Most Popular

-

1

Actor Jung Woo-sung admits to being father of model Moon Ga-bi’s child

-

2

Wealthy parents ditch Korean passports to get kids into international school

-

3

Man convicted after binge eating to avoid military service

-

4

First snow to fall in Seoul on Wednesday

-

5

Industry experts predicts tough choices as NewJeans' ultimatum nears

-

6

Final push to forge UN treaty on plastic pollution set to begin in Busan

-

7

Nvidia CEO signals Samsung’s imminent shipment of AI chips

-

8

Korea to hold own memorial for forced labor victims, boycotting Japan’s

-

9

Opposition chief acquitted of instigating perjury

-

10

Job creation lowest on record among under-30s

-

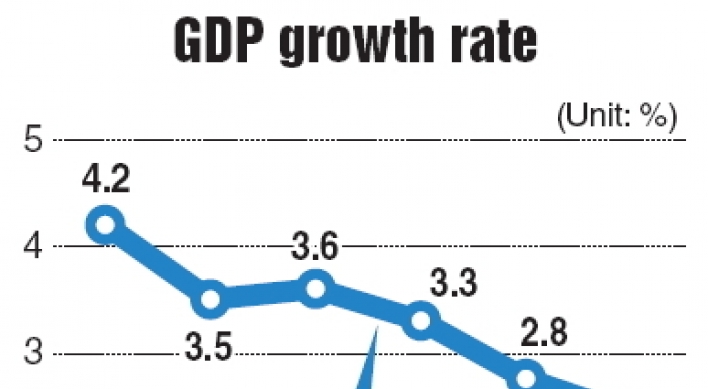

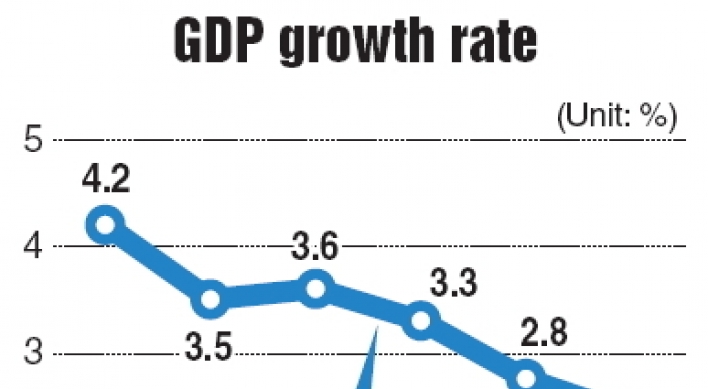

Korea’s GDP growth slows to 0.4% on-quarter

Chances of annual growth below 3% higher, experts sayKorea’s second-quarter growth more than halved from the preceding three months as the eurozone debt crisis dampened exports, raising concerns that the country’s annual growth might fall under 3 percent.The fourth-largest economy in Asia grew 0.4 percent on-quarter in the April-June period, slowing from a 0.9 percent in the first quarter, the Bank of Korea said Thursday.“The growth of consumer spending slowed while facility investment and expor

July 26, 2012

-

Shares gain on institutional buying

Korean stocks closed 0.74 percent higher Thursday as investors hunted for bargains following a recent plunge, analysts said. The local currency rose against the U.S. dollar. The benchmark Korea Composite Stock Price Index climbed 13.16 points to 1,782.47. Trading volume was moderate at 398.9 million shares worth 3.63 trillion won ($3.16 billion), with gainers outpacing losers 502 to 302. “Institutions led by pension funds unleashed bargain hunting, causing the key index to turn around,” said Kwa

July 26, 2012

-

KB Financial expected to take over ING Life Korea

Experts forecast deal will boost financial group’s competenceThe likelihood is increasing that KB Financial, the nation’s largest financial group, will take over ING Life Korea. KB Financial was the sole contender in the bid for the Netherlands-based insurance firm’s Korean arm on July 16, according to industry sources. Insiders see the Korean financial group to be the naturally preferred bidder. ING Life Korea is the fourth-largest life insurance firm in the country by market share, and is wort

July 26, 2012

-

Consumer group prepares class action suit over rate fixing

A Korean consumer advocacy group said Wednesday that it is preparing for a class action suit against banks’ alleged collusion to rig key money-market rates, as suspected rate fixing is presumed to add to households’ debt burden.The Fair Trade Commission, the country’s anti-trust watchdog, last week launched an investigation into major local banks and brokerage houses over their suspected involvement in rigging rates on the 91-day certificate of deposit, or the benchmark for bank lending rates.Th

July 25, 2012

-

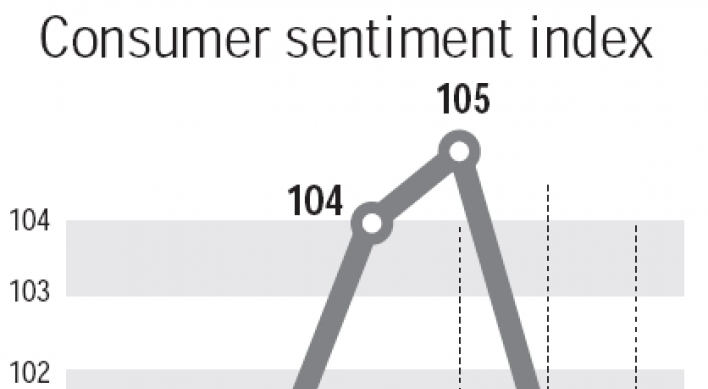

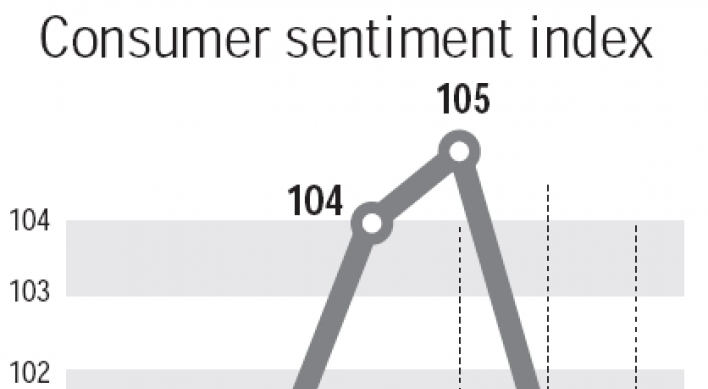

Consumer sentiment hits 5-month low in July

Korean consumers’ confidence fell to a five-month low in July as the economic outlook became bleaker due to the eurozone debt crisis, the central bank said Wednesday.The consumer sentiment index ― a gauge of consumers’ overall economic outlook, living conditions and future spending ― came in at 100 for July, down from 101 tallied in the previous month, according to a survey by the Bank of Korea.The July data marked the lowest level since the index reached an identical 100 in February, the bank s

July 25, 2012

-

KB Financial decides not to bid for Woori

Woori sale hangs in air as strong potential bidder backs outThe sale of Woori Finance Holdings hangs in the air once again as KB Financial Group decided not to make a bid, two days ahead of the deadline for preliminary bidding. Board directors of the nation’s largest financial group concluded in a meeting on Wednesday that they will not take part in the preliminary bidding for Woori Finance.Ten board directors including KB Financial chairman Euh Yoon-dae, KB Kookmin Bank chief executive Min Byon

July 25, 2012

-

BOK sees weakening growth momentum of Korean economy

South Korea’s central bank said Wednesday that the recovery pace of the local economy is weakening as exports are losing steam, hit by the eurozone debt crisis and China’s slowing growth.The Bank of Korea (BOK) delivered a surprise rate cut to 3 percent on July 12, underscoring its urgency to shield the local economy from bitter impacts of the eurozone debt problems. Market players bet on an addit

July 25, 2012

-

Banks under fire for improper profits

Local banks are increasingly under public criticism for their alleged improper profiteering from loan interest rates. A 50-something living in Seoul vented anger, saying that she recently failed to reimburse her loan because the bank informed her anew that there are penalties when paying back in advance. “The bank offered a low interest rate when I first went to get a loan, but the rate got higher later even though I once changed it to a interest rate, seeing the economic situation worsening. Th

July 24, 2012

-

Shares close 0.25 percent higher on bluechip gains

Korean stocks finished 0.25 percent higher Tuesday led by gains in large-cap shares on positive earnings outlooks, analysts said. The local currency rose against the U.S. dollar.After swerving in and out of negative territory, the benchmark Korea Composite Stock Price Index moved up 4.49 points to finish at 1,793.93. Trading volume was moderate at 481.6 million shares worth 4.09 trillion won ($3.57 billion), with decliners far outstripping gainers 538 to 274.“Market heavyweights led the index’s

July 24, 2012

-

Korea faces growing downside risks: ministry

Korea’s economy is recovering at a slow pace in the face of expanding downside risks stemming from eurozone debt problems and uncertain global economic situations, the Finance Ministry said Tuesday.In a report to lawmakers explaining its policy direction during the rest of this year, the ministry also said that it will place its top priority on bolstering the economy and stabilizing the livelihoods of ordinary citizens.“Despite continued improvement in employment and eased inflation, the economi

July 24, 2012

-

More households default on loans

Default rate rises much faster for non-banksThe default rate for household loans from secondary lenders is increasing sharply, raising fears of a household debt crisis.The proportion of borrowers from credit card companies who are at least 30 days behind in payments jumped from 4.5 percent in January last year to 5.6 percent in May this year.Loan default rates for capital services firms rose from 6.1 percent to 8.2 percent, and mutual savings banks from 12.2 percent to 14.9 percent in the same p

July 24, 2012

-

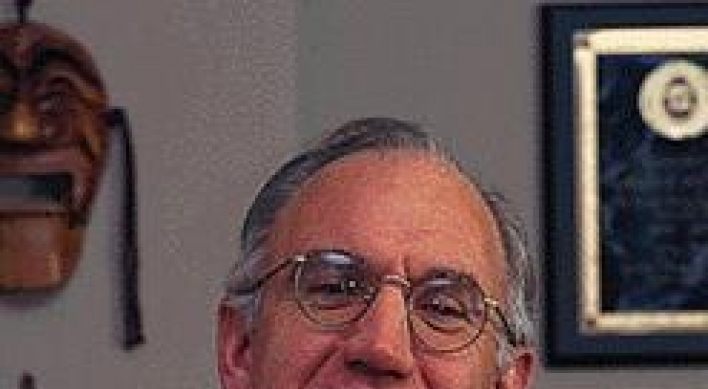

Harold Skipper wins APRIA-Kyobo award

Harold Skipper, an honorary professor of Georgia State University, has received the 2012 APRIA-Kyobo Life Contribution Award.Kyobo Life Insurance Co. and APRIA, or Asia-Pacific Risk and Insurance Association, announced on Tuesday that the scholar became the award’s first recipient. Skipper has contributed majorly to the establishment of APRIA as well as to insurance-related theories and research, having a huge part in globalizing the life insurance sector, Kyobo said.The 2012 APRIA-Kyobo Life Co

July 24, 2012

-

Korea No. 3 in capital flight to tax havens: report

Some $779 billion in financial assets have been moved from Korea to tax havens abroad for tax evasion since the 1970s, according to a report by a U.K. expert.The amount is the third-largest in the world, after China’s $1.19 trillion and Russia’s $798 billion, James Henry said in a report commissioned by the U.K. campaign group Tax Justice Network.The former chief economist at consultancy McKinsey & Company and expert on tax havens has compiled the most detailed estimates yet of the size of the o

July 23, 2012

-

Seoul shares fall on renewed eurozone worries

South Korean stocks closed 1.84 percent lower Monday as Spain’s call for a rescue fund spurred a new wave of fears that the eurozone debt crisis is deepening, analysts said. The local currency fell against the U.S. dollar.The benchmark Korea Composite Stock Price Index plunged 33.48 points to finish at 1,789.45. Trading volume was moderate at 491.3 million shares worth 3.55 trillion won ($ 310.5 million), with decliners far outstripping gainers 676 to 155.“Investors are unnerved by Spain because

July 23, 2012

-

Auditor asks FSS to boost rate oversight

Korea’s national auditor asked the country’s financial regulator to strengthen supervision of banks after finding that they did not pass on central bank interest-rate cuts sufficiently to borrowers.Lenders “unreasonably” charged extra yields, undermining the Bank of Korea’s policy rate cuts since 2008 and burdening companies and households, the Board of Audit and Inspection of Korea said in a statement on its website. The auditor said it advised the Financial Supervisory Service governor to come

July 23, 2012

-

BOK faces probe over cyber censorship

Some lawmakers are set to pound on the Bank of Korea for allegedly tracing the IP addresses of employees who badmouthed executives including Governor Kim Choong-soo on the bank’s internal online message board.The BOK had sought to hunt down staff members who wrote critically of the governor’s remarks during an internal meeting and the exceptional working conditions for Deputy Governor Kim Jun-il, and take legal action against them.The central bank took issue with two more postings that contained

July 23, 2012

-

JPMorgan downplays possibility of rate fixing

HONG KONG (Yonhap News) ― Global investment bank JPMorgan on Monday played down the possibility of South Korean financial firms’ rigging of interest rates on certificates of deposit, saying they may have had limited benefits from it.Korea’s Fair Trade Commission launched last week a probe into Kookmin Bank, the country’s largest lender, and eight other banks as well as 10 major brokerages over alleged CD rate rigging. JPMorgan said in a report that banks and brokers would have a limited benefit

July 23, 2012

-

Insurer loan default rate rises in May

The default rate on loans extended by South Korean insurers moved up in May from a month earlier mainly due to a rise in overdue household and corporate loans, the financial regulator said Sunday.The average ratio of overdue loans came to 0.83 percent of total lending by local life and non-life insurers, up 0.03 percentage points from the end of April, the Financial Supervisory Service said in a report.The May figure, however, marks a 0.22 percentage point dip from a year earlier when the defaul

July 22, 2012

-

Banks in public trust crisis

FSC chief defends financial firms under rate fixing probeLocal banks and brokerages are facing mounting consumer distrust over allegations that they rigged the interest rates of certificates of deposit, which, if true, would have caused households’ borrowing costs to rise.With nearly half of household loans tied to the benchmark CD rate, it is widely perceived that households had to pay higher interests because the CD rate was kept above market rates.The average interest rate for household loans

July 22, 2012

-

Seoul bourse likely to move in tight range

South Korean stocks are likely to be locked in range-bound trading this week as investors step to the sidelines over a lack of momentum, analysts said.The benchmark Korea Composite Stock Price Index rose 0.55 percent from a week earlier to finish at 1,822.93 last week, with the market fluctuating most of the week.The main index slumped 27.05 points to 1,794.91 on Wednesday as investor sentiment soured over U.S. Fed Chairman Ben Bernanke’s bleak economic outlook. But it bounced back to the psycho

July 22, 2012