Most Popular

-

1

Actor Jung Woo-sung admits to being father of model Moon Ga-bi’s child

-

2

Wealthy parents ditch Korean passports to get kids into international school

-

3

Man convicted after binge eating to avoid military service

-

4

First snow to fall in Seoul on Wednesday

-

5

Industry experts predicts tough choices as NewJeans' ultimatum nears

-

6

Final push to forge UN treaty on plastic pollution set to begin in Busan

-

7

Nvidia CEO signals Samsung’s imminent shipment of AI chips

-

8

Korea to hold own memorial for forced labor victims, boycotting Japan’s

-

9

Opposition chief acquitted of instigating perjury

-

10

Job creation lowest on record among under-30s

-

Weaker yen gives mixed forecast on local stock market

Major foreign investment banks anticipate the Japanese currency will trade lower against the U.S. dollar in 2013, a report showed Tuesday, while local analysts are mixed about the impact of a weaker yen on the local stock market.Thirteen global investment banks expect the yen will change hands at 81.62 yen against the U.S. dollar in the first quarter of next year, down 1.8 percent from 80.16 yen suggested a month earlier, according to the report by the Korea Center for International Finance.The

Dec. 18, 2012

-

Korea’s household debt is manageable: Goldman Sachs

South Korea’s household debts, though standing at an alarming level, are under control as a stabilizing housing market and regulatory steps to stem their growth have capped risks, a global investment bank said Tuesday. Goldman Sachs said in a report that the growth pace of home-backed lending here has slowed in recent months, curbing the overall rise in household liabilities, according to the Korea Center for International Finance. The country’s household credit, which includes credit purchases

Dec. 18, 2012

-

‘KOSPI will reach a new historical high by mid-year’

I expect the Korean Stock Exchange to pass its April 27, 2011, historical high of 2,231 by the middle of 2013. The KOSPI suffered a knee-jerk plunge after the Greek crisis erupted in mid-2011, and entered a gradual-but-choppy upchannel in August of that year. The upper range of this upchannel will cross 2,231 around mid-June 2013. Goldman Sachs, Morgan Stanley, Citi and UBS have all forecast the KOSPI will rise to 2,300 by the end of 2013. I agree with these forecasts, which are supported by a s

Dec. 18, 2012

-

KB Financial Group builds up global network for expansion

KB Financial Group is stepping up its efforts to strengthen its overseas network by opening branches and business cooperation with financial institutions overseas.Korea’s leading financial group believes such efforts will help it secure a new source of income.The lender is focusing on the financial markets of China, Indonesia, India and Vietnam, whose rapid growth is expected to continue in the future.The latest move by KB Financial Group to expand its overseas network was to establish a corpora

Dec. 18, 2012

-

Seoul shares gain 0.51 pct on foreign buying

South Korean stocks closed 0.51 percent higher on Tuesday on the back of foreigners' buying, but the gain was capped due to remaining corporate uncertainties, analysts said. The local currency fell slightly against the U.S. dollar. The benchmark Korea Composite Stock Price Index (KOSPI) added 10.02 points to finish at 1,993.09. Trading volume was moderate at 446.9 million shares worth 4.55 trillion won ($4.24 billion) with gainers outnumbering losers 426 to 384."We've seen steady foreign inflows

Dec. 18, 2012

-

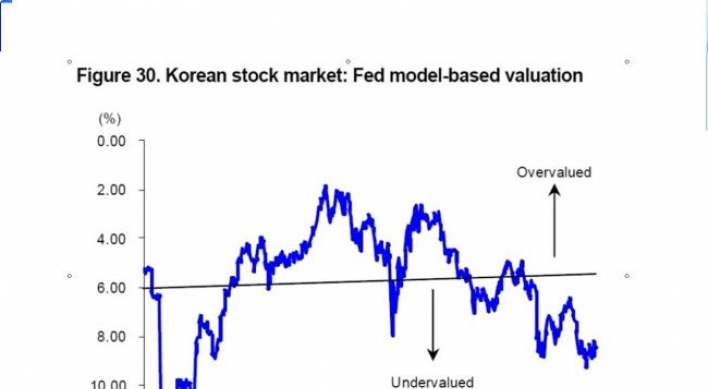

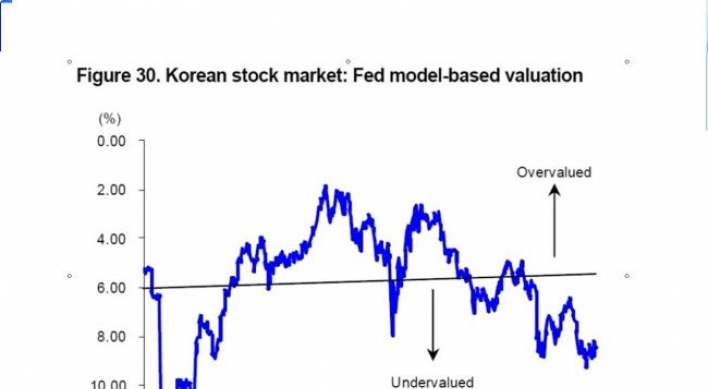

Rising foreign investment in Korean stocks may lead to bubble

The share of foreign investment in the Korean stock market rose to its highest since the global financial crisis in 2008-2009 as global liquidity increased thanks to policy rate cuts and quantitative easing by major economies in the U.S. and Europe. “Ample global liquidity revived the preference for risky assets, while foreign-exchange gains due to the Korean won’s strength and Korean firms’ stable profits attracted foreign investors,” said Lee Soo-jung, a researcher at Korea Investment and Secu

Dec. 17, 2012

-

Shares slip on U.S. fiscal cliff woes

South Korean stocks retreated 0.6 percent on Monday as investors sat on the sidelines while keeping a wary eye on stalled spending cut talks in the United States. The local currency rose against the U.S. dollar. The benchmark Korea Composite Stock Price Index fell 11.98 points to close at 1,983.06. Trading volume was moderate at 360.4 million shares worth 4.19 trillion won ($3.90 billion) with decliners outpacing gainers 497 to 309. “Investors felt more pressure as the deadline for an agreement

Dec. 17, 2012

-

Stocks likely to face correction this week

South Korean stocks are predicted to undergo correction this week as they had risen too much in the short term last week, analysts said Saturday.The benchmark Korea Composite Stock Price Index finished at 1,995.04 on Friday, up 1.92 percent from a week earlier.The KOSPI moved in a tight range earlier this week as investors sat on their hands ahead of the U.S. Federal Reserve’s policy-setting Federal Open Market Committee meeting.North Korea’s long-range rocket launch in the middle of the week al

Dec. 16, 2012

-

Bank holding firms to face tougher times in 2013

South Korea’s major financial holding companies are expected to fare worse in 2013 than this year due mainly to a decline in interest income amid persistent low interest rates, a financial information provider said Sunday.The combined net income of the four major bank holding companies ― KB Financial Group Inc., Woori Finance Holdings Co., Shinhan Financial Group and Hana Financial Group ― is predicted to reach 7.32 trillion won ($6.82 billion) next year, down 9.5 percent from this year’s estima

Dec. 16, 2012

-

Household debt rises at unsustainable rate

South Korea’s household debt has been rising at a faster rate than its economic growth, data showed Sunday, raising concern it could put the economy in jeopardy unless proper measures are taken.According to the data by the Bank of Korea, South Korea’s household credit totaled 937.5 trillion won ($873 billion) as of the end of September, up 5.6 percent from a year earlier.Household credit refers to credit purchases and loans for households extended by financial institutions, including commercial

Dec. 16, 2012

-

Power shortage offers banks opportunity

Power shortages in the wintertime pose a risk to the nation’s energy security, but they also create business opportunities for banks, which seek a new sources of growth as interest rates stay low. Industry sources said South Korean banks’ top priority at year-end was to find new areas of growth amid deteriorating profitability. Korean banks, which depend heavily on the profits from loan-to-deposit interest differences, have been losing money as the protracted economic downturn has kept loan inte

Dec. 16, 2012

-

KEB becomes first Korean bank to open branch in Abu Dhabi

Korea Exchange Bank opened a branch in Abu Dhabi, UAE, last week, the first time a Korean financial firm has done so in the Middle Eastern city.The bank said in a statement that the Abu Dhabi branch was an extension of the overseas marketing plans of KEB president and CEO Yun Yong-ro. “KEB Abu Dhabi is expected to play a key role in developing the economy of the UAE and supporting Korean companies to advance into countries with great potential such as (those in) Africa,” said Yun during a speech

Dec. 16, 2012

-

Shares down on U.S. fiscal cliff woes

South Korean stocks closed 0.39 percent lower on Friday as investor sentiment was dented by the stalled U.S. fiscal cliff talks, analysts said. The local currency fell against the U.S. dollar.The benchmark Korea Composite Stock Price Index dropped 7.73 points to 1,995.04. Trading volume was light at 345.1 million shares worth 4.24 trillion won ($3.95 billion), with decliners outnumbering gainers 407 to 380.“Local shares edged down as investors were still concerned about the U.S. fiscal cliff iss

Dec. 14, 2012

-

Samsung’s financial arms cut jobs on slump

Key financial affiliates of South Korea’s No. 1 conglomerate Samsung Group have eliminated hundreds of jobs via voluntary retirement programs as part of efforts to cut costs amid a prolonged economic slowdown, industry sources said Friday.Samsung Fire & Marine Insurance Co., the country’s top non-life insurer, has recently implemented a voluntary retirement program and dismissed around 150 workers. Samsung Fire has enforced the program annually since 2009, according to the sources.The move comes

Dec. 14, 2012

-

BOK freezes key rate for 2nd month in Dec.

South Korea‘s central bank froze the key interest rate for the second straight month on Thursday, opting to preserve policy room in the face of global economic uncertainty and the presidential election slated for next week.Bank of Korea (BOK) Gov. Kim Choong-soo and his six fellow policymakers left the benchmark 7-day repo rate unchanged at 2.75 percent for December. The central bank cut the rate in July and October.The decision was widely anticipated as 15 out of 16 analysts forecast the rate f

Dec. 13, 2012

-

Nonlife insurers’ overseas operations swing to loss

South Korea’s nonlife insurers saw their overseas operations swing to a net loss in the first half of the fiscal 2012 from a year earlier on increased insurance payouts, the financial regulator said Wednesday.The combined net loss of 23 overseas units managed by six local nonlife insurers reached $6.36 million in the April-September period, compared with a net profit of $7.73 million the previous year, according to the Financial Supervisory Service.The loss came as their insurance payouts increa

Dec. 12, 2012

-

Financial markets immune to N.K. rocket launches

South Korean financial markets barely reacted to the North Korean rocket launch on Wednesday, indicating investors’ indifference to any expected moves by Pyongyang.The KOSPI, which opened at 1,972.33 points, up 0.39 percent from Tuesday’s market close, continued to rally despite news of the missile launch shortly before 10 a.m. It closed at 1,975.44 points Wednesday, up 0.55 percent from the previous day. The Korean won pared gains, ending at 1,075 won per dollar.“The missile launch had been exp

Dec. 12, 2012

-

More middle class borrowers file for debt rescue program

The number of people who filed for a personal bailout program nearly quadrupled over five years as the economic slowdown began to kick in, especially among the debt-ridden middle class.The government program is designed to give people some leeway on overdue interest on loans and have their debts written off when they fulfill debt obligations.Most applicants of the rescue program belong to the middle class, who have a stable income or assets but are struggling to pay their debts. Experts said the

Dec. 11, 2012

-

Shares edge up on U.S. stimulus hopes

South Korean stocks closed 0.37 percent higher Tuesday on rising hopes for additional U.S. stimulus, analysts said. The local currency gathered ground against the U.S. dollar to a 15-month high. The Korea Composite Stock Price Index rose 7.20 points to finish at 1,964.62. Trading volume was moderate at 399.7 million shares worth 4.4 trillion won ($4.16 billion) with decliners outstripping advancers 413 to 385. “Local shares continued to trade almost flat as investors took to the sidelines amid t

Dec. 11, 2012

-

Insurance firms told to increase capital

The Financial Supervisory Service is taking stern regulatory measures against the insurance sector as some businesses have seen their financial status worsen from low returns.As a remedy, the regulator instructed some insurance firms to raise their capital base. It has found that some non-life insurers are suffering weak capability for insurance payments to policyholders.Those that will be under close monitoring of the FSS include players whose “risk-based capital” ratio stayed below optimum lev

Dec. 11, 2012