Articles by Son Ji-hyoung

Son Ji-hyoung

consnow@heraldcorp.com-

BNP Paribas to exit from asset management joint venture with Shinhan

France-based BNP Paribas Asset Management Holding is set to divest its entire stake in its South Korean joint venture with Shinhan Financial Group, the Korean banking group said Friday. Shinhan BNP Paribas, a 65:35 joint venture of Korea‘s second-largest banking group by total assets and the French counterpart, will become a fully owned subsidiary of Shinhan, as the former has decided to buy out the 35 percent stake from its partner. The two companies inked an agreement on Dec. 30, 202

Market Jan. 15, 2021

-

Virus, scandals slow Korean private fund growth

The coronavirus pandemic and a series of hedge fund turmoils last year have impeded the growth of private funds managed by asset management companies in South Korea, data showed Thursday. According to data by the Korea Financial Investment Association, the combined assets managed by Korea-domiciled private funds grew 5.7 percent to 438.7 trillion won ($398.4 billion) in 2020, far lower than their 2019 growth which stood at 23.5 percent. Between 2014 and 2019, the funds grew 18.8 percent annual

Market Jan. 14, 2021

-

NPS vows to beef up overseas investment through reshuffle

South Korea‘s public pension scheme, the National Pension Service, pledged Wednesday to add resilience to its capital deployment to overseas assets through a structural reorganization. Through the reshuffle, the NPS Investment Management will split its global public market division in two -- with one part dedicated to investing in foreign stocks and another in foreign fixed-income products. The move will allow the NPSIM to increase the in-house investment of foreign listed stocks and its

Market Jan. 13, 2021

-

Demographic shifts urge Korean insurers to adapt: Moody’s

The looming demographic shifts in South Korea are forcing domestic insurers to turn to new growth drivers, as the companies are likely to face flagging sales of their mainstream products and underwriting risks of their new products that lead to inadequate pricing, a report showed Wednesday. The report by Moody’s Investors Service cited Korea‘s fast aging population as a key attribute, adding that the working-age population is being met with a heavy financial burden to support the c

Economy Jan. 13, 2021

-

Kospi touches 3,000 points with retail investors’ buying binge

South Korean retail investors, who have been on a buying spree in recent months, brought benchmark indexes to fresh highs during intraday trading Wednesday. The Kospi touched 3,000 points for the first time in the market’s 38-year history in the early morning session, stretching to as high as 3,027.16 points. But the Kospi pulled back to close at 2,968.21 points, down 22.36 points, or 0.8 percent, shy of the previous session‘s close. The Kospi had maintained a record run for six c

Market Jan. 6, 2021

-

NPS to oppose Korean Air’s capital increase scheme

South Korea’s public pension fund the National Pension Service said Tuesday it would vote against Korean Air’s plan to issue new common shares, which is deemed pivotal to the planned takeover of debt-ridden rival Asiana Airlines. NPS, which was holding a 6.96 percent stake in Korean Air as of September, said in a statement the flag carrier’s move to issue new shares is detrimental to its shareholder value. The red flags range from Korean Air‘s hasty decision to acquire

Market Jan. 5, 2021

-

Stocks extend record rally for 6 trading days

South Korea’s stock market rallied Tuesday as investor appetite for equities in one of the world’s fastest-growing bourses continued to gain momentum. The Korea Exchange’s main board Kospi jumped 1.6 percent to end at 2,990.57 points Tuesday. While off to a muted start in the morning, the index shot up approximately 30 minutes before the market close. The 916 constituents’ combined market cap approached 2,060 trillion won ($1.9 trillion). The Kospi, as a result,

Market Jan. 5, 2021

-

Stock rally nears turning point as Kospi market cap tops W2,000tr

Stock analysts began to look for signs that the current bull market will end its run, as stocks in South Korea got started the year strongly on Monday, setting yet another all-time high on the first trading day of 2021. The Korea Exchange’s main board, the Kospi, closed at 2,944.45 points on Monday, up 2.5 percent from the previous close. The combined market capitalization of the Kospi’s 916 constituents, including electronics giant Samsung Electronics, exceeded 2,028.3 trillion wo

Market Jan. 4, 2021

-

[Market Close-up] Korean market gains momentum from individual investors

Cho Young-hoon, a 40-year-old office worker living in Seoul, had no interest in capital investment, before the pandemic hit last year. Following in his parents’ footsteps, he strongly believed in real estate investment, and considered buying stocks to be too risky and not as profitable as owning an apartment in Seoul. Buying an apartment using his savings, jeonse deposit and a mortgage loan was his strategy for over a decade. But then, in December 2019, the government made an unprecedent

Market Jan. 3, 2021

![[Market Close-up] Korean market gains momentum from individual investors](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2021/01/03/20210103000126_0.jpg&u=20210103160932)

-

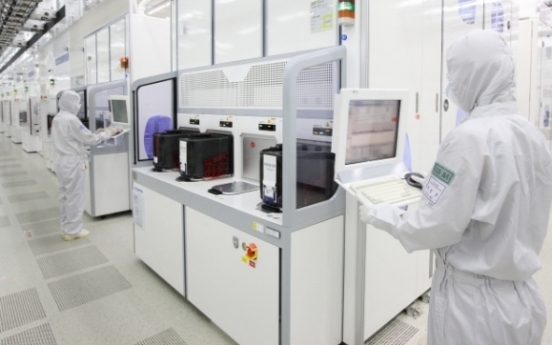

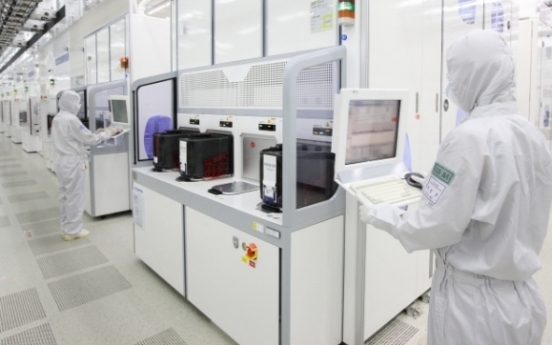

Samsung Electronics’ record run continues over optimism for foundry biz

The share price of Samsung Electronics on South Korea’s stock market has reached an unprecedented high yet again, surpassing 80,000 won ($73) during intraday trading Monday. Hitting 80,100 won per share in the early morning trade, Samsung Electronics rose 1.2 percent to close at 78,700 won -- the highest closing price since a 50-to-1 stock split in 2018 -- bringing its market cap to a new high of 469.8 trillion won. This accounted for over 24 percent of all 906 constituents of the Kospi,

Market Dec. 28, 2020

-

Kospi crosses 2,800 mark on chip rally

South Korea‘s stock market hit a new all-time high Thursday as the Korea Exchange’s main board Kospi crossed the 2,800 mark on massive institutional buying of chip shares. The Kospi rose 1.7 percent to 2,806.86 on Thursday, pushing its total market cap to reach 1,936.5 trillion won ($1.8 trillion). Kospi crossing the 2,800 mark came three weeks after it passed the previous threshold of 2,700 on Dec. 4, which was then a fresh high. Institutions net purchased 628.2 billion won worth

Market Dec. 24, 2020

-

Shinhan Life OKs merger with ex-ING's Korean arm

Shinhan Financial Group has approved a merger of its two wholly-owned life insurer subsidiaries -- Shinhan Life Insurance and Orange Life Insurance -- into a single entity next year, filings showed Thursday. As a result of the move, Orange Life, formerly the Korean arm of Amsterdam-based ING Group, will be merged into Shinhan Life. The two firms’ combined valuation exceeded 4 trillion won ($3.6 billion), according to the filings. Orange Life‘s 82 million shares will be converted i

Market Dec. 24, 2020

-

Korea to launch 1st tranche of New Deal policy fund by March

The South Korean government is poised to launch the first batch of its 20 trillion-won ($18 billion) government policy fund aimed at supporting Korean New Deal projects by March, the Finance Minister said Wednesday. With the first batch to start in March, the government is looking to raise 4 trillion-won commitments in the first year of the five-year scheme, Finance Minister Hong Nam-ki, who doubles as deputy prime minister, said in a pangovernmental meeting held at Seoul Government Complex.

Market Dec. 23, 2020

-

[News Analysis] SsangYong Motor halts trading as bankruptcy court grants breather

Stocks of SsangYong Motor halted trading starting Tuesday as the cash-strapped automaker is now under bankruptcy court supervision and has effectively been given a three-month grace period before it enters court receivership. Eyes are on whether SsangYong Motor to avoid the court-led rehabilitation proceedings by soliciting a new investor in that time. On Monday, SsangYong Motor said it had applied for an autonomous restructuring support program, when filing for bankruptcy to Seoul Bankruptcy

Market Dec. 22, 2020

![[News Analysis] SsangYong Motor halts trading as bankruptcy court grants breather](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/12/22/20201222000701_0.jpg&u=20201222175401)

-

Mirae Asset subsidiary lists 1st ETFs on London Stock Exchange

Mirae Asset Global Investments said Monday that its US exchange-traded funds provider subsidiary Global X has launched two products to be traded on the London Stock Exchange starting Friday. The thematic ETFs -- Global X Telemedicine & Digital Health UCITS ETF and Global X Video Games & Esports UCITS ETF -- mark the first ETFs of a Korean-owned company to be listed on a European exchange. According to data from market researcher ETFGI, the total size of listed ETFs and exchange-traded

Market Dec. 21, 2020

Most Popular

-

1

Industry experts predicts tough choices as NewJeans' ultimatum nears

-

2

Jung's paternity reveal exposes where Korea stands on extramarital babies

-

3

Samsung entangled in legal risks amid calls for drastic reform

-

4

Heavy snow alerts issued in greater Seoul area, Gangwon Province; over 20 cm of snow seen in Seoul

-

5

[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg&u=20241126161719)

-

6

Agency says Jung Woo-sung unsure on awards attendance after lovechild revelations

-

7

[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance

![[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050072_0.jpg&u=)

-

8

[Health and care] Getting cancer young: Why cancer isn’t just an older person’s battle

![[Health and care] Getting cancer young: Why cancer isn’t just an older person’s battle](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050043_0.jpg&u=20241126145342)

-

9

Prosecutors seek 5-year prison term for Samsung chief in merger retrial

-

10

UN talks on plastic pollution treaty begin with grim outlook

![[Market Close-up] Korean market gains momentum from individual investors](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2021/01/03/20210103000126_0.jpg&u=20210103160932)

![[News Analysis] SsangYong Motor halts trading as bankruptcy court grants breather](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/12/22/20201222000701_0.jpg&u=20201222175401)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg&u=20241126161719)

![[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050072_0.jpg&u=)

![[Health and care] Getting cancer young: Why cancer isn’t just an older person’s battle](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050043_0.jpg&u=20241126145342)