Most Popular

-

1

Actor Jung Woo-sung admits to being father of model Moon Ga-bi’s child

-

2

Trump picks ex-N. Korea policy official as his principal deputy national security adviser

-

3

Wealthy parents ditch Korean passports to get kids into international school

-

4

First snow to fall in Seoul on Wednesday

-

5

Man convicted after binge eating to avoid military service

-

6

S. Korea not to attend Sado mine memorial: foreign ministry

-

7

Toxins at 622 times legal limit found in kids' clothes from Chinese platforms

-

8

Korea to hold own memorial for forced labor victims, boycotting Japan’s

-

9

[Weekender] Korea's traditional sauce culture gains global recognition

![[Weekender] Korea's traditional sauce culture gains global recognition](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050153_0.jpg&u=20241123224317)

-

10

BLACKPINK's Rose stays at No. 3 on British Official Singles chart with 'APT.'

-

Woori Bank’s net profit surges 33% in 2018

Woori Bank, a major South Korean commercial lender, said Monday its net profit for 2018 soared 33.34 percent from a year earlier on the back of growth in interest income. Net profit came to 2.04 trillion won ($1.81 billion) in 2018 on a consolidated basis, up from 1.51 trillion won a year earlier, the lender said in a regulatory filing. Its operating profit jumped 27.22 percent on-year to 2.74 trillion won, a record high, the bank said, while noting that its yearly sales fell 16.05 percent to 19

Feb. 11, 2019

-

Lotte Capital to start preliminary bidding process Tuesday

The preliminary bidding for Lotte Capital, the loan services unit of Korean-Japanese conglomerate Lotte Group, takes place Tuesday, with the country’s major banking groups and private equity funds expected to participate. Lotte Capital is one of the three Lotte companies currently on the market. The two remaining firms on sale -- Lotte Card and Lotte Non-Life Insurance -- already held the preliminary bidding on Jan. 30, with a number of conglomerates and PEFs showing interest. Among the th

Feb. 11, 2019

-

IMF, World Bank to visit S. Korea for financial system assessment

Officials from the International Monetary Fund and the World Bank will visit South Korea this week for a regular assessment of the nation's financial system, officials said Monday.The IMF and World Bank conduct evaluations of the financial architecture of 25 selected countries every five years under the Financial Sector Assessment Program. South Korea was last reviewed in 2013. A delegation of IMF and World Bank officials will arrive in South Korea on Tuesday to discuss details of the assessment

Feb. 11, 2019

-

Banks turn to employees to break the mold

Amid slowing momentum in the banking industry and rising competition from fintech players, major financial groups are looking to break away from the status quo and design a new business paradigm.In an attempt to deviate from the conventional banking-focused mindset, most have chosen to fuel in-house ventures this year, encouraging the units to experiment with digital transformation in order to come up with new business ideas.The latest example is the state-run Industrial Bank of Korea, which in

Feb. 10, 2019

-

[News Focus] Anticipation grows for Korea’s 3rd internet bank

Anticipation is growing to see who will gain the right to operate South Korea’s third and possibly its fourth internet-only bank, as financial regulators prepare to welcome new players to the web-only banking business following the easing of bank ownership regulations.Right now Korea has just two internet banks: Kakao Bank, operated by mobile messaging giant Kakao; and K bank, run by telecommunications firm KT.But last month, a new regulatory change allowing nonfinancial institutions to ow

Feb. 10, 2019

![[News Focus] Anticipation grows for Korea’s 3rd internet bank](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2019/01/31/20190131001060_0.jpg&u=20190210154927)

-

Brokerage firms suffer negative earnings surprise in Q4

Major brokerage firms reported worse-than-expected earnings in the fourth quarter of last year, with analysts citing increased market volatility coupled with a slump in the nation’s equity-linked securities market, data released in recent days showed. Mirae Asset Daewoo’s fourth-quarter net profit dropped 72 percent on-year to 26.9 billion won ($23.9 million), noticeably below the average range of 40 billion-50 billion won projected by analysts. The firm had been reporting lackluster

Feb. 10, 2019

-

KB Financial’s net profit falls 7.3% in 2018

KB Financial Group, a major South Korean banking group, said Friday its net profit declined 7.3 percent on year in 2018, hit by outlays related to job cuts. Net profit stood at 3.06 trillion won (US$2.72 billion) last year, KB Financial said in a regulatory filing. The profit fell below the market expectation of 3.31 trillion won. KB Financial said it spent 286 billion won in severance payments and 185 billion won in compensation as it carried out a voluntary retirement program late last

Feb. 8, 2019

-

Woori partners with Grab Cambodia for low-interest loans to drivers

South Korea’s Woori Bank has partnered with Southeast Asian ride-hailing giant Grab’s Cambodia office to offer low-interest loans and other specialized financial products to Grab drivers in the country, the bank said Thursday.WB Finance, the Cambodian business unit of Woori Bank, signed a memorandum of understanding with Grab Cambodia, to launch a series of financial services specifically designed for Cambodia’s Grab drivers, including low-interest loans. “Grab Cambodia w

Feb. 7, 2019

-

Mobile payment recharging limit to be raised

South Korea’s financial regulator plans to raise the limit of recharging credit on mobile payment platforms from the current 2 million won ($1,782), as part of its plans to ease rules on quick payment services, an official said Thursday.The new plan addresses the growing ire among mobile platform operators and users on the 2 million won recharge cap, which makes it impossible for users to purchase goods that cost more than the stated limit through payment systems such as Kakao Pay or Naver

Feb. 7, 2019

-

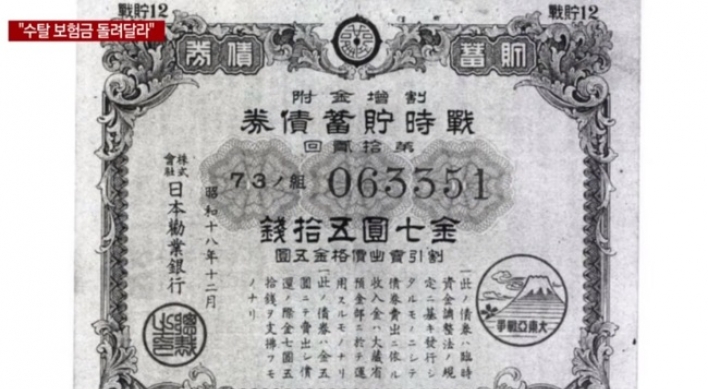

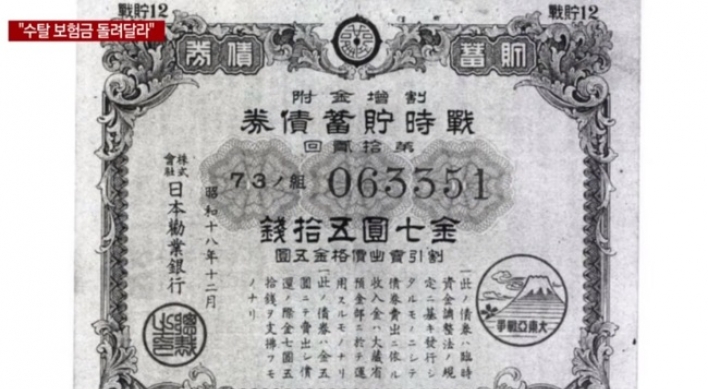

Korean seeks compensation for war bonds, insurance forcibly purchased during Japanese occupation

A South Korean man has reportedly filed a damage suit seeking compensation for war bonds and insurance products his father was forced to purchase from Japanese financial companies in 1943 during the Japanese colonial rule of Korea. According to a report by local broadcaster YTN on Thursday, Ahn Chul-woo, an 80-year-old man living in Busan, is pursuing a lawsuit in Korea against Japan Post Group, a major financial company and postal service operator in the neighboring country. Ahn directed his su

Feb. 7, 2019

-

K-pop stars rise as marketing bonanza for banking industry

Seeking to boost overseas business and expand their base of young customers, South Korea’s major banks have adopted a new marketing strategy in recent years: using K-pop groups as brand ambassadors.K-pop celebrities were for some time viewed as an unconventional choice for the banking industry, but partnerships soon rose as an effective way to overcome the conservative and rigid image of the market.The biggest beneficiary was KB Kookmin Bank, which recently renewed its advertising contract

Feb. 6, 2019

-

Korea's Hanwha Group, Hana Financial compete for Lotte Card

Anticipation is building up over who will become the new owner of Lotte Card, a credit card business owned by Korean-Japanese retail conglomerate Lotte Group that has been put up for sale. Lotte Group has set out to sell three of its financial units -- Lotte Card, Lotte Non-Life Insurance and Lotte Capital – as part of steps toward adopting a holding company structure. Under South Korean law mandating a separation of financial and industrial capital, a holding corporation cannot possess fi

Feb. 6, 2019

-

[Newsmaker] K-pop stars rise as marketing bonanza for banking industry

Seeking to boost overseas business and expand their young customer bases, South Korea’s major banks have adopted a new marketing trend over recent years -- using K-pop groups as brand ambassadors.K-pop celebrities were for some time viewed as an unconventional choice for the banking industry, but partnerships soon rose as an effective way to overcome the conservative and rigid image of the market.The biggest beneficiary was KB Kookmin Bank, which recently renewed its advertising contract w

Feb. 3, 2019

![[Newsmaker] K-pop stars rise as marketing bonanza for banking industry](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2019/02/01/20190201000827_0.jpg&u=20190203103728)

-

FSC vows to ease listing rules for 3rd bourse, rejuvenate SME investment

South Korea’s chief regulator said Wednesday that it plans to ease listing rules for the nation’s tertiary bourse, focused on startups and small and medium-sized firms, to reform the capital market and support the growth of the Korean economy. The Financial Services Commission will lower the bar for the size of the deposit that regular investors need to participate in the Konex market, FSC Chairman Choi Jong-ku said at an event in central Seoul. The required deposit will be 30

Jan. 30, 2019

-

Number of fake banknotes hits 20-yr low in 2018

The number of counterfeit South Korean banknotes detected here last year reached a 20-year low, the central bank said Wednesday.The Bank of Korea said a total of 605 fake bills were found in 2018, down a sharp 63.5 percent from 1,657 a year earlier. It was the lowest figure since 1998, when 365 forged notes were discovered.The BOK said the decrease was driven by the arrest of two big-time counterfeiters in the country. As a result, the number of counterfeit 10,000-won bills (worth around $8.95 e

Jan. 30, 2019

-

Meritz Securities reports record-high net profit

South Korea’s Meritz Securities said Tuesday that its annual net profit surged 22.1 percent to a record high last year, amid local securities firms’ continuing struggle to survive competition with giant investment banks. The firm said its 2018 net income amounted to 433.8 billion won ($388.4 million) compared with 355.2 billion won a year earlier. Its operating profit jumped 20 percent to 532.3 billion won, while net operating income rose 21.9 percent to 1.3 trillion won. &ldqu

Jan. 29, 2019

-

Rebranded Refinitiv brings risk management services to Korea

Refinitiv, a financial data company co-owned by Blackstone Group and Thomson Reuters, said it is introducing its risk-management business to South Korea this year for financial risk control and crime prevention.The firm was formerly the financial and risk business division of Thomson Reuters. It became independent under a new name, Refinitiv, when private equity group Blackstone purchased a 55 percent stake in the business from Thomson Reuters in October 2018.The company highlighted it

Jan. 29, 2019

-

Korean central bank has no plans to issue digital currency

The South Korean central bank said Tuesday that it has no plans to issue authorized digital currency in the near future despite heated debate over virtual money across the world.The Bank of Korea has completed a study on the prospects for the introduction of a central bank digital currency, referring to a form of fiat money that is issued by central banks and governments. Its final report said there is no urgent need for the BOK to introduce CBDC in the close future, while other leading central

Jan. 29, 2019

-

Look into BET coin

BET coin is BitParadise’s own version of bitcoin, which the company says can be used in lieu of currency on the new cryptocurrency exchange that encompasses the traits of trade mining and gaming. BET coins can also be viewed as points that can be earned though depositing bitcoins in the exchange. It is programmed to be used like complimentary items or services at offline casinos. The firm specifically compared the system to the comp system adopted by Kangwon Land, a state-owned casino in G

Jan. 28, 2019

-

[Herald Interview] Rebranded SoftBank Ventures Asia to form new fund for AI startups in Asia

SoftBank Ventures Asia, which recently renamed itself to reflect its broadened focus on startups in the Asia-Pacific region beyond South Korea, will form a new investment fund dedicated to artificial intelligence startups in Asia with “globally disruptive” products and services this year. The venture capital arm of Japan’s SoftBank Group plans to establish within the year a new global investment fund to back promising AI startups in Asian countries other than China, according t

Jan. 28, 2019

![[Herald Interview] Rebranded SoftBank Ventures Asia to form new fund for AI startups in Asia](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2019/01/28/20190128000404_0.jpg&u=20190128190331)

![[Weekender] Korea's traditional sauce culture gains global recognition](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050153_0.jpg&u=20241123224317)

![[News Focus] Anticipation grows for Korea’s 3rd internet bank](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2019/01/31/20190131001060_0.jpg&u=20190210154927)

![[Newsmaker] K-pop stars rise as marketing bonanza for banking industry](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2019/02/01/20190201000827_0.jpg&u=20190203103728)

![[Herald Interview] Rebranded SoftBank Ventures Asia to form new fund for AI startups in Asia](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2019/01/28/20190128000404_0.jpg&u=20190128190331)