Articles by Son Ji-hyoung

Son Ji-hyoung

consnow@heraldcorp.com-

Moon’s shareholder engagement push to empower pension funds

South Korean President Moon Jae-in on Tuesday called for the swift revision of laws to allow institutional investors to ramp up shareholder engagement in the domestic market. This, he stressed, would prevent abuses of power in the business world. In his New Year’s speech, Moon urged the government to amend the Capital Markets Act and the Commercial Act, saying the proposed changes were critical to ensure fairness in the domestic market.“Fairness is the backbone of innovation and incl

Market Jan. 7, 2020

-

Major banks up ante for W2tr Prudential Life bid

Major banking groups in South Korea are revealing their appetite for what could become the largest acquisition deal in the nation’s financial industry this year: a 100 percent stake in Prudential Life Insurance of Korea valued at some 2 trillion won ($1.7 billion).The latest to express an interest was Woori Financial Group Chairman Sohn Tae-seung on Friday. He told reporters at a New Year gathering event of financial circles in Korea that he is “willing to do an M&A” of Pru

Market Jan. 5, 2020

-

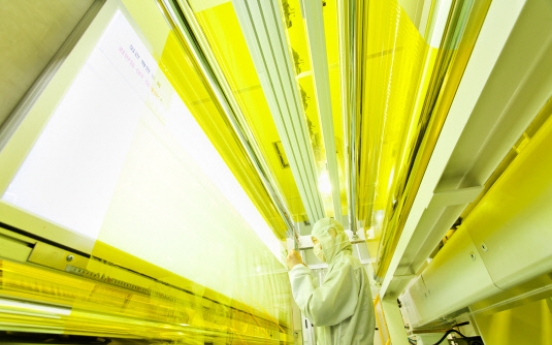

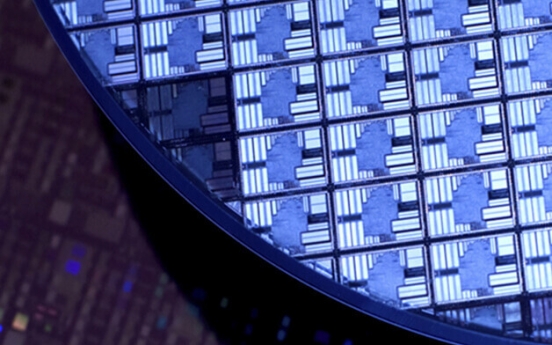

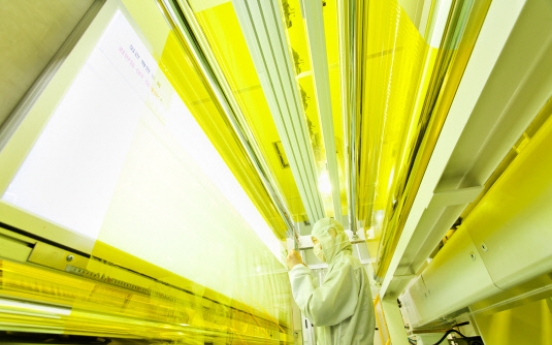

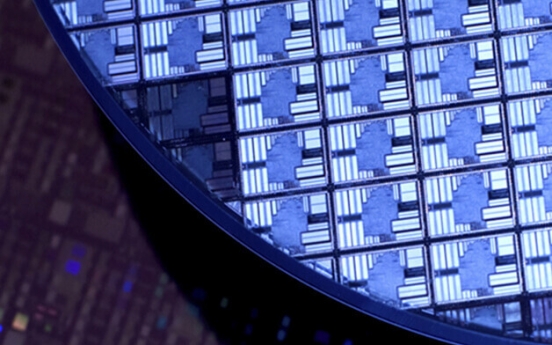

Wonik QnC embraces Momentive’s quartz operation for $266m

South Korea’s fabricated quartz maker Wonik QnC said Friday it had completed an acquisition of quartz and ceramics business units owned by New York-based company Momentive Performance Materials for $266 million, in a bid to achieve a vertical integration of its supply chain.Wonik QnC based in Gumi, North Gyeongsang Province, makes components for semiconductors, displays and other products using quartz. The cross-border deal will allow the company to wholly own the world’s leading fus

Market Jan. 3, 2020

-

Time is ticking for KDB to sell life insurance arm

Shareholders of Seoul-based KDB Life Insurance are under intensifying pressure to find a new owner, potentially facing a host of new complex regulations next month when a 10-year grace period expires. State-run policy lender Korea Development Bank has yet to find a preferred bidder for the life insurance unit, although Chairman Lee Dong-gull anticipated finding one through an open tender by end-2019.The uncertainty casts doubt on the bank’s sell-off by February, which would otherwise resu

Market Jan. 2, 2020

-

Sungdong Shipbuilding averts liquidation with W200b deal

A consortium led by HSG Heavy Industries signed a contract Tuesday to buy debt-saddled South Korean shipbuilder Sungdong Shipbuilding & Marine Engineering for 200 billion won ($173 million), allowing the shipbuilder to avert liquidation of its assets.So far the consortium has paid 10 percent of the total, with the balance due by February.This came a month after the consortium, composed of HSG Heavy and private equity firm Curious Partners, was chosen as the preferred bidder for the Tongyeong

Market Dec. 31, 2019

-

M&As to keep Korean industries going in 2020

South Korea was brimming with billiondollar mergers and acquisitions in 2019, mainly propelled by large business groups in search of new growth opportunities, along with the divestment of their noncore business units.Throughout 2019, Korean entities announced a record-high volume of M&A transactions worth a combined 37.7 trillion won ($32.6 billion), according to Maeil Business Newspaper’s capital market tracker Radar M.Experts say this uptrend will continue and will eventually fuel an

Market Dec. 31, 2019

-

W4.1tr Korean hedge fund Lime Asset faces fraud accusations

The Financial Supervisory Service, South Korea’s financial watchdog, intends to take legal action against Lime Asset Management, a Korean hedge fund that manages 4.1 trillion won ($3.5 billion) worth of assets, on allegations that it concealed losses from its investors.The news comes as its 600 billion won fund dedicated to trade finance was found to have been associated with a debacle involving New York-based investment adviser International Investment Group, which was accused of running

Market Dec. 30, 2019

-

[News Focus] Can NPS shareholder engagement curtail power of chaebol?

The world’s third-largest pension fund, South Korea’s National Pension Service, may opt to present shareholder proposals to its portfolio companies in Korea -- which number as many as 800 -- starting from Korea’s upcoming proxy season in March next year.The move, long awaited by civic groups that denounced chaebol families’ alleged misdeeds, comes as the public pension fund approved its shareholder engagement guidelines Friday, effective immediately. The latest action wou

Market Dec. 29, 2019

![[News Focus] Can NPS shareholder engagement curtail power of chaebol?](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2019/12/29/20191229000142_0.jpg&u=20191229175329)

-

KB Kookmin Bank to acquire Cambodian lender for $603.4m

South Korea’s commercial lender KB Kookmin Bank said Thursday its board has agreed to acquire a 70 percent stake in Cambodia’s lender Prasac Microfinance Institution for $603.4 million from Sri Lanka-based nonbanking lender LOLC Holdings.Prasac Microfinance is the No. 1 microfinance deposit-taking institution, taking up over 40 percent of market share in Cambodia with 177 branches.KB Kookmin will close the deal within three months, after a due diligence and approval from financial au

Market Dec. 26, 2019

-

S. Korea emerges as major player in global gaming M&As: report

South Korean companies are increasingly becoming key players of mergers and acquisitions in the global game industry, in pursuit of fresh revenue sources and growth engines, data showed on Thursday.From 2013 to 2018, Korea ranked No. 4 in global M&A transactions in the industry, according to Samjong KPMG in its report titled “Global M&A Trends in Game Industry.” Of the total 528 deals globally, Korean entities proposed, signed and closed a combined 45 deals, followed by

Market Dec. 26, 2019

-

Indebted CJ Group moves to generate cash through divestment

Korean food-to-entertainment conglomerate CJ Group is moving to generate cash through divestment efforts by its affiliates this month, making potential room to tackle the group’s snowballing liabilities.The group’s debt -- which stood at 16.6 trillion won ($14.3 billion) as of end-June according to Korea Ratings -- has cast a shadow on Chairman Lee Jae-hyun’s “Great CJ 2020” initiative to secure 100 trillion won in annual group revenue, pushing the conglomerate to t

Market Dec. 25, 2019

-

Kakao M carries on M&A push with $23m deal

Kakao M, a subsidiary of South Korean internet giant Kakao, is again adding momentum to mergers and acquisitions to consolidate its content production capacity and generate synergy among its media units.In the latest move, Kakao M subsidiary Starship Entertainment inked a deal to buy a 100 percent stake in a local performing arts company, Shownote, for 26.8 billion won ($23 million) in cash. Starship Entertainment also announced a plan to raise 11 billion won in capital, part of which will come

Market Dec. 25, 2019

-

Glenwood PE signs W608b deal to acquire SKC Kolon PI

South Korea’s investment house Glenwood Private Equity has inked a deal to buy a controlling stake in the world’s leading polyimide film maker SKC Kolon PI for 608 billion won ($523.2 million) from its two major stakeholders, according to regulatory filings on Tuesday. The purchase price of a 54.07 percent stake in SKC Kolon PI has shrunk from earlier market estimates of some 700 billion won. The transaction is poised to take place by Feb. 28. SKC Kolon PI is a joint venture of Korea

Market Dec. 24, 2019

-

Hyundai Investments partners with La Francaise to create European office-focused fund

Seoul-based Hyundai Investments said Tuesday it has joined hands with French investment house La Francaise to create a blind pool fund that focuses on small and midsized office buildings in Western Europe. The new fund seeks 8 percent internal rate of return through a 10-year investment, according to Hyundai Investments. The Korean vehicle did not disclose the fund’s volume and its limited partners committed to the fund. The fund will target core-plus commercial buildings in key citie

Market Dec. 24, 2019

-

IMM PE to invest W134.7b to become HanaTour’s top shareholder

Seoul-based private equity house IMM Private Equity will become the largest shareholder of HanaTour Service, in a capital increase by South Korea’s No. 1 travel agency, HanaTour said on Monday. IMM PE will buy HanaTour’s newly issued 2.3 million common shares, or 16.7 percent of the outstanding shares, for 134.7 billion won ($115.8 million) -- with a 16.3 percent premium to its market price -- according to HanaTour’s disclosure. The funding will be raised from IMM PE&rsquo

Market Dec. 24, 2019

Most Popular

-

1

Dongduk Women’s University halts coeducation talks

-

2

Russia sent 'anti-air' missiles to Pyongyang, Yoon's aide says

-

3

Defense ministry denies special treatment for BTS’ V amid phone use allegations

-

4

OpenAI in talks with Samsung to power AI features, report says

-

5

Two jailed for forcing disabled teens into prostitution

-

6

South Korean military plans to launch new division for future warfare

-

7

Gold bars and cash bundles; authorities confiscate millions from tax dodgers

-

8

Teen smoking, drinking decline, while mental health, dietary habits worsen

-

9

Kia EV9 GT marks world debut at LA Motor Show

-

10

North Korean leader ‘convinced’ dialogue won’t change US hostility

![[News Focus] Can NPS shareholder engagement curtail power of chaebol?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2019/12/29/20191229000142_0.jpg&u=20191229175329)