[Market Close-up] Device shipment shortage unnerves Samsung Electronics investors

Analysts revise down target stock price as Samsung Electronics becomes biggest foreigner selloff target in Korea

Published : 2021-05-23 15:24:44

Concerns about electronic device shipments due to a global semiconductor component shortage is leaving retail stock investors unnerved as their net purchases of Samsung Electronics common shares worth 22.6 trillion won ($20 billion) so far this year appears to have barely yielded returns.

Foreign investors, on the other hand, are fleeing South Korea‘s largest handset producer and semiconductor manufacturer. Samsung Electronics has been the most heavily sold stock by foreign investors year-to-date among Korea’s listed shares, as they divested net 10.7 trillion-won worth of shares since January.

Local analysts are revising down their target stock prices of Samsung Electronics. Despite positive notes on its foundry chip manufacturing business, hindered shipments of consumer goods will sap investor confidence for the time being.

Hana Financial Investment’s semiconductor analyst Claire Kim on Friday revised Samsung Electronics‘ 12-month forward target stock price to 101,000 won apiece, down from 110,000 won as of January.

Kim noted that the shortage of components, such as driver integrated circuits and mobile application processors, has started to hamper shipments of Samsung Electronics mobile handsets and consumer electronics devices from the second quarter.

“The unprecedented component shortage is affecting production of various applications, and this is a cause of concern for (end-product) businesses,” Kim noted in the report. “Benefits from the base effect (from the coronavirus crisis last year) is becoming more elusive, and this puts pressure on investor sentiment.”

Samsung Electronics shares have lost momentum since its foundry chip plant in Austin, Texas was forced to shut down due to heavy snowfall, and shipment concerns are adding more downward pressure, Kim added.

Song expected Samsung Electronics’ smartphone shipment decline to cut operating profit in the IT & Mobile Communications Division by 35 percent on-quarter.

By type of end-products, won-denominated revenue from mobile devices will fall 19 percent from the previous quarter, while that of display panels will drop 6 percent and that of TVs will decline 10 percent.

Other than the likely device shipment constraint, Song‘s anticipation that economic indicators in the United States -- such as the Institute for Supply Management’s Manufacturing Purchasing Managers‘ Index and Non-manufacturing Index -- have peaked led to a readjustment of its price-to-book ratio from 2.2 to 1.9 and subsequently of its target price.

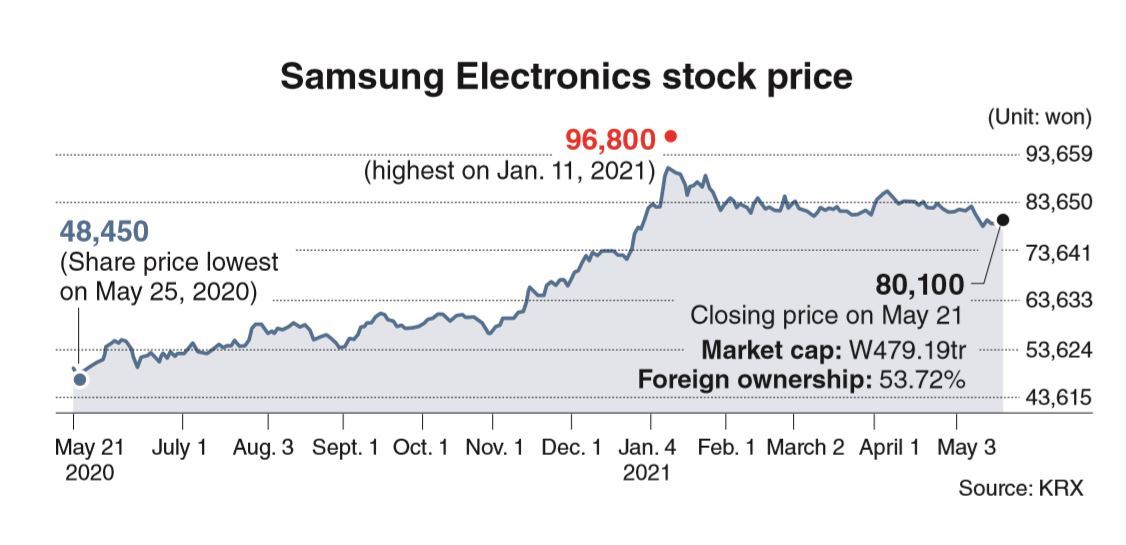

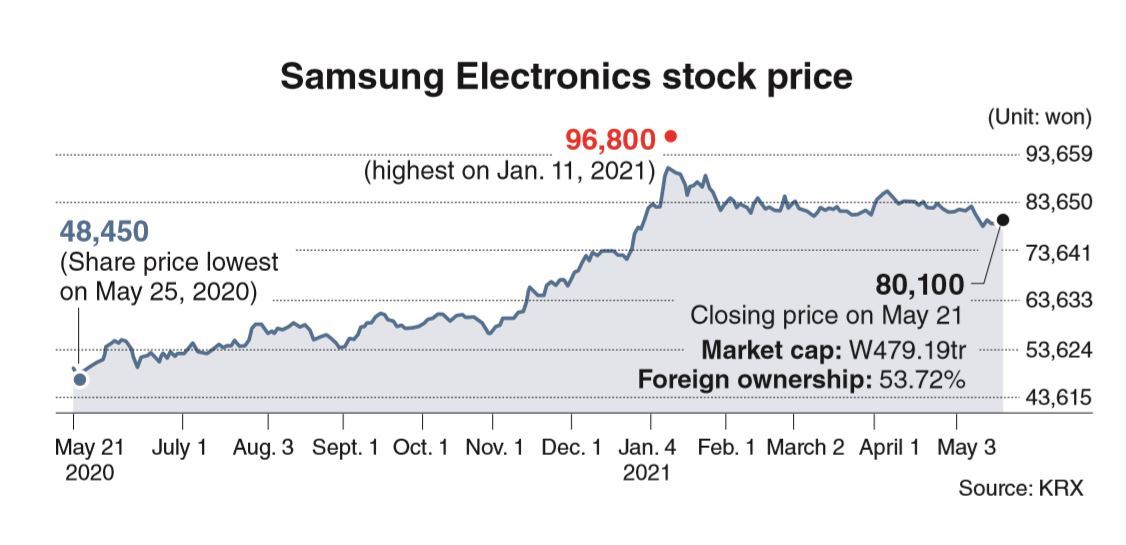

Samsung Electronics on Friday closed at 80,100 won. Hitting the 52-week high at 96,800 on Jan. 11, Samsung Electronics’ share price has gradually retreated throughout this year.

The market cap of its common shares came to 478.1 trillion won, accounting for 21.6 percent of the total market cap of 807 shares listed on the Korea Exchange’s main board Kospi.

According to market data tracker FnGuide, the local analyst consensus of Samsung Electronics‘ second-quarter operating profit reached 10.6 trillion won, up over 30 percent on-year. The consensus of its target price stood at 105,650 won apiece.

By Son Ji-hyoung (consnow@heraldcorp.com)

Foreign investors, on the other hand, are fleeing South Korea‘s largest handset producer and semiconductor manufacturer. Samsung Electronics has been the most heavily sold stock by foreign investors year-to-date among Korea’s listed shares, as they divested net 10.7 trillion-won worth of shares since January.

Local analysts are revising down their target stock prices of Samsung Electronics. Despite positive notes on its foundry chip manufacturing business, hindered shipments of consumer goods will sap investor confidence for the time being.

Hana Financial Investment’s semiconductor analyst Claire Kim on Friday revised Samsung Electronics‘ 12-month forward target stock price to 101,000 won apiece, down from 110,000 won as of January.

Kim noted that the shortage of components, such as driver integrated circuits and mobile application processors, has started to hamper shipments of Samsung Electronics mobile handsets and consumer electronics devices from the second quarter.

“The unprecedented component shortage is affecting production of various applications, and this is a cause of concern for (end-product) businesses,” Kim noted in the report. “Benefits from the base effect (from the coronavirus crisis last year) is becoming more elusive, and this puts pressure on investor sentiment.”

Samsung Electronics shares have lost momentum since its foundry chip plant in Austin, Texas was forced to shut down due to heavy snowfall, and shipment concerns are adding more downward pressure, Kim added.

Song expected Samsung Electronics’ smartphone shipment decline to cut operating profit in the IT & Mobile Communications Division by 35 percent on-quarter.

By type of end-products, won-denominated revenue from mobile devices will fall 19 percent from the previous quarter, while that of display panels will drop 6 percent and that of TVs will decline 10 percent.

Other than the likely device shipment constraint, Song‘s anticipation that economic indicators in the United States -- such as the Institute for Supply Management’s Manufacturing Purchasing Managers‘ Index and Non-manufacturing Index -- have peaked led to a readjustment of its price-to-book ratio from 2.2 to 1.9 and subsequently of its target price.

Samsung Electronics on Friday closed at 80,100 won. Hitting the 52-week high at 96,800 on Jan. 11, Samsung Electronics’ share price has gradually retreated throughout this year.

The market cap of its common shares came to 478.1 trillion won, accounting for 21.6 percent of the total market cap of 807 shares listed on the Korea Exchange’s main board Kospi.

According to market data tracker FnGuide, the local analyst consensus of Samsung Electronics‘ second-quarter operating profit reached 10.6 trillion won, up over 30 percent on-year. The consensus of its target price stood at 105,650 won apiece.

By Son Ji-hyoung (consnow@heraldcorp.com)

http://www.koreaherald.com/common/newsprint.php?ud=20210523000182