Articles by Jung Min-kyung

Jung Min-kyung

mkjung@heraldcorp.com-

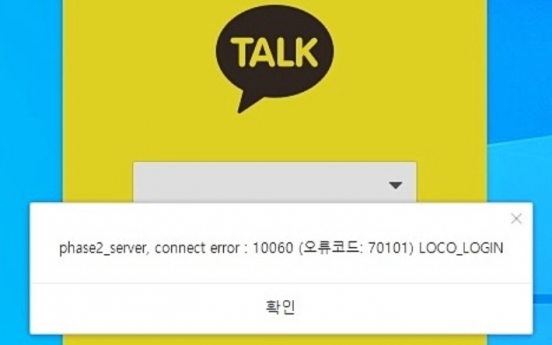

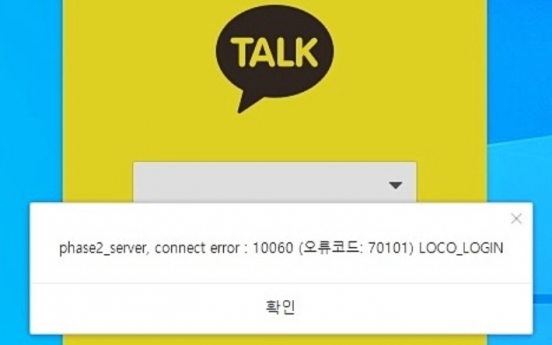

Upbit to replace KakaoTalk login service amid data center fire fiasco

South Korea’s cryptocurrency exchange Upbit is set to replace its fast login service via KakaoTalk next month, while in damage control mode from the recent Kakao data center fire fiasco. Dunamu, the operator of Korea’s No.1 crypto exchange by trading volume, will end its login service via KakaoTalk, fully replacing it with its own login system from Nov. 21, the firm’s spokesperson said Tuesday. “The new service will be adopted on Oct. 31 and fully kick off on Nov. 21 af

Business Oct. 18, 2022

-

Financial watchdog launches inspection into Kakao’s contingency plans

South Korea’s financial watchdog launched a probe into the overall contingency plan of Kakao’s financial arms and how they dealt with a service disruption over the weekend caused by a fire at a data center, officials said Monday. The Financial Supervisory Service requested Kakao Bank, Kakao Pay and Kakao Pay Securities to file a report on their hourly countermeasures against the server disruption that lasted more than 30 hours, on top of its existing contingency plan. The FSS noted

Business Oct. 17, 2022

-

Kakao, Naver malfunctions leave investors shuddering

South Korea’s retail investors on Sunday were grappling with the fear that the much-favored tech shares of Kakao and Naver might suffer another round of massive falls after their service malfunctions shocked the nation over the weekend. A fire broke out on Saturday at an SK C&C building housing data centers of the two internet giants and disrupted operations of their popular services, including messenger app KakaoTalk and taxi-hailing app Kakao T, for more than 10 hours. As of 2 p.m.

Business Oct. 16, 2022

-

Scandal-ridden SillaJen’s shares surge following trade resumption

Scandal-ridden biotechnology firm SillaJen’s shares surged by nearly 30 percent on Thursday a day after South Korea’s sole bourse operator decided to resume its trading on the secondary index. The firm's shares jumped nearly 30 percent from the previous closing to 10,850 won ($7.58), effectively ending its 29 months of suspension and quickly picking up speed from its opening price of 8,380 won. Though the closing price on the last trading day before its suspension -- May 4, 2020 --

Market Oct. 13, 2022

-

KRX resumes trading of SillaJen

South Korea’s stock exchange decided Wednesday to resume trading of the troubled biotech company SillaJen, effectively ending a suspension of over two years to a divided response from the market. The Korea Exchange’s Kosdaq market committee decided to keep SillaJen listed on the secondary, tech-heavy bourse in a decision that followed an hourslong meeting. It has yet to release a detailed explanation for its decision, but a KRX official, requesting anonymity, told

Market Oct. 12, 2022

-

Watchdog vows to complete inspection of troubled funds by next year

The head of South Korea’s financial watchdog pledged Tuesday that he will complete an inspection into the troubled funds and products that led to investors suffering hefty losses in recent years. The vow follows public criticism that the Financial Supervisory Service failed to screen and prevent fiascos including Ponzi schemes carried out by hedge funds and local financial institutions in recent years. The FSS has yet to decide on the reimbursement plans regarding the troubled 2019 German

Market Oct. 11, 2022

-

Naver, Kakao shares lose W63tr of market cap

Naver and Kakao, tech stocks that had moved the market during the COVID-19 pandemic, have recently become big disappointments to investors, having lost over a combined 63.3 trillion won ($44.4 billion) in market value since the beginning of the year. South Korea’s No. 1 search engine operator Naver has fallen 57 percent since the first trading day of the year. Its shares fell from 376,000 won on Jan. 3 to 160,000 won on Friday, pulling its market cap down from 62.9 trillion won to 26.2 tr

Market Oct. 10, 2022

-

Korea’s central bank chief sees more rate hikes coming

The chief of South Korea’s central bank hinted at more rate hikes to come on Friday to combat high inflation, while stressing that the possible currency swap deal with the US is only a short-term solution. “We believe that we need to maintain our stance to raise rates going forward in order to prevent entering a stagnant state of high inflation,” Bank of Korea Gov. Rhee Chang-yong told lawmakers during a parliamentary audit. “The BOK has so far carried out a series of s

Economy Oct. 7, 2022

-

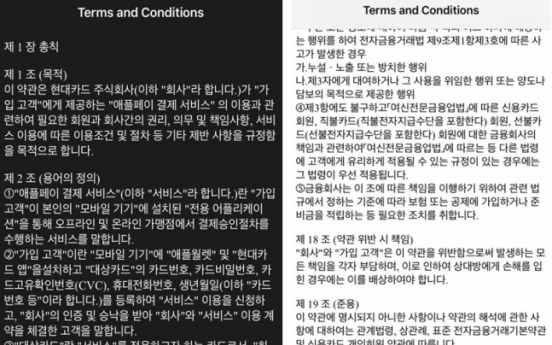

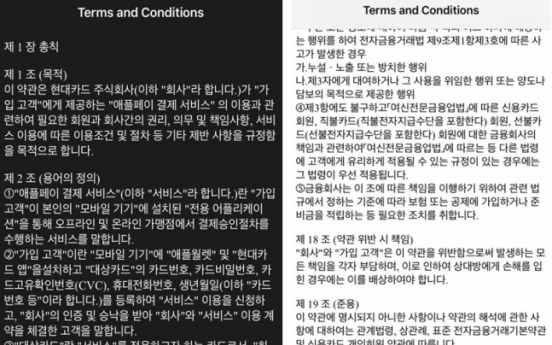

Apple Pay likely to start Korean services next month

Apple Pay will start its Korean services next month or at least early December, according to recently leaked documents stating terms and conditions for Hyundai Card customers. The screen captures of digital documents labeled “terms and conditions” in Korean said that “the purpose of this document is to regulate the conditions and procedures of the rights between our customers and the company, obligations and responsibility and more for the usage of Apple Pay services provided

Market Oct. 7, 2022

-

Financial regulator considers disclosing IDs of short-selling abusers

South Korea’s top financial regulator said Thursday that it is actively considering to disclose the identity of illegal short sellers amid growing criticism that the practice has been disrupting the local stock market. The remark comes amid growing anger from retail investors that have been witnessing the value of their stock investments dropping sharply in recent months. Many are blaming illegal short selling, claiming that they are the victims in a market vulnerable to such practices by

Market Oct. 6, 2022

-

Lone Star, other investor-state disputes cost Korea W68.5b

South Korea has spent nearly 68.5 billion won ($48.1 million) in total to fight and settle investor-state dispute settlements since 2013,#including its battle with US-based private equity firm Lone Star, data showed Wednesday. The majority of the money was spent to hire overseas attorneys or pay compensation in a total of 10 cases overseen by the US-based International Center for Settlement of Investment Disputes and other dispute settlement bodies, data from the Ministry of Justice, National T

Business Oct. 5, 2022

-

Countries with high income inequality, debt suffer higher COVID deaths: report

Countries with high income inequality and national debt have reported more COVID-related deaths in the first year of the pandemic, a report showed Tuesday. Of the 38 Organization for Economic Cooperation and Development member nations, those with a high Gini coefficient -- a gauge of economic inequality such as levels of income -- and high national debt saw the most deaths from COVID-19 in 2020, a report released by the Korea Institute of Public Finance said. “Our research showed that if

Economy Oct. 4, 2022

-

4 in 10 households projected to be single-person by 2040

Four out of 10 households in South Korea are projected to be single-person by 2040, with the portion of families of four or more – once the most common form of family here – shrinking to 10 percent, a report showed Monday. According to a report compiled by KB Financial Group, the number of single-person households was 7.1 million, or 33.4 percent of the total, last year. And the figure is expected to reach some 9 million by 2040, taking up 37.9 percent of the total households here.

Economy Oct. 3, 2022

-

SC Bank, Toss mull compensation for won-dollar rate error

Standard Chartered Bank Korea and Toss Securities are discussing ways to compensate customers who suffered losses due to a faulty won-dollar exchange rate posted on their mobile trading apps, officials said Thursday. The won-dollar exchange rate on Toss Securities’ mobile trading system was frozen at 1,298 won per US dollar from 1:50 p.m. to 2:15 p.m. on Wednesday, when the actual rate hovered around 1,440 won. SC Bank Korea, the London-based financial giant’s Korean unit, which pr

Market Sept. 29, 2022

-

Samsung insurers to invest $650m in Blackstone alternatives portfolio

Samsung Group’s insurance units signed a deal worth $650 million with US-based private equity firm Blackstone to expand its global alternative asset portfolio, the Korean insurers said Wednesday. Samsung Life Insurance and non-life insurer Samsung Fire & Marine Insurance will invest in overseas real estate, infrastructure and private equities managed by Blackstone through the latest deal. The investment will be managed by Samsung’s asset management arms Samsung Asset Management and

Market Sept. 28, 2022

Most Popular

-

1

Actor Jung Woo-sung admits to being father of model Moon Ga-bi’s child

-

2

Wealthy parents ditch Korean passports to get kids into international school

-

3

Man convicted after binge eating to avoid military service

-

4

First snow to fall in Seoul on Wednesday

-

5

Final push to forge UN treaty on plastic pollution set to begin in Busan

-

6

Korea to hold own memorial for forced labor victims, boycotting Japan’s

-

7

Nvidia CEO signals Samsung’s imminent shipment of AI chips

-

8

Industry experts predicts tough choices as NewJeans' ultimatum nears

-

9

Job creation lowest on record among under-30s

-

10

NK troops disguised as 'indigenous' people in Far East for combat against Ukraine: report