Final push to forge UN treaty on plastic pollution set to begin in Busan

-

6

Korea to hold own memorial for forced labor victims, boycotting Japan’s

-

7

Nvidia CEO signals Samsung’s imminent shipment of AI chips

-

8

S. Korea not to attend Sado mine memorial: foreign ministry

-

9

Toxins at 622 times legal limit found in kids' clothes from Chinese platforms

-

10

Job creation lowest on record among under-30s

-

S. Korea's daily FX turnover jumps to record high in 2019

The daily foreign exchange turnover by local and foreign banks in South Korea climbed to an all-time high in 2019 on a sharp increase in the transaction of derivatives, central bank data showed Friday. The daily FX turnover came to an average $55.77 billion in the year, up $260 million, or 0.5 percent, from a year earlier, according to the data from the Bank of Korea. The amount marks the highest since 2008, when the central bank began including transactions of FX derivatives in such data. &

Jan. 31, 2020

-

Watchdog imposes ‘heavy sanctions’ on Woori, KEB Hana executives for DLF misselling

South Korea’s financial watchdog on Thursday said it has decided to impose heavy sanctions on the top executives of two major banking groups -- Woori Bank and KEB Hana Bank -- for misselling derivatives-linked funds last year. The Financial Supervisory Service’s sanctions committee has decided to hand Woori Financial Group Chairman and Woori Bank CEO Sohn Tae-seung as well as Hana Financial Vice Chairman and former Hana Bank CEO Ham Young-joo “reprimands and warnings,”

Jan. 30, 2020

-

Investments in Korean startups hit record high

The startup market here saw record investments of 4.28 trillion won ($3.61 billion) last year, according to the Ministry of SMEs and Startups on Thursday. The figure was up from 2.38 trillion won in 2017. Of the total, private funds invested 1.48 trillion won, or 35 percent, of money injected into the local startup industry. By segment, smart health care companies received 617.2 billion won, while sharing-economy businesses and financial technology firms attracted 276.1 billion won and 12

Jan. 30, 2020

-

Median apartment price in Seoul jumps 50% under Moon govt

The median price of apartments in Seoul surpassed the 900 million won ($760,000) threshold in January for the first time, according to commercial bank KB Kookmin Bank on Thursday. The bank’s monthly report on real estate prices showed that the median price of Seoul apartments reached 912.2 million won as of this month, a record high since comparable data started to be compiled in December 2008. A housing unit with a market value of 900 million won or more, categorized as an “exp

Jan. 30, 2020

-

[KH Explains] TRS, leverage scheme behind hedge fund debacle in Korea

The recent brouhaha surrounding hedge fund company Lime Asset Management is stoking concerns about a potential liquidity crunch across the financial market in South Korea. At the heart of the controversy is what is called a total return swap. Simply put, a TRS is a financial deal that helps fund operators like Lime Asset enjoy leverage. For instance, a hedge fund can acquire underlying assets, including bonds, equities, commodities and mortgage-backed securities, in partnership with a cash-r

Jan. 29, 2020

![[KH Explains] TRS, leverage scheme behind hedge fund debacle in Korea](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2020/01/29/20200129000651_0.jpg&u=20200129172505)

-

Fear of coronavirus spreads to Korea’s commercial banks

Silence prevails at KEB Hana Bank’s main branch in Myeong-dong, central Seoul, on Wednesday in Seoul, except for a bell ringing that a bank clerk -- wearing a mask -- is ready to serve the next customer. At the entrance, customers wonder if they are entering a hospital by mistake, as they are greeted with noncontact infrared thermometers and hand sanitizers placed at every corner, along with signs that read “preventative measures top priority.” The branch is one of many bri

Jan. 29, 2020

-

IBK chief takes office, ending 27 days of labor protests

The head of the Industrial Bank of Korea officially took office Wednesday after nearly a month of being unable to enter his office in the face of fierce protests from the labor union, which objected to the government’s influence on financial organizations. After reaching an agreement with the labor union to improve management transparency, IBK CEO Yoon Jong-won had his inauguration ceremony Wednesday, vowing to turn the state bank into a world-class financial institution that upholds et

Jan. 29, 2020

-

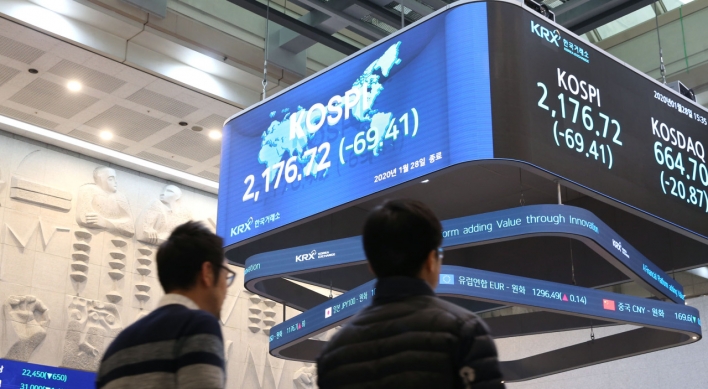

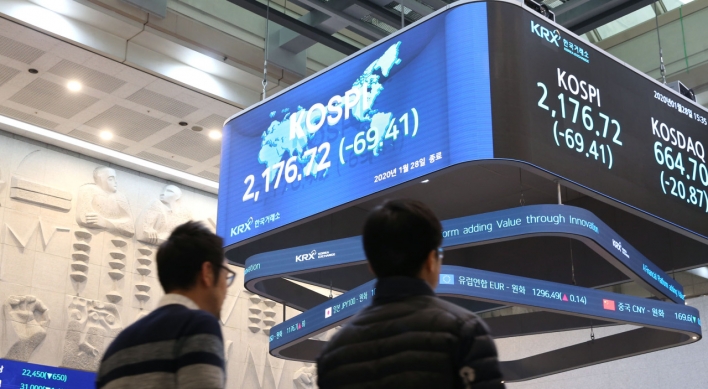

Investors eye low-risk assets as Seoul stocks trim losses

South Korean stocks trimmed their losses Tuesday, losing 3 percent on the first trading session after the four-day Lunar New Year’s holiday, as the fast-spreading Wuhan coronavirus outbreak weakened investor sentiments. The local currency closed at 1,176.7 won against the US dollar, up 8 won from the previous session’s close, declining to a two-month low. The benchmark bourse Kospi opened sharply low -- down 53.91 points, or 2.40 percent, from the previous session. The weak start c

Jan. 28, 2020

-

State-backed W1.5tr infra fund to raise private money

Korea’s state-backed fund seeking a commitment of 1.5 trillion won ($1.27 billion) is looking to raise 900 billion won in private money, its lead fund manager Samsung Asset Management said Tuesday. The fund has a maturity of 30 years and is set to close all transactions by October 2024. The fund is designed to target overseas infrastructure assets, ranging from new and renewable energy plants, oil and gas plants, airports and roads to railways and smart city infrastructure. Managing th

Jan. 28, 2020

-

NPS wins big from Samsung affiliates’ recent rally

The overall value of the shares in Samsung affiliates and subsidiaries held by South Korea’s largest institutional investor, the National Pension Service, jumped nearly 60 percent over the past year, according to data made public Tuesday. The NPS’ shares in 13 Samsung units were worth 49.28 trillion won ($41.7 billion) as of Wednesday last week, up 57 percent from 31.4 trillion won ($26.7 billion) Jan. 2 last year, according to financial research firm FnGuide. The whopping increa

Jan. 28, 2020

-

Hedge fund AlpenRoute may freeze W180b investor funds as distrust builds

AlpenRoute Asset Management said Tuesday it may opt to suspend investor withdrawal of assets worth 181.7 billion won ($154.4 million) from its 26 open-ended funds by February to ward off illiquidity, as the distrust of hedge fund managers across South Korea has triggered abrupt money withdrawal attempts. Of its 226.4 billion won assets in open-ended funds -- designed to allow investors to withdraw at will -- that mainly target equities in privately held companies, AlpenRoute has decided to defe

Jan. 28, 2020

-

Seoul stocks open sharply lower amid Wuhan coronavirus woes

South Korean stocks opened sharply lower Tuesday, the first trading session after the four-day Lunar New Year's holiday, as the fast-spreading Wuhan coronavirus around the globe sapped investor sentiment. The benchmark Korea Composite Stock Price Index fell 57.43 points, or 2.56 percent, to 2,188.70 in the first 15 minutes of trading. The local stock market was closed Friday and Monday. South Korea on Monday reported its fourth confirmed Wuhan coronavirus case amid mounting concerns the pneum

Jan. 28, 2020

-

Market watchers downplay long-term impact of coronavirus in Korea

Although concerns over the possible impact of the deadly coronavirus on the financial market are rising here, analysts say that the “noise” caused by the contagious virus originating from China will be short-lived and eventually overshadowed by company fundamentals that remain strong, coupled with the easing trade conflict between China and the United States. “The spread of coronavirus will not likely cause an unprecedented pandemonium but merely an uncanny noise to investors,

Jan. 27, 2020

-

US, Japanese investors biggest players in S. Korean stock, bond markets: FSS

The number of foreign investors in South Korea’s stock and bond markets exceeded 480,058 last year, up 1,358 from a year earlier, according to the nation’s financial regulator Financial Supervisory Service on Monday. Of the total figure, individuals made up 11,657, while institutional investors made up 36,401, including 23,064 private funds, 2,305 pension funds, 997 stock brokerage firms, 738 banks and 512 insurance firms. By nationality, the US and Japan were the two largest pl

Jan. 27, 2020

-

Mobile payment accelerates demise of coins, banking branches

Last year, the number of newly minted coins hit the lowest value on record and the number of banking branches continued to drop, according to data on Monday. The Bank of Korea, the nation’s central bank, said newly issued coins last year amounted to some 36.4 billion won ($30.9 million) in value, the lowest since comparable data started being compiled in 1992 and down 14.3 percent from a year earlier. The figure is even lower than the 39.6 billion won worth of newly made coins i

Jan. 27, 2020

-

Investors flock to real estate funds, seeking stable, high returns

Investors have been increasingly turning to real estate funds, looking for low-risk, high-return investments, according to data on sunday. Total investments in real estate funds stood at 99.39 trillion won ($84.90 billion) -- 96.19 trillion won for private equity funds and 3.21 trillion won for public funds -- as of Jan. 21, according to data released by the Korea Financial Investment Association, a nonprofit self-regulatory organization. The figure has been on a steady uptrend over the year

Jan. 27, 2020

-

Samsung may see passive funds cut exposure sooner than expected

A cap on Samsung Electronics’s weight in a Korean equity index could kick in earlier than planned, triggering fears that billions of dollars will exit the stock.Instead of the bi-annual adjustment, the Korea Exchange is considering putting a 30 percent limit on Samsung’s weighting on the Kospi 200 Index earlier due to the stock’s recent rally, said Ahn Kil-Hyun, the manager of the team that oversees the index. Given the gauge’s popularity among passive funds, research pro

Jan. 23, 2020

-

Duty-free shares suffer decline amid new coronavirus fear

Shares in South Korean duty-free operators took a hit amid concerns that the outbreak of the Wuhan coronavirus may hurt the companies’ revenues from Chinese visitors, data showed Thursday. Hotel Shilla closed at 97,000 won ($83) on Thursday, down 10.6 percent from Friday’s closing price of 108,500 won. Shinsegae fell 4.37 percent over the cited period to finish at 306,500 won. Lotte Shopping also tumbled 4.76 percent to close at 130,000 won.On Monday, South Korea reported

Jan. 23, 2020

-

FSS expands consumer protection in reshuffle

The Financial Supervisory Service on Thursday unveiled its reshuffle blueprint, focusing on consumer protection and innovative finance.The move came amid the ongoing controversy regarding the so-called derivatives-linked fund fiasco -- the improper sales of products by local banks and securities. The FSS is slated to announce its sanction decision for two major banking chiefs later this month.“To respond to the stronger consumer protection needs and enhance the supervisory functions over

Jan. 23, 2020

-

Kakao’s prospects for brokerage biz brighten

South Korea’s mobile payment platform Kakao Pay has got preliminary approval to enter the securities business, according to the financial regulator Thursday.The Securities and Futures Commission, under the Financial Services Commission, has given its temporary approval to Kakao Pay to become the majority shareholder of local brokerage Baro Investment & Securities. A final decision will be made at the commission’s next meeting, slated for Feb. 5.Having got the nod to acquire a loc

Jan. 23, 2020

![[KH Explains] TRS, leverage scheme behind hedge fund debacle in Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2020/01/29/20200129000651_0.jpg&u=20200129172505)