S&P ETP expert says Korean ETF market is growing in healthy way

Published : 2021-11-09 15:35:30

South Korea’s exchange-traded fund market is getting very competitive and growing in a healthy way, in line with local asset management firms’ fierce competition, an executive from S&P Dow Jones Indices said Tuesday.

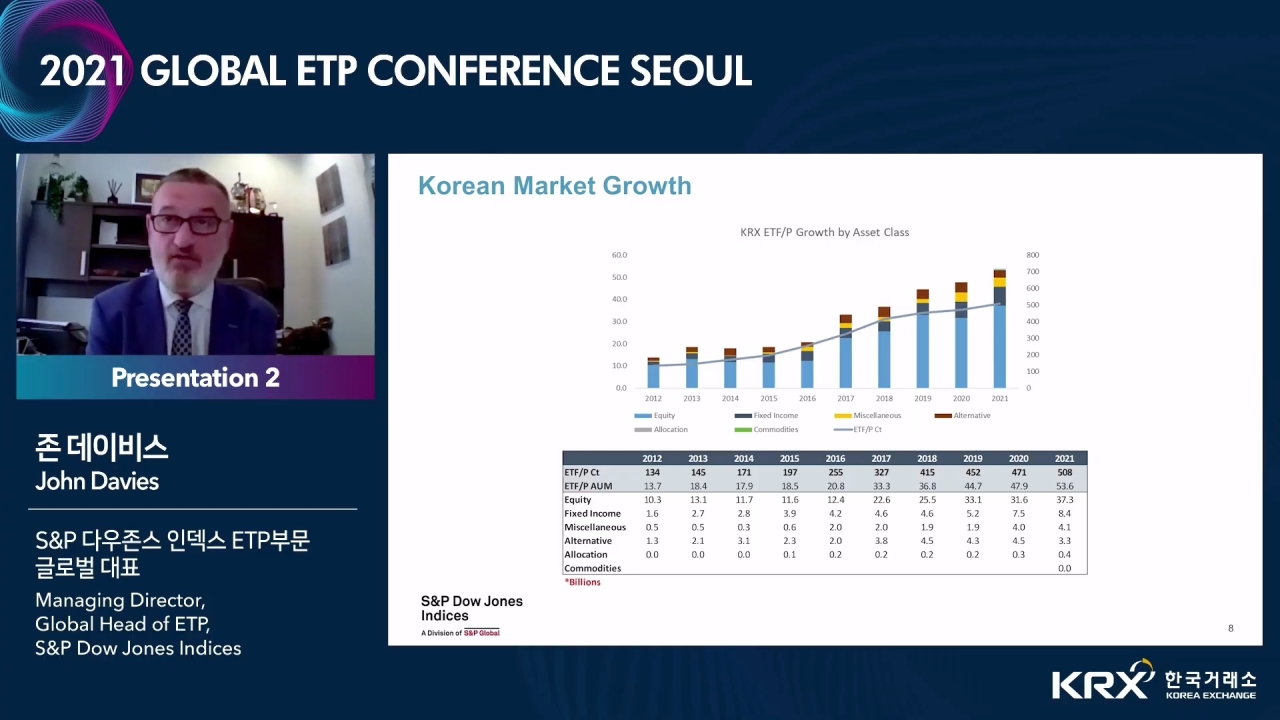

“The Korean ETF market’s 10-year compound annual growth rate is around 25 percent, which is way above the global market’s rate of growth of 16 percent,” John Davies, global head of exchange-traded products at S&P Dow Jones Indices, said during his presentation at the 2021 Global ETP Conference Seoul, held at the Korea Exchange’s Seoul office.

According to the expert, the combined assets under management by asset management companies here has surged to $54 billion, with over 500 funds listed as of 2021. Among asset classes, equity and fixed income each showed threefold increases from 2012.

While global ETFs’ combined assets under management by asset managers around the world amounts to $9 trillion as of this year, 2021 is likely to be the first time in the market’s history of attracting $1 trillion of fresh funds, according to Davies’ forecast. Compared to the past when it took 19 years to reach the $1 trillion mark, the market has been showing phenomenal growth lately, he said.

Davies also suggested that exchange-traded products related to environmental, social and governance efforts and new technologies such as blockchain, cryptocurrencies and artificial intelligence are likely to continuously grow, but a greater number of passively managed funds will be enrolled under innovation and various collaboration.

“The Korean ETF market’s 10-year compound annual growth rate is around 25 percent, which is way above the global market’s rate of growth of 16 percent,” John Davies, global head of exchange-traded products at S&P Dow Jones Indices, said during his presentation at the 2021 Global ETP Conference Seoul, held at the Korea Exchange’s Seoul office.

According to the expert, the combined assets under management by asset management companies here has surged to $54 billion, with over 500 funds listed as of 2021. Among asset classes, equity and fixed income each showed threefold increases from 2012.

While global ETFs’ combined assets under management by asset managers around the world amounts to $9 trillion as of this year, 2021 is likely to be the first time in the market’s history of attracting $1 trillion of fresh funds, according to Davies’ forecast. Compared to the past when it took 19 years to reach the $1 trillion mark, the market has been showing phenomenal growth lately, he said.

Davies also suggested that exchange-traded products related to environmental, social and governance efforts and new technologies such as blockchain, cryptocurrencies and artificial intelligence are likely to continuously grow, but a greater number of passively managed funds will be enrolled under innovation and various collaboration.

Meanwhile, the bourse operator’s annual event was held under the theme “The new wave of market innovation -- Strategies for post-COVID investment landscape.” Since 2010, the international conference has invited exchange-traded product opinion leaders from both in and out of Korea.

Including Davies and KRX Chairman Sohn Byung-doo, Morningstar’s indexes strategist Dan Lefkovitz, S&P Dow Jones Indices’ head of Korea Kim Beom-suk, MSCI Vice President Kim Tae-woo and the US Securities and Exchange Commission senior policy adviser Steve Oh participated in the conference this year.

Including Davies and KRX Chairman Sohn Byung-doo, Morningstar’s indexes strategist Dan Lefkovitz, S&P Dow Jones Indices’ head of Korea Kim Beom-suk, MSCI Vice President Kim Tae-woo and the US Securities and Exchange Commission senior policy adviser Steve Oh participated in the conference this year.

http://www.koreaherald.com/common/newsprint.php?ud=20211109000796