[NPS in Action] ‘Paper tiger’ NPS rebrands self as vocal shareholder, but motives murky

Pension Fund turns focus to firms without controlling stakeholders

Published : 2023-02-13 15:52:52

This is the third part of a series on South Korea’s largest investor, the National Pension Service, analyzing its current status and identifying tasks that lie ahead. -- Ed.

The new chief investment officer of the National Pension Service, the country's largest investor, vowed in December last year to be a more vocal shareholder to shore up returns and assert more control over how companies are run.

In other words, the CIO aims to more strictly follow the so-called “stewardship code.”

The code is based on the premise that an institutional investor that manages people’s money is in a similar position to a steward who manages a large house or ship.

Just like how good stewards thoroughly take care of different affairs for their employers' benefit, the code sees that good institutional investors should influence the decision-making process of the companies that they are putting their money into to ensure they are well run.

As of November last year, NPS invested 138 trillion won ($109.3 billion) in the domestic stock market, accounting for 6 percent of the total market capitalization of listed companies in Korea.

It is the biggest shareholder of many non-chaebol firms -- those not controlled by a founding family -- ranging from telecom carrier KT to banking conglomerate Woori Financial Group.

“Responsible investment in companies with decentralized ownership, such as KT, Posco, and financial holding companies, should be strengthened,” NPS CIO Seo Won-joo added.

NPS’ plan to become more assertive in exercising its shareholder rights was further empowered by President Yoon Suk Yeol on Jan. 30.

“Since there is a possibility for a moral hazard to occur in the process of forming a governance structure in companies with dispersed ownership, it is necessary (for institutional investors) to consider exerting stewardship,” Yoon said.

NPS' true intention

NPS claims that its recent move for strong stewardship is mainly due to problems in the governance system of companies that do not have owners with controlling stakes.

This stance is slightly different from the one adopted under the former President Moon Jae-in administration, when the pension fund exerted stewardship mainly with its holdings in chaebol conglomerates.

But President Yoon argues that institutional investors should not interfere with chaebol companies’ corporate governance, as he considers it excessive and "socialismlike government involvement."

The NPS says that since there have been public criticisms over lax management and opaque governance structure of companies without a controlling shareholder, it is legitimate for the pension fund to urge those firms to become more transparent.

“CEOs of those corporations have been long considered as problems because many of them have excessive power. Using that power, they have been securing reappointment over and over again -- as we have seen in many financial groups' cases,” an NPS official told The Korea Herald.

Nonetheless, some experts suspect that NPS has a hidden agenda.

“(NPS) is trying to strengthen stewardship code because the government wants more control (over private firms),” Yun Suk-myung, a researcher at Korea Institute for Health and Social Affairs, said.

“The fact that they are targeting only companies without identifiable owners also proves that they are doing this for more control over private firms. Conservative parties tend to be close with chaebol corporations so they are targeting firms without those owners," he added.

An overhaul of the National Pension Fund Management Committee, which is the highest decision-making body of the NPS, is needed to clear up such suspicions, said Nam Chae-woo, a research fellow at the Korea Capital Market Institute who specializes in funds and pension studies.

"This body should be reformed to have more professional investors who can make a decision only based on maximizing profit.”

It is because the body is chaired by the minister of health and welfare which makes it hard to retain a politically neutral stance.

The committee members -- which consists of ex officio members, external experts, and representatives of both employees and employers -- set directions on investment policies, make decisions on key matters related to managing funds, and also develop guidelines and asset allocation plans.

Korea University business professor Park Kyung-suh, who conducted research for NPS before it adopted the stewardship code in 2018, agrees with Nam.

“There is a CIO but that is not sufficient, more professional investors should be included in the committee,” Park said.

He also raised an example case of former Health Minister Moon Hyung-pyo and Hong Wan-sun, former CIO of NPS, who were found guilty of using their power to pressure NPS committee members to make a decision to vote for the merger of Cheil Industries and Samsung C&T -- two key affiliates of South Korea's top conglomerate, Samsung Group in 2015.

“Under the current system, NPS is prone to be affected by politicians or corporations,” Park added.

Paper tiger?

Whenever NPS talks about stewardship code, it touches a raw nerve in the private sector -- especially when companies see it akin to meddling, especially in the appointment process of top executives.

But when looking into past cases, NPS has not held much sway as a shareholder.

In March last year, NPS, which owns an 8.69 percent share in Samsung Electronics, voted against appointing or reappointing Kyung Kye-hyun, Park Hark-kyu, Kim Han-jo and Kim Jong-hoon as the IT giant’s board members, claiming that they have “history of undermining the enterprise value or violating shareholders’ rights.”

However, all four of them became board members with well over the majority of the shareholders’ support.

A rare exception was in 2019 when Korean Air Chairman Cho Yang-ho could not be reappointed as the director of the board. NPS opposed the three-year extension of Cho's term at the time.

The NPS has increasingly voted against management agenda at local firms’ shareholder meetings, but its influence has not been sufficient to have an effect.

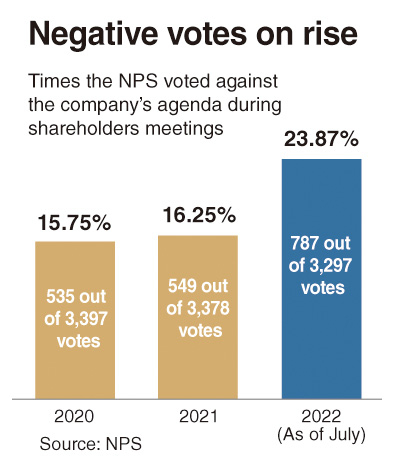

NPS voted against management plans in 535 out of 3,397 (15.75 percent) ballots in 2020, 549 out of 3,378 (16.25 percent) in 2021, and 787 out of 3,297 (23.87 percent) as of July 2022.

The plans were rejected in just 19 cases in 2020, 10 in 2021 and also 10 as of July 2022.

Still, local business operators remain sensitive.

After the NPS CIO recently said the pension fund would oppose telecom giant KT's decision to reappoint its current CEO, Ku Hyeon-mo, as the sole candidate, saying that the process was not transparent, KT on Thursday announced that it would restart the CEO appointment process from scratch, accepting applications from Feb. 10-20.

"We have been fairly appointing our CEO in accordance with our regulations. However, to further strengthen transparency, fairness, and objectivity, the board decided to apply an open competition system, a review process led by outside directors, and also disclose our evaluation result,” KT board members said in a statement on Thursday.

An industry insider who wished to be unnamed said “Even minor activist investors can affect the company’s agenda. So, NPS’ negative votes are burdensome for local firms.”

Researcher Yun sees that NPS' influence is likely to grow.

“It is currently managing around 920 trillion won and this is expected to expand to 1,800 trillion won in 2041. So NPS’ influence is likely to increase further,” Yun said.

http://www.koreaherald.com/common/newsprint.php?ud=20230213000673