Most Popular

-

1

Samsung entangled in legal risks amid calls for drastic reform

-

2

Heavy snow alerts issued in greater Seoul area, Gangwon Province; over 20 cm of snow seen in Seoul

-

3

Seoul blanketed by heaviest Nov. snow, with more expected

-

4

[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg&u=20241126161719)

-

5

Seoul snowfall now third heaviest on record

-

6

Samsung shakes up management, commits to reviving chip business

-

7

K-pop fandoms wield growing influence over industry decisions

-

8

Heavy snow of up to 40 cm blankets Seoul for 2nd day

-

9

Seoul's first snowfall could hit hard, warns weather agency

-

10

How $70 funeral wreaths became symbol of protest in S. Korea

-

Korea’s steel and iron imports from China jump to 6-year high

South Korea’s iron and steel imports from China jumped to a six-year high last year, industry data showed Tuesday, causing worries that the low-priced products might hurt local steelmaking companies.According to the data from the Korea Iron & Steel Association, South Korea’s imports of iron and steel products from China increased 34.9 percent on-year to 13.4 million tons last year. The amount is the largest since 2008, when 14.31 million tons were imported from China.The association attributed t

Jan. 20, 2015

-

Asset managers’ influence over stock market dips to 10-year low in 2014

Asset managers’ sway on the South Korean stock market is on the wane, with the portion of stocks in their fund portfolios to the total market capitalization hitting the lowest ratio in 10 years, data showed Tuesday.According to the data compiled by the Korea Financial Investment Association, stocks in asset managers’ investment funds accounted for 5.56 percent of the total market cap at the end of last year, the lowest since 2004 when the comparable figure was 3.25 percent.After peaking at 9.63

Jan. 20, 2015

-

Korea to revise income tax codes amid criticism

South Korea’s Ministry of Strategy and Finance said Monday it would readjust and revise some of the country’s income tax codes after closely evaluating the changes in the patterns of tax payments and individuals’ tax burdens stemming from settling the previous year’s taxes.This comes amid growing public criticism that many income earners will have to pay more taxes than receive tax refunds next month as they file their year-end taxes with the National Tax Service this month.The Finance Ministry

Jan. 19, 2015

-

Tax office to warn potential delinquents in advance

The National Tax Service said Monday that it would encourage taxpayers to pay their taxes voluntarily by giving out notices and data beforehand, instead of taking regulatory measures afterwards.The central tax agency called in chiefs and senior managers of regional tax offices on the day to confirm this year’s tax administration policies, according to officials. The meeting was chaired by NTS Commissioner Lim Hwan-soo and attended by Finance Minister Choi Kyung-hwan.The key change is the shift f

Jan. 19, 2015

-

Woori Bank offers compensation, buybacks for Picity trust fund

Woori Bank said Monday it would partially compensate individual investors’ losses on the controversial Picity trust fund, offering to buy back the product to end disputes.Under arbitration by the Financial Supervisory Service, the bank consented to compensate 40 percent of the investors’ net losses, while denying the investors’ claims that the bank failed to inform them about the risks involved. “In the settlement, we were suggested to compensate 40 percent of the investor losses, in addition to

Jan. 19, 2015

-

Perceived inflation higher than official rate due to rise in meat, utility prices

The sharp rise in meat, dairy and public utility prices pushed up inflation perceived by ordinary people last year to more than the marginal gains tallied by the government, statistics agency said Monday.Data by Statistics Korea showed that while inflation rose 1.3 percent last year compared to 2013, prices of certain key commodities that directly impact people’s everyday lives rose at a faster clip, offsetting some of the advantages of lower costs for consumers.Last year’s inflation gain is unc

Jan. 19, 2015

-

S. Korea to hold fair to lure more Chinese capital

The South Korean government is scheduled to hold an investor relations session in Beijing later this week in a bid to lure more Chinese capital, a South Korean diplomat said Monday.Kwon Pyung-oh, deputy minister in charge of trade and investment at South Korea's Ministry of Trade, Industry & Energy, will lead the one-day fair on Friday, he said.Direct South Korean investment in China jumped 29.8 percent from a year ago to US$3.97 billion in 2014, according to figures released by China's commerce

Jan. 19, 2015

-

Hana Financial Group seeks reinvigoration

Hana Financial Group pledged change and innovation this year in the face of an interbank merger and fundamental group-wide reform.The nation’s second-largest banking group held a national rally on Saturday at Jamsil Gymnasium, bringing together over 10,000 executives and employees from its key affiliates ― Hana Bank, Korea Exchange Bank, Hana Daetoo Securities and Hana Card.“2014 was about communication and cooperation, and this year, we will focus on change and innovation,” said chairman Kim Ju

Jan. 18, 2015

-

Banks to raise dividend payout ratios this year

The nation’s top-ranking financial companies are signaling an increase in their dividend payout ratios, reflecting their optimistic business prospects for this year.Their move has been influenced by the economic policies of Finance Minister Choi Kyung-hwan, who has pushed companies to release their capital into the market and revitalize the economy.The market champion Shinhan Financial Group will be the first to take action.“Korea tends to pay out a relatively low dividend compared to other Asia

Jan. 18, 2015

-

Shares likely to bounce back on ECB policy hopes

The South Korean stock market is likely to rebound this week on the back of rising hopes for an additional stimulus by the European Central Bank, analysts said Saturday. The country’s key stock market index, the KOSPI, closed 1.9 percent lower on Friday than a week ago, on a continued slide in global oil prices that fell to their lowest levels in more than four years, and renewed concerns over Greece’s potential exit from the eurozone economy. Analysts said South Korean shares are expected to cr

Jan. 18, 2015

-

Seoul shares likely to bounce back on ECB policy hopes

The South Korean stock market is likely to rebound next week on the back of rising hopes for an additional stimulus by the European Central Bank, analysts said Saturday.The country's key stock market index, the KOSPI, closed 1.9 percent lower on Friday than a week ago, on a continued slide in global oil prices that fell to their lowest levels in more than four years, and renewed concerns over Greece's potential exit from the eurozone economy. Analysts said South Korean shares are expected to c

Jan. 18, 2015

-

[Weekender] Simplicity key to Hyundai Card office culture

Modern society is fated to grow ever more complicated, and to keep hold of the things that truly matter, one must eliminate excessive formalities, according to a top official of Hyundai Card.“A meeting should be about discussing a specific issue and reaching a tangible conclusion, but people are too often distracted with the process itself,” Hwang Yoo-no, Hyundai Card and Hyundai Capital’s executive vice president and corporate service division head, told The Korea Herald in a recent interview.

Jan. 16, 2015

![[Weekender] Simplicity key to Hyundai Card office culture](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2015/01/16/20150116001264_0.jpg&u=20150116203112)

-

Seoul shares dive 1.36% on strong foreign selling

South Korean stocks ended 1.36 percent lower Friday as foreigners continued to offload local equities on global financial uncertainties and plunging oil prices, analysts said. The local currency gained ground against the U.S. dollar.The benchmark Korea Composite Stock Price Index failed to recover to the 1,900 mark it surrendered in the morning session and closed at 1,888.13 after plummeting 26.01 points. Trading volume was low at 289 million shares worth 3.9 trillion won ($3.62 billion), with d

Jan. 16, 2015

-

Korea’s investment in China jumps 29.8% in 2014

Direct investment by South Korean companies into China jumped 29.8 percent from a year ago to $3.97 billion in 2014, China’s commerce ministry said Friday. The rapid growth in investment by South Korean firms in China marked a striking contrast to Japanese companies, whose direct investment in the world’s second-largest economy dropped 38.8 percent to $4.33 billion last year amid geopolitical tensions between Beijing and Tokyo. Last year, total foreign direct investment into China rose 1.7 perce

Jan. 16, 2015

-

Korean won 4th-best performer against dollar this year

The South Korean won has become one of the top four performers among major currencies against the U.S. dollar so far this year, data showed Friday, as a plunge in crude oil prices helped improve corporate earnings in the oil importing country.The South Korean currency has gone up 1.93 percent to 1,082.20 won against the greenback in two weeks since starting off the year at 1,103.50 won, according to market data. The won’s appreciation rate was the fourth largest among 26 currencies, while the Tu

Jan. 16, 2015

-

FSC to expand venture capital support

The nation’s top financial regulator plans to expand the exemption of guarantee requirements for start-ups to support fledgling firms.The Financial Services Commission is considering whether to ease regulations on investment limits to revitalize the KONEX market that opened in 2013 to facilitate financing for start-ups and small companies. The K-OTC, which deals with the trading of non-listed shares, will also open a second market in March for the trading of small venture firms’ stocks.The FSC r

Jan. 15, 2015

-

Kookmin Bank to get tax refund worth over W400b

Kookmin Bank, South Korea’s second-largest lender by assets, has won a lawsuit against the country’s tax agency to get back 442 billion won ($408.7 million) in tax it has paid, industry sources said Thursday.In 2007, the bank was hit with heavy taxes by the National Tax Service as the lender set aside 932 billion won in loan-loss provision after a merger with its struggling credit card unit. The NTS argued that the lender intended to avoid corporate tax by setting aside huge loan-loss reserves.A

Jan. 15, 2015

-

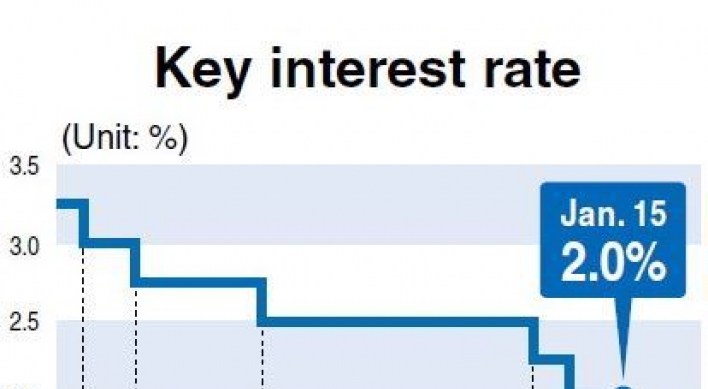

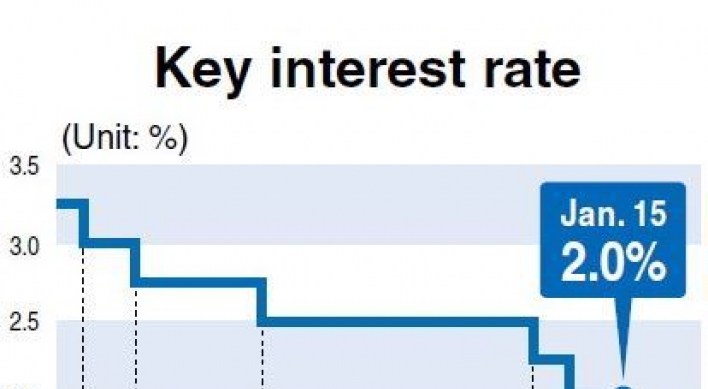

BOK revises down growth outlook to 3.4%

The Bank of Korea on Thursday revised down its growth forecast to 3.4 percent from 3.9 percent for this year amid weakening consumption and private investment.The central bank also cut its inflation forecast to 1.9 percent from 2.4 percent, and kept its key base rate at 2 percent for the third consecutive month due to the continued global economic slowdown.The U.S. seemed to be the only major economy showing signs of a moderate recovery this year, the BOK noted. The BOK cut its growth forecast t

Jan. 15, 2015

-

Shinhan Financial chairman declares ‘year of action’

Shinhan Financial Group chairman Han Dong-woo said Thursday that he wanted visible achievements in its overseas operations, declaring 2015 a year of “action.”The chairman vowed to continue pursuing last year’s six core goals: internalization of hearty finance, a profit jump through creative finance, differentiation of postretirement business, pioneering unchartered overseas markets, innovative management of business channels and strategic cost-cutting. Shinhan Financial Group chairman Han Dong-

Jan. 15, 2015

-

Kookmin Bank to get over 400 bln won tax refund

Kookmin Bank, South Korea's second-largest lender by assets, has won a lawsuit against the country's tax agency to get back 442 billion won ($408.7 million) in tax it has paid, industry sources said Thursday.In 2007, the bank was hit with heavy taxes by the National Tax Service as the lender set aside 932 billion won in loan-loss provision after a merger with its struggling credit card unit.The NTS argued that the lender intended to avoid corporate tax by setting aside huge loan-loss reserves.Ac

Jan. 15, 2015

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg&u=20241126161719)

![[Weekender] Simplicity key to Hyundai Card office culture](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2015/01/16/20150116001264_0.jpg&u=20150116203112)