Most Popular

-

1

Blackpink's solo journeys: Complementary paths, not competition

-

2

Russia sent 'anti-air' missiles to Pyongyang, Yoon's aide says

-

3

Smugglers caught disguising 230 tons of Chinese black beans as diesel exhaust fluid

-

4

[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg&u=20241121172748)

-

5

Dongduk Women’s University halts coeducation talks

-

6

Defense ministry denies special treatment for BTS’ V amid phone use allegations

-

7

OpenAI in talks with Samsung to power AI features, report says

-

8

Two jailed for forcing disabled teens into prostitution

-

9

Disney+ offers sneak peek at 2025 lineup of Korean originals

-

10

Gold bars and cash bundles; authorities confiscate millions from tax dodgers

-

Korea to support venture capital for fintech start-ups

The government will fully support venture capital to finance start-ups in financial technology business, as digital innovation will play a critical role in the fourth industrial revolution, Korea’s top financial regulator said Wednesday. “With the advent of fintech and ICT-based firms, once-exclusive financial services are evolving into new types of services,” Financial Services Commission chairman Yim Jong-yong said at a forum in Seoul.Financial Services Commission chairman Yim Jong-yong (Yonha

June 1, 2016

-

NPS to up global investments in 2017-2021

Korea’s National Pension Service, which manages the world’s third-largest public pension fund after Japan and Norway, said it decided to increase the fund’s allocation in global investments in its mid-to-long-term fund investment portfolio.According to the plan finalized at the health minister-led fund management committee Monday, the combined proportion of investment in global equities, bonds and alternatives will increase to more than 35 percent of the total fund by 2021 from 24.3 percent as o

May 16, 2016

-

KDB to inject capital into Eximbank through KAI shares

The state-run Korea Development Bank said Tuesday that it will hand over its shares of Korea Aerospace Industries to the Export-Import Bank of Korea as part of an emergency financial relief.“We have decided to give our KAI shares to Eximbank,” KDB chief executive Lee Dong-geol told reporters ahead of a meeting with the Financial Services Commission on Tuesday.Korea Development Bank (Yonhap)KDB will hand over its 7.86 percent stake in KAI worth about 500 billion won ($426 million) to boost the ca

May 10, 2016

-

Shinhan Financial leads in Q1 earnings

First-quarter earnings reports show Shinhan Financial Group cementing its lead in the local banking sector, with a 30 percent increase in net profits. The group’s net profit in the January-March period stood at 771.4 billion won ($670.7 million), up 30.3 percent from the same period last year, the company said in a regulatory filing last week. From three months earlier, the tally marked a spike of 90.9 percent. “Improvements in banking, with a pickup in the net interest margin, had a big role (i

April 24, 2016

-

KEB Hana, Woori chosen as won clearing house in China

The Bank of Korea said Tuesday that it has appointed branches of KEB Hana Bank and Woori Bank in Shanghai, China, as clearing houses for won-yuan direct trading when the market opens. The envisioned currency market in Shanghai, scheduled to launch within the first half of this year, is Korea’s maiden step to allow offshore trading of its currency. China is Korea’s biggest trading partner, accounting for some 25 percent of its exports. Hana Financial Group (Yonhap)In Seoul, the won-yuan market op

April 12, 2016

-

Insurers most profitable among Korean financials in 2015

Insurance companies raked in the most profits in the financial sector last year, largely boosted by investment-related earnings and non-operating profits, industry data showed Sunday.The combined net incomes of Korean insurers stood at 6.3 trillion won in 2015, followed by 3.5 trillion won for banks and 3.2 trillion won for securities firms, according to preliminary earnings reported to the Financial Services Commission and regulatory filings with the Financial Supervisory Service.Banks suffered

March 27, 2016

-

Shinhan Financial eyes fintech, global expansion

Shinhan Financial Group chairman Han Dong-woo said that it will focus on financial technology, or fintech, and global expansion this year.Chairman Han revealed the plan after his financial group revealed a net profit of 2.4 trillion won ($2.06 billion) in 2015, the highest of its kind in the domestic financial industry. The company has surpassed the 2 trillion won mark in profits for two consecutive years. Shinhan Financial Group chairman Han Dong-woo speaks at a forum in Seoul in January. (Shin

March 24, 2016

-

FSC to promote independent financial advisors

The Financial Services Commission is expected to devise a policy that enables financial professionals to start their own investment advisory ventures, in the second half of this year, according to the country’s regulators on Sunday.The FSC will seek to introduce a revised law to boost independent financial advisory services in the local capital market for legislation by the end of May.The IFA revision will allow employees of financial services companies to set up and operate investment advisory

March 20, 2016

-

Woori Bank to invest W2b in national crowdfunding program

Woori Bank said Tuesday it will spend 2 billion won ($1.66 million) in the first national crowdfunding program to support small and medium-sized start-ups and facilitate crowdfunding sentiment in the local market.“K-Crowd Fund” is the first national fund to support the Growth Ladder Fund, a government-funded program linking new start-ups with venture capital and other financial firms. Woori Bank will invest in Magellan Technology Investment, one of the three operators of the 20 billion won K-Cro

March 10, 2016

-

Financial regulators issue warning to Lotte, Hana on poor customer management

Korea’s financial regulator has issued a warning to two local credit card companies -- Hana Card and Lotte Card -- ordering them to improve their customer management system, particularly with regard to money laundering.Corporate logo of Hana Card (Hana Card)This comes after the Financial Supervisory Service reviewed their operations last year and uncovered some “defects.”“We did not enforce disciplinary measures against the two card companies, but issued a warning about their systems, ordering t

March 9, 2016

-

KB Financial to strengthen nonbanking services

KB Financial Group, one of the country’s largest financial groups, seeks to improve its management structure by strengthening its nonbanking business, the lender said last week.The group hopes to enhance its portfolio by maximizing the synergy created among its financial subsidiaries, which include KB Asset Management and KB Investment and Securities. According to statistics released by the group, some 67 percent of KB’s main profits currently come from KB Kookmin Bank, the country’s largest com

Feb. 11, 2016

-

Hanwha establishes fintech JV with China’s Dianrong

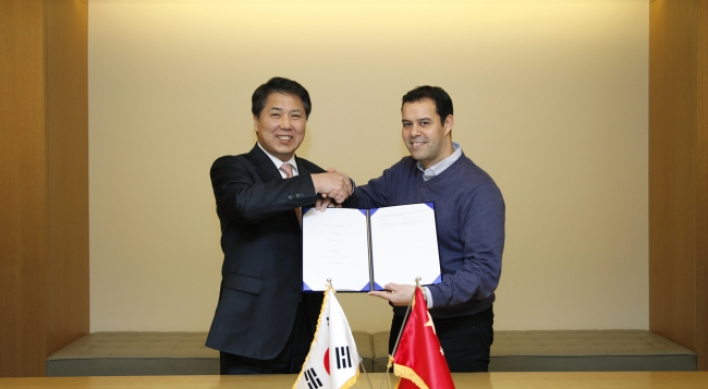

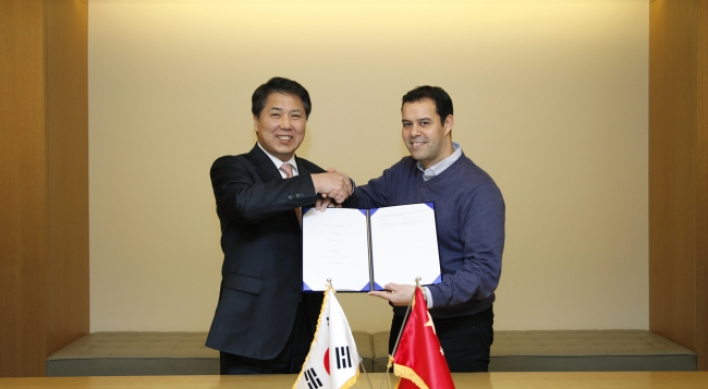

Hanwha Group has officially embarked into the newly emerging fintech, or financial technology, industry in partnership with China’s leading peer-to-peer lending platform Dianrong. Hanwha said that Hanwha S&C, the group’s information technology unit, and Dianrong signed an agreement to establish an equal joint venture in Seoul Thursday. The new joint venture, unnamed as of yet, will launch an open P2P marketplace lending service -- a modern service that matches lenders directly with borrowers on

Feb. 4, 2016

-

Shinhan Financial ranks 18th in global sustainable company list

Shinhan Financial Group came in at 18th place on a list of the world’s 100 most sustainable companies, announced Wednesday at the ongoing World Economic Forum in Davos, Switzerland, the Seoul-based group said Thursday. It is the highest ranking that a Korean company has ever reached on the list, which is known as the Global 100 and compiled annually by Canada-based Corporate Knights since 2005. German carmaker BMW topped this year’s list. Aside from Shinhan, three other Korean companies made it

Jan. 21, 2016

-

Fintech start-up, KB Kookmin roll out robo-adviser

Financial technology start-up Quarterback Investments said Sunday that it has rolled out a robo-adviser solution for trust goods, dubbed the Quarterback R-1, jointly with KB Kookmin Bank, Korea’s largest retail bank by asset value. Utilizing data from exchange-traded funds and exchange-traded notes in the domestic and global markets, the Quarterback R-1 enables investors to diversify their investment portfolio for stable returns, according to the Korean start-up, an affiliate of fintech firm all

Jan. 10, 2016

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg&u=20241121172748)