SK Innovation will split off its battery and oil businesses as wholly owned subsidiaries to further propel their growth, the company announced Wednesday. The new entities, tentatively named SK Battery and SK E&P, will officially launch on Oct. 1, following the approval of general shareholders at a meeting slated for next month.

The announcement came as the firm reported a return to the black in the second quarter, with a net profit of 415.9 billion won ($362.2 million) and an operating profit of 506.5 billion won.

According to the SK Group company, the envisioned SK Battery will focus on midsized and large electric vehicle batteries, battery rental service, battery metal recycling and energy storage systems businesses, the company said in a press release.

The other unit, SK E&P, will concentrate on carbon capture and storage business on top of its current oil exploration and production business, while SK Innovation will serve as their holding firm.

The carved-out battery unit is to go public.

SK Innovation President and CEO Kim Jun said earlier this month the firm was considering an initial public offering of SK Battery on Nasdaq in the US, or both on Nasdaq and Korea’s main bourse Kospi.

“The timeline of the initial public offering of SK Battery and how many shares will be offered are undecided,” a company official said.

“It hasn’t been decided whether Jee Dong-seob, the current chief of SK Innovation’s battery business, will lead SK Battery,” the official added.

The spinoff of SK Battery draws a parallel with that of LG Energy Solution from LG Chem in December.

LG Chem plans to offer 20-30 percent of LG Energy Solution shares in an IPO, which LG Chem Vice Chairman Shin Hak-cheol said could happen as early as this year. With the offering, the firm seeks to raise capital needed to bankroll its aggressive expansion plans. LG Energy Solution is valued at roughly 100 trillion won.

During a conference call on second quarter results, SK Innovation officials explained that the time is ripe for the split-off, as SK battery is ready to stand alone without financial support from its parent company.

“SK Battery is expected to reach a breakeven point next year with an annual revenue projected at approximately 6.5 trillion won. Also, SK Battery is projected to register a mid-single-digit operating margin starting 2023 and a high single-digit figure starting 2025,” the company said during the conference call.

The official added that SK Battery’s order backlog stands at 1,000 gigawatt-hours, which is worth 130 trillion won. To meet the demand, SK Battery plans to increase its annual production capacity to 85 GWh in 2023, 200 GWh in 200 and 500 GWh in 2030. This ambitious expansion plan requires 2 trillion to 3 trillion won a year, and taking SK Battery public and selling its shares would provide sufficient capital.

Asked on the progress of Blue Oval SK, a joint venture between Ford and SK Innovation established in May, SK Innovation said that both firms are striking details such as whether to build and how to operate a 60-GWh battery plant, which is set for commercial operation starting in 2025.

“Ford needs 240 gigawatts of batteries every year. This means that there is an opportunity to seek further partnerships for potentially 180 GWh in addition to the 60 GWh,” the company said.

Also, SK Innovation said that it will incubate a battery metal recycling business as the new growth engine, with plans to retrieve nickel, cobalt and manganese from defective batteries generated from its production lines and spent electric vehicle batteries, which will materialize en masse starting 2025.

In particular, SK Innovation will establish a 60,000-ton plant by 2025 to produce high-purity lithium by recycling those dead batteries.

Though overshadowed by the split-off of SK Battery, SK Innovation propelled stellar results in the second quarter, enjoying 11.1 trillion won in revenue and 506.5 billion won in operating profit, buoyed by record sales in the lubricants business.

“In the first six months this year, SK Innovation logged 20.3 trillion won in revenue and 1 trillion won in operating profit, bouncing back from revenue of 18.1 trillion won and operating loss of 2.2 trillion won on-year. This is the first time for SK Innovation to breach the 1 trillion-won mark in operating profit in three years,” the company said.

SK Lubricants, after breaking away from SK Innovation in 2009, witnessed a record quarterly operating profit of 226.5 billion won.

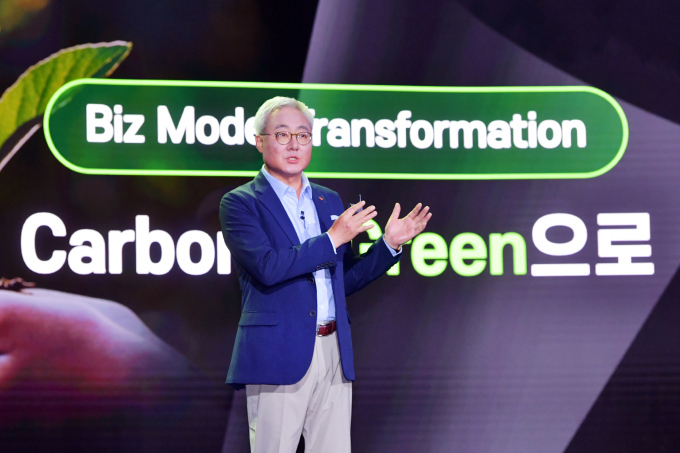

“SK innovation will accelerate its carbon-to-green growth at full throttle,” said Kim Jong-hoon, SK Innovation‘s board chairman.

![[AtoZ into Korean mind] Humor in Korea: Navigating the line between what's funny and not](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/22/20240422050642_0.jpg&u=)

![[Herald Interview] Why Toss invited hackers to penetrate its system](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/22/20240422050569_0.jpg&u=20240422150649)

![[Exclusive] Korean military set to ban iPhones over 'security' concerns](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/23/20240423050599_0.jpg&u=20240423183955)

![[Graphic News] 77% of young Koreans still financially dependent](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/22/20240422050762_0.gif&u=)

![[Exclusive] Korean military to ban iPhones over security issues](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/23/20240423050599_0.jpg&u=20240423183955)

![[Today’s K-pop] Ateez confirms US tour details](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/23/20240423050700_0.jpg&u=)