Most Popular

-

1

Dongduk Women’s University halts coeducation talks

-

2

Defense ministry denies special treatment for BTS’ V amid phone use allegations

-

3

OpenAI in talks with Samsung to power AI features, report says

-

4

Russia sent 'anti-air' missiles to Pyongyang, Yoon's aide says

-

5

Two jailed for forcing disabled teens into prostitution

-

6

Trump picks ex-N. Korea policy official as his principal deputy national security adviser

-

7

S. Korea not to attend Sado mine memorial: foreign ministry

-

8

South Korean military plans to launch new division for future warfare

-

9

Gold bars and cash bundles; authorities confiscate millions from tax dodgers

-

10

North Korean leader ‘convinced’ dialogue won’t change US hostility

-

KKR closes W2.4tr deal to invest in SK E&S in eco push

US investment firm KKR & Co. said Friday it has acquired newly issued redeemable convertible preferred shares of South Korean energy company SK E&S for 2.4 trillion won ($2 billion). The investment, via KKR‘s Asia Pacific Infrastructure Fund, will provide KKR with an opportunity to receive cash or in-kind redemption for repayment in the future, as well as an opportunity to convert the securities into common shares of SK conglomerate’s natural gas arm, according to KKR. The

Nov. 5, 2021

-

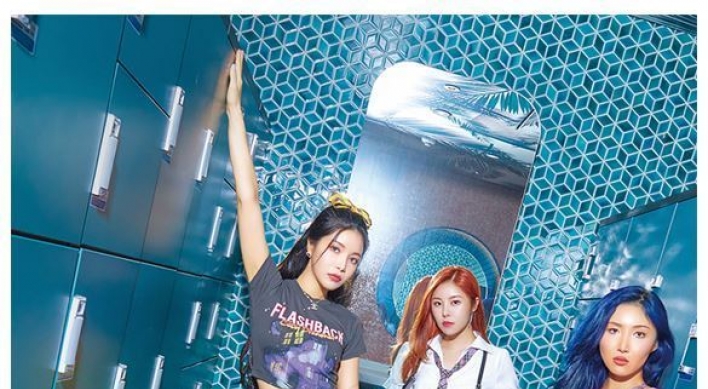

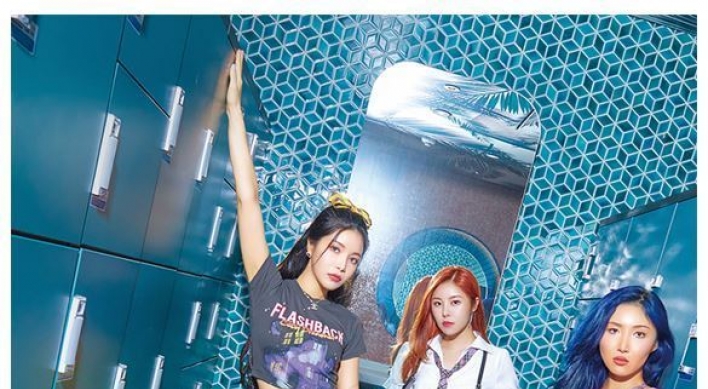

Mamamoo’s agency aims to morph into global content provider via IPO

Rainbow Bridge World, the South Korean entertainment agency behind girl group Mamamoo, said Friday that it is looking to spur growth globally by raising funds through its initial public offering scheduled for later this month. “We will further accumulate experience in producing high-quality content by making active investments (after the IPO). We are poised for a leap in the global market as an integrated content provider,” Kim Jin-woo, co-chief executive officer at Rainbow Br

Nov. 5, 2021

-

Gaming giant Netmarble’s development unit pulls IPO plan

Netmarble Neo, the development unit of South Korea’s top gaming company Netmarble, has scrapped its plan to go public, on the back of its lackluster performance and underperforming gaming stocks listed on the local market, according to investment banking sources on Friday. The company withdrew its preliminary application for an initial public offering a day earlier, which was submitted to the Korea Exchange in June. Blaming “stagnant market situation” for the thwarted plan,

Nov. 5, 2021

-

Seoul stocks retreat on institutional sell-offs

South Korean stocks retreated on Friday, led by institutional sell-offs. The Korean won fell against the US dollar. The benchmark Korea Composite Stock Price Index (Kospi) lost 13.95 points, or 0.47 percent, to close at 2,969.27 points. Trading volume was moderate at about 676 million shares worth some 12.4 trillion won ($10.5 billion), with losers outnumbering gainers 608 to 269. Institutions sold a net 446 billion won, while retail investors purchased 388 billion won. Foreigners bought a ne

Nov. 5, 2021

-

BGF shares hit price ceiling on takeover of engineering plastic maker Kopla

Convenience store chain operator BGF has confirmed Friday its plan to acquire a stake in engineering plastic resin maker Kopla for at least 180.8 billion won ($152.6 million), in a strategic move to enter into a new business, sending its shares jumping nearly 30 percent at some point. According to filings with the Financial Supervisory Service, BGF is poised to acquire 11 million common shares of Kopla from Kopla President Han Sang-yong and his affiliated parties and through a new rights offer

Nov. 5, 2021

-

Seoul stocks open lower on financial, bio losses

South Korean stocks opened lower Friday, largely amid losses in the financial and bio stocks. The benchmark Korea Composite Stock Price Index (KospiI) fell 10.23 points, or 0.34 percent, to 2,972.99 points in the first 15 minutes of trading. Market bellwether Samsung Electronics increased 0.57 percent to 71,000 won, No. 2 chipmaker SK hynix advanced 1.42 percent to 107,500 won, and Hyundai Motor, the country's largest carmaker, moved up 0.7 percent to 215,500 won. Among losers, pharmaceutical

Nov. 5, 2021

-

Desire for digital interaction defines where finance is headed: KakaoBank CEO

Human desire for constant, convenient and unique interactions in digital spaces defines where the future of finance, as well as KakaoBank, is headed, the CEO of South Korea’s largest online lender said Wednesday. “People say the ‘uncontact’ phenomenon has triggered digitalization of industries under the pandemic, but they still love to contact, they just want to do it in a digital space. And we are going to see how such human desire will reshape the future of industrie

Nov. 4, 2021

-

DP presidential candidate vows to push for MSCI World Index inclusion

The presidential candidate of the ruling Democratic Party of Korea said Thursday that he would push for winning a developed market status for South Korea from Morgan Stanley Capital International to revive the undervalued stock market here, if elected. “The price-earnings ratio in the domestic stock market is about one-third compared to other advanced economies. We must mitigate the so-called ‘Korea discount,’” Lee Jae-myung said during a conference with a group of repo

Nov. 4, 2021

-

Shinhan Financial chief highlights net-zero goals at COP26

Shinhan Financial Group Chairman Cho Yong-byoung vowed to contribute to South Korea’s swift transition into a carbon neutral society with the financial giant‘s net-zero goals at the 2021 United Nations Climate Change Conference in Glasgow, Scotland, the firm said Thursday. The chief of Korea’s second-largest banking group by total assets on late Wednesday introduced Shinhan Financial’s own plans to achieve carbon neutrality in finance dubbed the “zero carbon drive

Nov. 4, 2021

-

BTS agency teams up with Korean crypto exchange to venture into NFT market

Hybe, the K-pop powerhouse behind BTS, said Thursday that it has teamed up with South Korea’s top cryptocurrency exchange operator to establish a joint venture to branch out into the nonfungible token marketplace. The music agency is poised to acquire a 2.48 percent stake in Dunamu for 500 billion won ($423.7 million), as the operator of cryptocurrency exchange Upbit plans to issue 861,004 ordinary shares for third-party rights, offering to invite Hybe as a new shareholder. Dunamu also

Nov. 4, 2021

-

Seoul stocks advance on Fed's comments over tapering

South Korean stocks advanced Thursday, as the US Federal Reserve signaled "patience" in raising interest rates. The Korean won fell against the US dollar. The benchmark Korea Composite Stock Price Index (KOSPI) rose 7.51 points, or 0.25 percent, to close at 2,983.22 points. Trading volume was moderate at about 759 million shares worth some 14.4 trillion won ($12.2 billion), with losers outnumbering gainers 580 to 295. Foreigners bought a net 326 billion won, while retail investors s

Nov. 4, 2021

-

Korean investors commit 90m euros to coinvest with BlackRock's infra fund

South Korean institutional investors have allocated a combined 90 million euros ($104 million) of commitment to a separately structured coinvestment vehicle of a fourth flagship fund by BlackRock Infrastructure Solutions, industry sources said Thursday. Seoul-based investment house IPM Asset Management said Thursday it has created the vehicle for Korean investors, allowing them to implement a coinvestment strategy alongside BlackRock’s fund, dubbed Global Infrastructure Solutions 4. Thr

Nov. 4, 2021

-

Blockchain firm AMAXG enters NFT business

Blockchain company AMAXG said on Thursday it has entered the nonfungible token platform business to trade unique and noninterchangeable data stored on digital ledgers. AMAXG said it recently opened a digital asset NFT transaction platform named BIZA-UVIT, and built strategic partnerships with the Federation of Artistic and Cultural Organizations of Korea (FACO), the Global Medical Aesthetic Exchange Association (GMAEA) and the Korea Blockchain Enterprise Promotion Association. FACO plans to di

Nov. 4, 2021

-

Seoul stocks open steeply higher over Fed's tapering

South Korean stocks opened steeply higher Thursday, following the US Federal Reserve's decision to start to taper its bond purchases. The benchmark Korea Composite Stock Price Index (KOSPI) rose 29.91 points, or 1.01 percent, to 3,005.62 in the first 15 minutes of trading. Overnight, the tech-heavy Nasdaq composite added 1.04 percent and the Dow Jones Industrial Average gained 0.29 percent as the Federal Reserve said it will start to taper its massive asset purchases later this month amid the

Nov. 4, 2021

-

Mirae Asset appoints younger leaders in reshuffle

In a bid to respond more swiftly to changes in the global business environment, South Korean asset managing giant Mirae Asset Financial Group said Wednesday that it has appointed new executives at affiliates as part of a new shake-up. Two chief executive officers -- Choi Chang-hoon and Lee Byeong-seong -- were named as the new chiefs of Mirae Asset Global Investments as part of the firm’s efforts to accelerate innovative growth. “Celebrating the 25th anniversary of the group&rsquo

Nov. 3, 2021

-

Seoul stocks shed over 1% ahead of US Fed meeting

South Korean stocks closed more than 1 percent lower Wednesday as investors seek clues on the timeline for the tapering with the US Federal Reserve meeting this week in focus. The Korean won fell against the US dollar. The benchmark Korea Composite Stock Price Index (KOSPI) lost 37.78 points, or 1.25 percent, to close at 2,975.71 points. Trading volume was moderate at about 649 million shares worth some 12.3 trillion won ($10.4 billion), with losers outnumbering gainers 684 to 187. Foreigners

Nov. 3, 2021

-

Kakao Pay debuts as 14th in market cap

Kakao Pay, the fintech arm of mobile giant Kakao Corp., became Korea’s 14th-largest stock by market capitalization upon its market debut on the country’s stock market Wednesday, after its opening price doubled from its IPO price. The mobile payment service provider, which offered shares at 90,000 won ($76) for its IPO, began trading at 180,000 won on the main Kospi board and rose to 230,000 won before closing at 193,000 won. If the company remains within the top 50 on the Kosp

Nov. 3, 2021

-

Regulators vow deregulation for new growth engines in finance

The chiefs of South Korea’s two main financial regulators -- the policymaking Financial Services Commission and the market watchdog Financial Supervisory Service -- have met with the heads of major insurance companies and banking groups here to discuss policy initiatives to support the growth of market players through deregulation, the two said Wednesday. “The rapid digital transformation of finance and the growth of online platform businesses are rapidly changing the nation’s

Nov. 3, 2021

-

Kakao Pay off to solid start on stock market debut

South Korean mobile payment service Kakao Pay came off to a solid start on its debut Wednesday, trading higher than its initial public offering (IPO) price. The payment arm of Kakao Corp., South Korea's top messenger app, exchanged hands at 185,000 won as of 9:20 a.m., up 2.78 percent from its opening price of 180,000 won. Kakao Pay has set the IPO price at 90,000 won per share, seeking to raise 1.53 trillion won through the IPO. The firm's market capitalization stood at 24.1 won, the 14th la

Nov. 3, 2021

-

Seoul stocks open lower ahead of US Fed meeting results

South Korean stocks opened lower Wednesday ahead of the US Federal Reserve meeting as investors seek a clue from the timeline for the interest rate hike. The benchmark Korea Composite Stock Price Index (Kospi) retreated 11.17 points, or 0.37 percent, to 3,002.32 in the first 15 minutes of trading. The Fed is set to reveal its meeting results Wednesday (New York time). Market bellwether Samsung Electronics lost 0.28 percent to 71,300 won, while No. 2 chipmaker SK hynix advanced 0.47 percent to

Nov. 3, 2021