Articles by Choi Jae-hee

Choi Jae-hee

cjh@heraldcorp.com-

Number of Koreans with W1b in assets climbs 10%

Amid liquidity-driven booms in the real estate and stock markets amid the COVID-19 pandemic, the number of people with assets of more than 1 billion won ($847,000) increased by over 10 percent last year from a year earlier, a report showed Sunday. The number of Koreans with financial assets worth over 1 billion won stood at 390,000 last year, taking up 0.76 percent of the total population, according to the Korea Wealth Report 2021 released by KB Financial Group Research Institute. The

Market Nov. 14, 2021

-

Citibank Korea strengthens community outreach programs, ESG drive

As part of efforts to grow together with the local community, Citibank Korea, the South Korean unit of Citigroup, has carried out diverse social contribution programs, while beefing up management activities focused on environmental, social and governance factors, or ESG, the lender said Thursday. Based on three principles, including employee participation, long-term commitment and leading activity, the foreign bank has continuously fostered a volunteer culture among employees for its corp

Market Nov. 11, 2021

-

Efforts needed to improve ESG disclosure system: report

In the midst of the COVID-19 pandemic, South Korea’s financial groups have been gearing up for the so-called “sustainable financing,” centered on environmental, social and governance factors, or ESG, but global ESG experts urged them to make their ESG disclosure system more sophisticated, according to research shared with the Korea Herald report Wednesday. Sustainable financing refers to a bank’s financial services like loans for companies’ sustaina

Market Nov. 10, 2021

-

Citigroup’s retail closure in Korea to cost max W1.8tr: reports

The US-based global banking giant Citigroup will reportedly spend up to $1.5 billion, or 1.8 trillion won, on the withdrawal of its retail business in South Korea, according to news reports Tuesday. The group said in a regulatory filing that its expenditure on severance pay for employees at the Korean subsidiary’s retail banking operations will range between $1.2 billion and $1.5 billion. It will pay the envisioned personnel costs in phases by the end of next year, the Wall Street Jour

Market Nov. 9, 2021

-

Citibank Korea committed to supporting ESG drive in corporate sector

Citibank Korea, the South Korean unit of Citigroup, has ramped up efforts to gain an upper hand in sustainable financing, focused on environmental, social and governance factors, to support local companies’ ESG management, the lender said Sunday. Sustainable financing refers to a bank’s financial services, ranging from loans to bonds, designed to provide financial support for sustainable economic activities and projects of private companies or public entities. The prolonged COVID-19

Market Nov. 7, 2021

-

Regulators vow deregulation for new growth engines in finance

The chiefs of South Korea’s two main financial regulators -- the policymaking Financial Services Commission and the market watchdog Financial Supervisory Service -- have met with the heads of major insurance companies and banking groups here to discuss policy initiatives to support the growth of market players through deregulation, the two said Wednesday. “The rapid digital transformation of finance and the growth of online platform businesses are rapidly changing the nation’s

Market Nov. 3, 2021

-

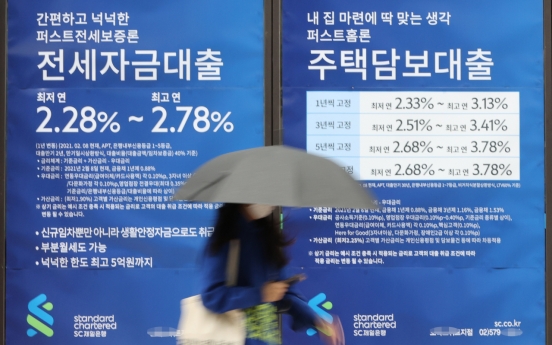

Money moving to savings as ultralow rate era nears end

South Korean banks’ lending rates neared 5 percent following the central bank’s first pandemic-era rate hike in August, which ramped up cash flows into bank deposits, data showed Tuesday. The adjustable rate charged on mortgage loans extended by the nation’s four major banks -- KB Kookmin Bank, Shinhan, Hana and Woori -- remained between 3.31 and 4.8 percent, as of Monday. Both the bottom and upper ends of the range rose nearly 0.6 percentage point from 2.62 to 4.2 perce

Market Nov. 2, 2021

-

Irregular workers with college degrees hit record high: data

South Korea saw its number of “non-regular” workers with four-year college degrees grow to an all-time high in August, data showed Monday, sparking concerns about the quality of jobs being created. According to data from Statistics Korea, the number of workers holding degrees from four-year colleges but employed on temporary or part-time contracts stood at 2.84 million, up 320,000, or 12.7 percent from a year earlier. It marked the highest since the agency started to compile such da

Economy Nov. 1, 2021

-

Banks urged to prevent loan bottleneck amid toughened lending rules

South Korea’s financial authorities have called on local banks to take action to ensure a stable supply of credit loans and tighter supervision of household debts, officials said Sunday. The policymaking Financial Services Commission and the market watchdog Financial Supervisory Service reportedly advised the nation’s commercial banks to submit the action plans, which can be either monthly or quarterly, for personal unsecured loans. The authorities also ur

Market Oct. 31, 2021

-

FSC chief vows support for banks’ integrated digital platform

The nation‘s top financial regulator on Thursday vowed policy efforts to forge an integrated online platform for conventional players to accelerate digital transformation of their financial services in face of rising big tech companies. “The growth of contactless banking transactions, the so-called ‘unbundling’ as well as ‘rebundling’ trend, and the entry of tech giants into financial services have added fuel to market competition. It is time to

Market Oct. 28, 2021

-

Citibank’s retail business closure not subject to regulator’s approval: FSC

The policymaking Financial Services Commission said Wednesday that Citibank Korea’s plans to gradually phase out its consumer banking operations are not subject to the regulator’s authorization. “According to the current banking act, Citibank Korea‘s withdrawal of retail business in phases is not regarded as a ‘shutdown of banking business,’ which falls under the FSC‘s approval,” the authority said in a statement, which indicates the forei

Market Oct. 27, 2021

-

South Korea’s housing market on verge of stabilization: fiscal chief

South Korea’s fiscal policy chief said Wednesday that the nation’s overheated housing market is showing signs of cooling down with the government’s tightened grip on ample liquidity amid the COVID-19 pandemic as well as its home supply plans. “Affected by a series of government measures, including announcements of housing supply plans, benchmark interest rate hike and tougher household debt control measures, an upward trend in housing prices has slowed and changes

Economy Oct. 27, 2021

-

Income-based lending rules to be toughened amid snowballing household debt

South Korea’s top financial regulator on Tuesday said it will implement stricter lending calculations for mortgage loans, called the “debt-service ratio,” or DSR, months earlier than expected as part of additional debt control measures. The DSR gauges how much borrowers pay for principal and interest in proportion to yearly income. Since July, a 40 percent DSR has been applied to borrowers seeking to receive loans for buying properties valued at over 600 million w

Market Oct. 26, 2021

-

After sell-off failure, Citibank Korea to phase out consumer banking

Citibank Korea, the South Korean unit of Citigroup, said Monday that it has decided to shut down its consumer banking operations in phases, instead of selling them off as planned. Citing constraints in finding potential buyers with intentions to buy the units in one piece, the bank said plan B is to minimize customer inconvenience and protect employees’ jobs. The announcement, however, has drawn strong opposition from unionized workers who say the envisioned closure

Market Oct. 25, 2021

-

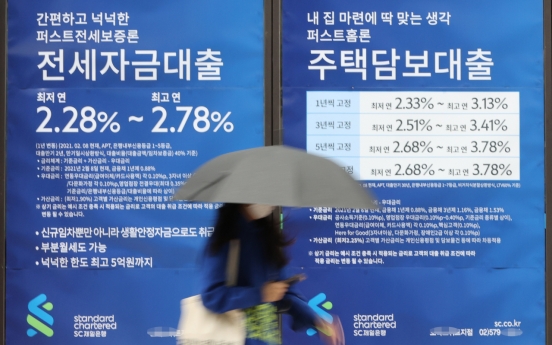

‘Jeonse’ loans taken out by those in 20s, 30s soar W60tr

The amount of “jeonse” loans for homes extended to Koreans in their 20s and 30s surged by nearly 60 trillion won ($50.9 billion) in the last five years, raising alarm over the growing household debt burden among young borrowers, a lawmaker said Friday. Jeonse is a housing lease system unique to Korea whereby tenants pay a lump-sum deposit instead of monthly rent on a two-year contract. The outstanding balance of jeonse loans at five major lenders here -- KB Kookmin Bank, Shin

Market Oct. 22, 2021

Most Popular

-

1

Now is no time to add pressure on businesses: top executives

-

2

CJ CheilJedang to spur overseas growth with new Hungary, US plants

-

3

Seoul to host winter festival from Dec. 13

-

4

Nationwide rail disruptions feared as union plans strike from Dec. 5

-

5

Blackpink's solo journeys: Complementary paths, not competition

-

6

N. Korea, Russia court softer image: From animal diplomacy to tourism

-

7

[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg&u=20241121172748)

-

8

Smugglers caught disguising 230 tons of Chinese black beans as diesel exhaust fluid

-

9

Korean Air offers special flights for mileage users

-

10

Actor Song Joong-ki welcomes second child in Rome

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg&u=20241121172748)