Most Popular

-

1

Now is no time to add pressure on businesses: top executives

-

2

CJ CheilJedang to spur overseas growth with new Hungary, US plants

-

3

Seoul to host winter festival from Dec. 13

-

4

Nationwide rail disruptions feared as union plans strike from Dec. 5

-

5

Blackpink's solo journeys: Complementary paths, not competition

-

6

N. Korea, Russia court softer image: From animal diplomacy to tourism

-

7

[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg&u=20241121172748)

-

8

Smugglers caught disguising 230 tons of Chinese black beans as diesel exhaust fluid

-

9

Actor Song Joong-ki welcomes second child in Rome

-

10

Korean Air offers special flights for mileage users

-

KB to offer integrated wealth management service

Korea’s major lender Kookmin Bank said it will team up with KB Securities to offer integrated wealth management services from February.KB Financial Group has set up a new advisory group for wealth management service by pulling experts from investment products and service divisions under the bank and the brokerage, respectively, the bank said. Kookmin Bank's head office in Yeouido, Seoul (Kookmin Bank)The advisory group consists of 24 experts including an investment strategist, a portfolio diver

Jan. 31, 2017

-

Profits at brokerages decline in 2016: data

Profits at South Korea’s major securities firms have declined in 2016 mainly due to weaker stock transactions and losses from derivatives and bond investments amid rising bond yields, industry data showed Tuesday.According to regulatory filings on the Financial Supervisory Service, Samsung Securities’ net profit declined 36.6 percent on-year to 174.4 billion won and operating profit plunged 43.8 percent to 211.7 billion won in 2016. (123rf)HMC Investment & securities also saw its net profit fall

Jan. 31, 2017

-

Demand deposits keep rising amid uncertainties

Demand deposits at South Korea's five major commercial banks have exceeded 300 trillion won ($257 billion), as a growing number of people are waiting for investment opportunities, data showed Tuesday.Demand deposits at Shinhan, KB Kookmin, Woori, KEB Hana and NH banks totaled 327.3 trillion won at the end of last year, an increase of 41.7 trillion won from a year earlier. This undated file photo is of a pile of bank notes. (Yonhap)KB Kookmin posted the largest growth of 11 trillion won, followed

Jan. 31, 2017

-

Banks' loan delinquency rate dips on seasonal effect

The delinquency rate of domestic banks' won-denominated loans dropped again last month, as they stepped up efforts to reduce bad loans, officials said Tuesday.They were also recovering from the impact of the restructuring of the nation's shipping and shipbuilding industries. (Yonhap)The delinquency rate for bank loans fell 0.17 percentage point on-month to 0.47 in December, according to the Financial Supervisory Service, the country's financial watchdog.It represents a decrease for two months in

Jan. 31, 2017

-

Online sales of insurance products surge in 2016

The sales of non-life insurance products via the Internet soared last year, as local insurance firms rushed to roll out cheap and online-only products to woo customers, data showed Monday.According to the General Insurance Association of Korea, local non-life insurance companies raised a total of 1.4 trillion won ($1.19 billion) in premiums by selling products through the Internet last year, up 34.3 percent from a year earlier. (Yonhap)The growth rate is far higher than the 1.3 percent on-year r

Jan. 30, 2017

-

Scandal-hit pension fund loses managers ahead of relocation

South Korea’s pension behemoth is suffering an exodus of fund managers ahead of its planned relocation from Seoul to Jeonju, North Jeolla Province, in late February, according to news reports.The managers’ leaving the National Pension Service coincides with the ongoing political scandal that led the special prosecutor to indict NPS CEO Moon Hyung-pyo on Jan. 16 on charges of abusing power and giving false testimony. He acknowledged having pressured the world’s third-largest pension fund to give

Jan. 30, 2017

-

Profits at Korean financials estimated to have surged in 2016: data

Korea’s major financial groups are likely to witness their 2016 annual profits rise from a year earlier, on profits from increased lending and reduced costs in risk management, industry data showed Monday.According to data by financial information provider FnGuide, combined annual net profits at Shinhan Financial Group, KB Financial Group, Hana Financial Group and Woori Bank are estimated to have hit 7.37 trillion won ($6.27 billion) in 2016, up 1.33 trillion won from 6.39 trillion won in 2015.T

Jan. 30, 2017

-

Bond funds suffer massive cash outflow amid rate hike concerns

Funds that invest in domestic bonds suffered massive cash outflows in January as investors pulled part of their money out of the funds amid concerns over the accelerating pace of rate hikes, industry data showed Monday.According to the data compiled by industry tracker FNGuide, domestic funds have logged an outflow of 879 billion won ($752 million) as of Wednesday, and saw a cash outflow of 3.33 trillion won in the past three months as concerns over rate hikes in the United States emerged. (Yonh

Jan. 30, 2017

-

Household loans by major banks top W500tr in 2016

The outstanding household loans extended by the country's top five commercial lenders topped the 500 trillion-won ($428 billion) mark last year, as more people took out loans to buy homes and finance their costs for education and other things, industry data showed Monday.According to the data, the outstanding loans extended to households by the country's top five lenders -- Shinhan, Kookmin, Woori, Hana-KEB and Nonghyup -- reached a record high of 500.92 trillion won at the end of last year, up

Jan. 30, 2017

-

Woori Bank privatization to be completed this week

The privatization of Woori Bank, South Korea's No. 2 lender by assets, is expected to be completed this week after the state deposit insurer receives a final payment for its sale of a major stake. The Korea Deposit Insurance Corp. signed a 2.4 trillion-won ($2.06 billion) deal with seven institutional investors on the sale of its 29.7 percent stake in Woori Bank. This photo, taken on Nov. 13, 2016, shows people passing by the headquarters of Woori Bank in Seoul. (Yonhap)The deal calls for IMM P

Jan. 30, 2017

-

Top 10 biz groups take up more than half of stock market cap

South Korea's top 10 conglomerates by assets take up over half of the country's stock market capitalization, data showed Monday, pointing to their huge clout in Asia's fourth-largest economy.According to the data by corporate tracker Chaebul.com, listed subsidiaries of the 10 largest family-controlled business groups, known as chaebol here, had a combined market capitalization of 793.9 trillion won ($680 billion) as of Wednesday, or 51.6 percent of the value of all shares traded on the main bour

Jan. 30, 2017

-

Korean stock market's return rate far below those of foreign rivals

South Korea's stock market has risen 11 percent in the past five years, far lower than other global markets' yield rates, as the local stock market has been locked in a tight range, data showed Monday.According to the data compiled by the Korea Exchange, the country's benchmark index, the KOSPI, closed at 2,026.46 points on the last trading day of 2016, up from 1,825.74 points five years ago. (Yonhap)Japan's Nikkei 225 index came at the top of the performance list by surging to 19,114.37 points

Jan. 30, 2017

-

Woori Bank renews current CEO’s term

Recently privatized Woori Bank said its outside directors decided Wednesday to renew the term of its current CEO Lee Kwang-goo, who led the bank’s long-awaited privatization along with strong earnings last year.He beat two other candidates -- Lee Dong-gun, an executive vice president and head of the bank’s business support group, and Kim Seung-gyu, a former vice president of the bank’s management support unit -- after a series of interviews by the outside directors. Woori Bank CEO Lee Kwang-goo

Jan. 25, 2017

-

Korea's stock funds suffer W1t of outflows in 3 weeks

South Korea's stock funds have suffered massive redemptions in the first three weeks of this year apparently on profit-taking, data showed Wednesday, as no further momentum is expected in the equity market dogged by uncertainties.Domestic stock funds, excluding exchange traded funds, posted 1.03 trillion won ($850 million) of net outflow this year as of Monday, according to fund information provider KG Zeroin. An image of stock funds. (Yonhap)It came after a total of net 7.9 trillion won outflow

Jan. 25, 2017

-

Korean companies stay with same accounting firm too long, undermining transparency

South Korean companies tend to work with the same accounting firm for a long period of time, an analysis showed Wednesday, a practice partly blamed for corroborated cover-ups of financial troubles that later blow up in damaging losses for lenders and investors.The analysis by corporate watcher CEO Score of 483 companies said that as of end of 2015, the firms on average stayed with the same accountant for 6.8 years. The trend compares to Japan where, by law, a contract with an accounting firm is

Jan. 25, 2017

-

Unfair equity trading grows 37% in 2016

The number of unfair trading cases in South Korea's equity market reported to the nation's financial watchdog increased more than 37 percent on-year in 2016, as it tightened monitoring and supervision, data showed Wednesday.The Financial Supervisory Service said it caught a total of 208 suspected unfair trade practices, such as insider trading, stock manipulation and fraud, during the year, up 37.7 percent from a year earlier. An image of the Financial Supervisory Service provided by Yonhap News

Jan. 25, 2017

-

Conglomerates' cash holdings jump

South Korea's leading conglomerates are estimated to have increased their cash holdings last year, raising hopes for ample dividends, investment officials said Wednesday with supportive data.Samsung Electronics, the head of the pack, on Tuesday announced last year's operating profit at 29.2 trillion won ($25 billion), the fifth consecutive year of a sum nearing 30 trillion won. Cash and cashable assets totaled 88.2 trillion won, a record for the IT giant after increasing by close to 17 trillion

Jan. 25, 2017

-

Hana Financial's net jumps 47.9% on-year in 2016

Hana Financial Group Inc., a major South Korean banking group, said Tuesday its net profit surged 47.9 percent in 2016 from a year earlier on synergy effects.Net profit came to 1.345 trillion won ($1.15 billion) in 2016 on a consolidated basis, compared with 909.7 billion won a year ago, the group said in a regulatory filing. (Yonhap)The earnings were Hana's strongest annual results since 2012.Interest income came to 4.642 trillion won in 2016, up 2.3 percent from a year earlier.The group's net

Jan. 24, 2017

-

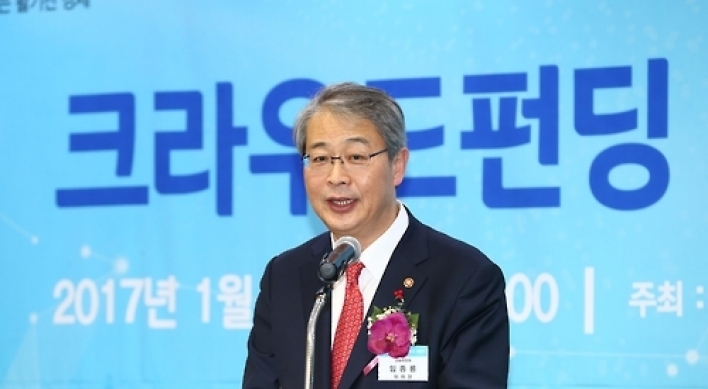

Korea's crowdfunding is half success

Crowdfunding in South Korea has been half successful over the first year, data showed Tuesday, as the authorities pledged more efforts to promote the system.A total of 18 billion won ($15.4 million) has been raised so far from 7,172 investors to fund 121 projects, according to the Financial Services Commission. Yim Jong-yong, chairman of the Financial Services Commission, delivers a speech at a ceremony to mark the first anniversary of the introduction of the crowdfunding system in Seoul on Jan.

Jan. 24, 2017

-

Launch of internet-only K-Bank postponed till late Feb

South Korea’s internet-only banking service provider K-Bank has decided to delay its launch to late February from the initial plan of late January to ensure business stability and consumer protection, industry officials said Tuesday.The bank received the license from the Financial Services Commission for banking services on Dec. 14, bring it a step closer to becoming the nation’s first bank to offer financial services 24 hours without brick-and-mortar branches and bank tellers. It was also the f

Jan. 24, 2017

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg&u=20241121172748)