Water crisis escalates: Mintel research reveals rapid increase in consumer concern over water shortages globally

By PRNEWSWIREPublished : June 15, 2023 - 15:10

- 49% of consumers in the Asia-Pacific* region now believe their country is suffering from climate change, with Indonesians feeling they are suffering the most (60%).

- Eco-activism resonates more among consumers in the region with 58% saying that eco-activists have raised their awareness of environmental issues compared to 46% of the global average.

- Plastic pollution falls out of the top three environmental concerns among global consumers.

SINGAPORE, June 15, 2023 /PRNewswire/ -- Water shortages are the fastest-growing global environmental consumer concern, according to new research from Mintel's annual Global Outlook on Sustainability*.

The number of consumers globally who rank water shortages in their top three environmental concerns has risen from 31% in 2022 to 35% in 2023, representing a 13% increase and a faster rise in concern than any other environmental issue in the last year. In 2021, less than three in ten (27%) consumers globally worried about water shortages.

Escalating fears have resulted in water shortages pushing plastic pollution out of the top three environmental concerns, with concern around plastic pollution (eg ocean plastic) falling from 36% in 2021 to 32% in 2023.

Within the the Asia-Pacific (APAC) region, China (37%), South Korea (34%), and Indonesia (32%), expressed the highest levels of concern over water scarcity. Meanwhile, concerns over food shortage due to drought or crop failure are most significant in Japan and Australia (28% respectively) – higher than the global average of 25%.

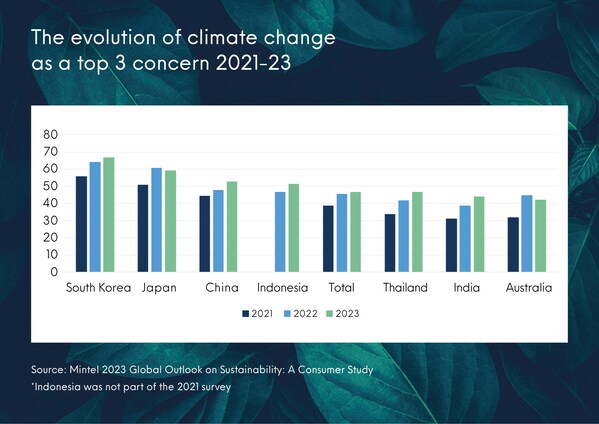

Despite the escalating concern over water scarcity, climate change remains the top global environmental concern. Thailand ties in with the global average at 47% in 2023, while India saw the highest increase in the region, soaring from 31% in 2021 to 44% in 2023.

Over half of consumers worldwide (51%) now believe their country is facing the effects of climate change, up from 44% in 2021. Indonesians feel they are suffering the most (60%), while Japan saw a decline from 44% in 2022 to 40% in 2023.

Richard Cope, Senior Trends Consultant, Mintel Consulting, said:

"Consumers' growing prioritisation of water shortages as a top three environmental concern reflects how water stress has become a reality worldwide. The ascent of water shortages from fifth to third place in global consumers' list of environmental priorities is symptomatic of a population directly impacted by—as opposed to increasingly informed about—climate change. This marks a new era where environmental concerns become pressing issues of self-preservation, such as water and food shortages and a desire to conserve resources for future resilience. While plastic pollution remains a prominent concern it is sliding down consumers' agendas as they increasingly focus on their personal supply shortages and are educated to realise that other issues might be generating more emissions."

Eco-activism resonates among consumers in the region

Frequently a topic of controversy, Mintel research also explores the impact of eco-activism, with 46% of global consumers** acknowledging that eco-activists have heightened their environmental awareness. The impact climate activism has on awareness varies significantly across the regions, with the highest impact reported in Indonesia (80%), Thailand (74%), and India (69%). And while many consumers are paying attention to activists, nearly half (48%) of Australians say eco-activists who create disruption (eg by stopping traffic) should be penalised by the government.

"It's clear that eco-activists are having an impact, and are even seen as legitimate protestors, in many markets. In fact, our research shows that eco-activists are welcomed as educators in many markets, especially in the Asia-Pacific and Latin American markets. Activists are also becoming instrumental in holding brands to account for greenwashing. As activists educate the world on energy, sourcing and distribution emissions, consumers will increasingly adopt a more informed, considered and holistic view of these impacts," adds Cope.

Consumers distrust carbon offsetting as a solution

Meanwhile, a disconnect between consumers' and companies' environmental goals is emerging. Almost two-thirds (65%) of APAC consumers would favour companies reducing their own carbon emissions rather than relying on Carbon Offsetting programmes outside of their own area of business. Additionally, a considerable proportion of consumers in Australia and South Korea (41% and 37% respectively) distrust companies' honesty about their environmental impact.

When asked what would encourage them to consider buying more responsible products, 41% of global consumers say they look for a score of how environmentally impactful the product is (eg colour coded, 1-5 score), highlighting the convenience of a Nutriscore-style colour-coded impact labelling system.

"Our research shows that, on a global scale, consumers don't want brands to engage in carbon offsetting. Projects preventing deforestation form the basis of most carbon credit programmes used by corporations to assert the carbon neutrality of their businesses or products, but in the wake of media coverage around the challenges in validating these schemes, it's understandable that the public is challenging companies to become more involved and invested in reducing their emissions directly.

"Based on the success of the food industry's nutrition traffic light system, consumers want brands to use a similar system that makes it easy to understand the environmental impact of the products they're thinking of buying and helps them make more sustainable choices," said Cope.

Consumers want governments to provide more incentives

Four in 10 (44%) APAC consumers agree that the country where they live offers sufficient financial incentives to install new energy innovations in their home (eg subsidies to install heat pumps, insulation or solar panels) compared to 34% of the global average. A similar proportion of consumers in the region (46%) believe their country provides adequate financial incentives to lease/buy an electric vehicle (eg subsidies for vehicle purchase/loan costs, installing a charger at my home), with China and India leading at 61% respectively – significantly outperforming all other markets covered in Mintel's research.

"Whilst many consumers may support state regulation and dissuasion, they are largely united in feeling that governments are not doing enough to incentivise green behaviours, specifically concerning transitioning towards cleaner energy and transport," concludes Cope.

Notes:

*which tracks the environmental and social priorities, purchasing behaviours, engagement, and level of understanding of sustainability topics among consumers across 16 countries globally. In APAC, this includes Australia, China, India, Indonesia, Japan, South Korea and Thailand.

**excluding China

Mintel's 2023 'Global Outlook on Sustainability: A Consumer Study' tracks the environmental and social priorities, purchasing behaviours, engagement and level of understanding of sustainability topics among consumers from 16 countries. Learn more about the research findings and how Mintel is helping businesses lead effective change here. Additional research and interviews with Richard Cope are available upon request from the Mintel Press Office.

![[Weekender] Korea's traditional sauce culture gains global recognition](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050153_0.jpg&u=20241123224317)

![[More than APT] Residents, architects together design homes](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/11/24/20241124050036_0.jpg&u=)